Legal tip 685. Taxes in rentals with option to buy

Wednesday, January 18, 2012 @ 11:47 PM

It depends on the way the contract is agreed, there is NOT just ONE formula for this type of agreements but can be tailored according to parties wishes:

-If you pay an initial amount for the option, this and rentals will be taxed with VAT 18%. Once the option is exercised, you will substract the amount paid at the beginning and will pay either transfer tax or VAT- depending on first of subsequent transmissions- at the applicable rate ( 4% or 7%)

- Same if you pay nothing at the beginning but the contract clearly stablishes that rentals will be counted as part of the price if the option is exercised.

- If the contract states that amounts are partially rent and partially will be considered part of the price. Each part will tribute correspondingly ( rentals- 18%,part of the price 4% or 7%). If the option is not finally exercised the taxpayer will be reimbursed the amounts paid as part of the price and its corresponding taxes.

.jpg)

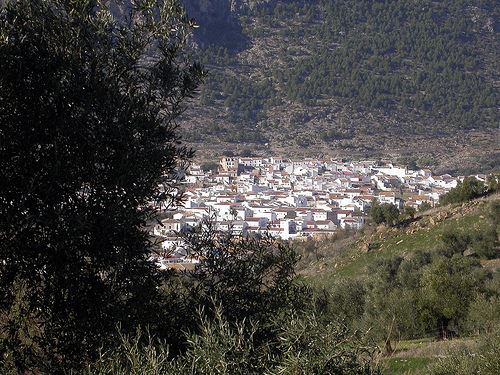

"Algodonales, pueblo aceitero", Cádiz, Spain, by maesejose, at flickr.com