Digital nomads are remote workers who work from different locations, often a foreign country. They often work in cafes or bars, co-working spaces, or public libraries, relying on devices with wireless internet capabilities, like smart phones and mobile hotspots to allow them to do their work wherever they want.

Digital nomads are remote workers who work from different locations, often a foreign country. They often work in cafes or bars, co-working spaces, or public libraries, relying on devices with wireless internet capabilities, like smart phones and mobile hotspots to allow them to do their work wherever they want.

With 34% of remote employees working 4-5 days a week out of the office, the digital nomad lifestyle could be an exciting possibility if you’ve caught the travel bug and want to break free from the shackles of 9-5 life.

Who are digital nomads?

Digital nomads are people who travel freely while working remotely, using technology and the internet. Such people generally have minimal material possessions and work remotely in temporary housing, hotels, cafes, public libraries, co-working spaces, or recreational vehicles, using WiFi, smartphones or mobile hotspots to access the Internet.

Digital nomads are people who travel freely while working remotely, using technology and the internet. Such people generally have minimal material possessions and work remotely in temporary housing, hotels, cafes, public libraries, co-working spaces, or recreational vehicles, using WiFi, smartphones or mobile hotspots to access the Internet.

The majority of digital nomads describe themselves as programmers, content creators, designers, or developers. Some digital nomads are perpetual travellers, while others only maintain the lifestyle for a short period of time.

While some nomads travel through multiple countries, others remain in one area, and some may choose to travel while living in a vehicle, in a practice often known as van-dwelling.

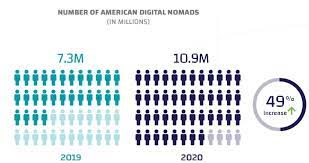

In 2020, a research study found that 10.9 million American workers described themselves as digital nomads, an increase of 49% from 2019.

Benefits of being a digital nomad

People typically become digital nomads owing to a desire to travel, to enjoy location independence and the lowered cost of living often provided by leaving expensive cities.

Cost of living ranks chief among the criteria that digital nomads value when selecting a destination, followed by climate, diversity, and available leisure activities.

There are also benefits for employers, as a 2021 study concluded that there is a causal relationship between worker productivity and the option to "work from anywhere," as workers who were freed from geographic limitations showed an average output increase of 4.4% while controlling for other factors.

Digital nomads also typically spend more than 35% of their income in the place where they are staying, an injection of capital that has been shown to stimulate local economies in popular destinations, primarily promoting the service industry and the sale of consumer goods.

According to the online blog Hobspot, there are five benefits which stem from being a digital nomad:

1. You’ll be more productive.

2. You’ll have more breakthrough ideas.

3. You’ll become more adaptable.

4. You’ll have more time to do the things you love.

5. You’ll make lifelong friendships.

Challenges of being a digital nomad

Although digital nomads enjoy advantages in freedom and flexibility, they report loneliness as their biggest struggle, followed by burnout.

Feelings of loneliness are often an issue for digital nomads because nomadism usually requires freedom from personal attachments such as marriage. The importance of developing quality face-to-face relationships has been stressed to maintain mental health in remote workers.

Feelings of loneliness are often an issue for digital nomads because nomadism usually requires freedom from personal attachments such as marriage. The importance of developing quality face-to-face relationships has been stressed to maintain mental health in remote workers.

Other challenges include: maintaining international health insurance with coverage globally; abiding by different local laws including payment of required taxes; obtaining work visas; and maintaining long-distance relationships with friends and family back home.

Digital nomads also very rarely have access to retirement benefits, unemployment insurance, or set time off from work, and often make less money than they could make through traditional employment.

As many digital nomads resort to gig work or freelancing, their opportunities for pay can be inconsistent and sporadic.

Other challenges may also include time zone differences, the difficulty of finding a reliable connection to the internet, and the absence of delineation between work and leisure time.

There are a few contributing factors to the blurring of this line; certain paid work can be viewed as leisure when it is enjoyable, but many tasks that involve travel and acquiring accommodations can become viewed as another type of work, even though those would traditionally fall into the leisure category.

Another issue faced by digital nomads is that of mobility; a travelling worker must be able to keep any necessary equipment with them as they move from location to location, and it is difficult too for a digital nomad to manage personal belongings. In fact, many digital nomads do not have a "home base," and must therefore adopt a minimalist lifestyle.

One potentially negative impact of digital nomadism, that does not affect the nomads themselves, is the possibility of 'transnational gentrification.' Concerns have been raised about the nature of the relationship between digital nomads, who are most often from the Global North, and the countries they travel to, generally in the Global South.

The problem may arise in regards to competition for housing between native people and travelling workers, as well as in personal interactions and the risk of tourism over-dependency.

The impact of Covid-19

In 2020, a research study found that 10.9 million American workers described themselves as digital nomads, an increase of 49% from 2019. The primary reason for this rapid increase is office closure and the shift toward home-working brought about by the COVID-19 Pandemic.

In 2020, a research study found that 10.9 million American workers described themselves as digital nomads, an increase of 49% from 2019. The primary reason for this rapid increase is office closure and the shift toward home-working brought about by the COVID-19 Pandemic.

Multiple countries were prompted to offer new visa programs and to change their policies towards foreign workers because of the pandemic.

The pandemic had a larger impact, in terms of mobility, on traditional job holders than on independent workers. While the number of independent workers living as digital nomads increased slightly in 2020, the number of traditional workers who changed their lifestyle to live as digital nomads nearly doubled, from 3.2 million people in 2019 to 6.3 million in 2020.

This is because many traditional jobs stopped requiring their employees to physically report to an office or set location every day, so many people were subsequently able to travel freely while still working.

An important effect of the pandemic was the limited ability to travel, particularly across national borders. For this reason, more and more digital nomads have chosen to remain domestic, especially in the United States. Living as a digital nomad often entails travelling from high-cost areas (eg major cities) to cheaper regions (foreign or domestic).

Though the rapid increase of digital nomads in 2020 is expected to be more than just a short-lived trend, the extreme rate of change is not likely to continue indefinitely.

The pandemic locked us down, but at the same time freed many workers from the confines of the office. A new breed of digital nomads emerged – people who took their laptops, jumped on planes and set up shop in some of the most beautiful parts of the world. And with them have come schemes to make it easier for them to stay for months on end.

Barbados was one of the first countries to formalise arrangements with its “welcome stamp”, launched in June 2020. To qualify, workers must earn more than US$50,000 (£37,000) during the 12 months they are in the country and pay $2,000 for the application. They will not be subject to income tax while they are there.

In June 2021, Malta launched a nomad residence permit with which workers can live in the country once they earn €2,700 (£2,230) a month. Applicants pay €300 each, plus the same for each dependant.

Iceland has operated a long-term visa for remote workers since October 2020, and Bermuda has a new “work from Bermuda” certificate. Spain and Sri Lanka are set to follow suit.

The schemes all run in a fairly similar fashion: workers pay to apply and get the right to stay in the country while working for an employer based elsewhere. The visas typically last a year, which can usually be extended once the time is up. Once you have one in place, you can rent a property and travel in and out of the country.

Getting prepared to be a digital nomad

However, there are things to bear in mind before you pack your bag.

“Being a digital nomad can be made to work. However, it is seldom as straightforward as people sometimes think,” says Lee McIntyre-Hamilton of Keystone Law, who specialises in global mobility. “Obtaining a visa is just the start of the process.”

Alex Lilburn, a software developer, moved from the UK to Barbados in January 2021 after making his application for the welcome stamp.

“I saw a piece on the BBC headlined something like: Working remotely? You could be working from paradise,” he says. The article mentioned Barbados, so he started looking into the practicalities. “I worked from home before, but suddenly there was no expectation from clients that we would turn up once a month,” he says.

“I saw a piece on the BBC headlined something like: Working remotely? You could be working from paradise,” he says. The article mentioned Barbados, so he started looking into the practicalities. “I worked from home before, but suddenly there was no expectation from clients that we would turn up once a month,” he says.

“I spoke to my employer. They were very supportive and said if there were no tax implications, they would help make it happen.”

Barbados offers a zero income tax rate for those on its welcome stamp, but you will pay VAT on goods and services. Lilburn is paid by his employer in the UK, and it takes out income tax and national insurance as if he was still working at home.

Software developer Alex Lilburn now works in Barbados.

In general, tax rules around residency are complicated, especially if you are travelling for a short period and may make trips back to the UK.

Whether or not you pay tax in the UK depends on whether you are a UK tax resident. Broadly, HM Revenue & Customs says that if you are in the UK for 183 days or more

in a tax year, you are tax resident. But residency is complicated and travellers should go through the statutory residence test for clarity.

“If an individual remains a UK resident when they are living and working overseas, HMRC will continue to tax any income that the individual earns while they are living and working overseas,” says McIntyre-Hamilton.

You may also be subject to taxes in the country you are staying in – leading to the possibility of being taxed twice, although there are exemptions where there is a double tax treaty with the UK, eg in the case of Spain.

Even if you are not resident in the UK, any money sourced there – such as bank interest, dividends or rental income – will typically be subject to UK income tax. “I have seen some evidence of digital nomads moving from country to country in the expectation that this will avoid triggering issues in any one country. Generally, this assumption is incorrect,” says McIntyre-Hamilton.

Lilburn has no intention of moving. It’s great workwise, he says: the time difference is currently four hours, and he has meetings in the morning when his UK colleagues are at their desks, then does his coding work in the afternoon. He recently renewed his welcome stamp for another year, which was slightly cheaper than the original application, at $1,500, and says he can see no reason why he won’t do the same again next year.

“I came to Barbados for the scenery and weather, but I’m staying for the people – whether it’s the other people on the visa, who are similar people at the same life stage, or the Bajans I’ve met who have been so friendly,” he says. “It’s amazing, it really is.”

Bermuda visa says ‘welcome’

Lauren Anders Brown is a documentary maker who was visiting her partner in Bermuda in March 2020 when the pandemic hit. She ended up staying, and that summer, applied for the island’s digital nomad visa.

Lauren Anders Brown is a documentary maker who was visiting her partner in Bermuda in March 2020 when the pandemic hit. She ended up staying, and that summer, applied for the island’s digital nomad visa.

“It costs $285 to apply but it was simple,” she says. “You have to prove your overseas company pays you into a bank account, that you are paying your taxes, and that you have health insurance.”

She’s self-employed with Collaborate: ideas & images, in the UK. She earns into accounts in the UK and the US, where she is originally from, and uses accountants to make sure she has paid the right tax. Her partner is a doctor and applied for a traditional working visa.

“It was a hell of a lot easier for me to stay than him,” she says, “because the digital nomad visa is a new kind of immigration law.”

Non-residents are normally not allowed to drive, but under the scheme she is. She was also able to rent a place to live while he was still getting his visa approved.

Bermuda’s only downside is it is expensive. The visa lasts a year, and she has renewed it. “There’s blue water, it’s dog-friendly – it really suits us,” she says.

Spain and digital nomads

In 2021, Spain announced plans for a digital nomad visa. The law responsible for the digital nomad visa is known as the Startup Law. In December 2021, the law was presented to parliament, and in January 2022, a draft of the law was approved. The Startup Act was approved by parliament in November 2022. According to the law, Digital Nomad Visas in Spain are initially valid for up to 12 months and can be renewed, which will allow digital nomads to reside in Spain for up to five years, and they receive special tax benefits by paying a reduced tax rate.

In 2021, Spain announced plans for a digital nomad visa. The law responsible for the digital nomad visa is known as the Startup Law. In December 2021, the law was presented to parliament, and in January 2022, a draft of the law was approved. The Startup Act was approved by parliament in November 2022. According to the law, Digital Nomad Visas in Spain are initially valid for up to 12 months and can be renewed, which will allow digital nomads to reside in Spain for up to five years, and they receive special tax benefits by paying a reduced tax rate.

Note: Here are two digi-houses, both located in Montejaque, near Ronda (Malaga) and available from 1 November 2023. Scroll down past the article (similar to this one) for descriptions, photos and prices.

Casa Real, Montejaque

Casa Rita, Montejaque

DIGITAL NOMADS - Help me, Ronda (help-me-ronda.com)

© Pablo de Ronda

Sources:

The Guardian

Hobspot

SUR

Wikipedia

Photos:

Acer

The Entrpreneur

Global

The Guardian

Iberdrola

Wikipedia

Tags: Alex Lilburn, Barbados, Bermuda, Collaborate: ideas & images, digital nomad, Guardian HM Revenue & Customs, Hobspot, Iceland, Keystone Law, Lauren Anders Brown, Lee McIntyre-Hamilton, Malta, remote working, Spain, Sri Lanka, Startup Act, SUR, Wikipedia