The Canary Islands or the Balearic Islands?

Saturday, May 31, 2025

Choosing the perfect island paradise for your move is a delightful dilemma, especially when considering the sun-drenched Spanish archipelagos of the Balearics and the Canaries. Both offer an alluring escape, but their distinct characteristics cater to different lifestyles and preferences. This comprehensive guide will help you navigate their unique charms, comparing everything from their geographical makeup and climate to property prices and culinary delights, ultimately assisting you in deciding which island group is better suited to your needs.

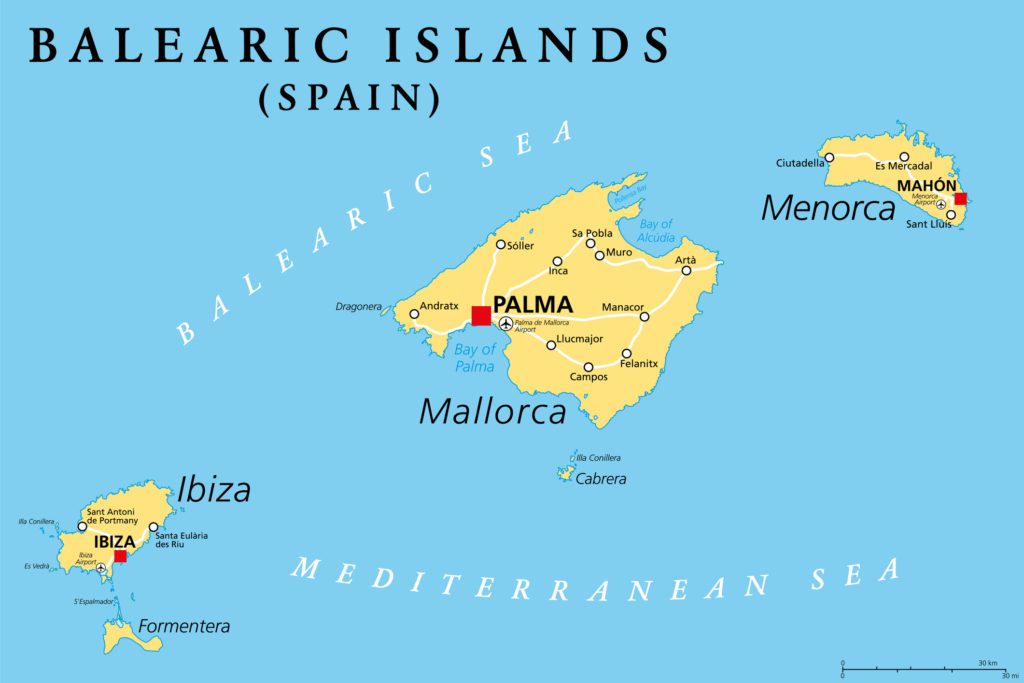

The Archipelagos Unveiled: A Geographical Overview

To understand the differences, it's crucial to first grasp the composition and location of these captivating islands.

The Balearic Islands: Located in the western Mediterranean Sea, off the eastern coast of mainland Spain, the Balearics are geographically closer to Europe and form an autonomous community of Spain. The archipelago consists of several islands, but the main ones are:

- Mallorca: The largest island, known for its stunning mountain ranges, picturesque coves, vibrant capital Palma, and diverse landscapes ranging from bustling resorts to tranquil rural areas.

- Menorca:A more laid-back and unspoiled island, famous for its pristine beaches, natural harbours, and a slower pace of life. It's a UNESCO Biosphere Reserve, emphasising its commitment to environmental preservation.

- Ibiza: Globally renowned for its electrifying nightlife, but also offers beautiful beaches, charming old towns, and surprisingly tranquil areas once you venture away from the main party hubs.

- Formentera: The smallest inhabited island, accessible only by ferry from Ibiza, it's a true gem with Caribbean-like turquoise waters and an incredibly relaxed atmosphere, perfect for a quiet escape.

The Canary Islands: Situated in the Atlantic Ocean, off the northwest coast of Africa, the Canaries are geographically closer to Africa but politically and culturally European, also forming an autonomous community of Spain. This distance from the European mainland contributes significantly to their unique climate and natural environment. The main islands are:

- Tenerife: The largest and most populous island, dominated by Mount Teide, Spain's highest peak. It offers a diverse range of landscapes, from volcanic terrain and lush forests to bustling tourist resorts and historic towns.

- Gran Canaria: Often described as a "miniature continent" due to its varied microclimates and landscapes, ranging from the famous Maspalomas dunes in the south to the green, rugged north and the vibrant capital, Las Palmas.

- Lanzarote: Distinctive for its volcanic landscapes, particularly Timanfaya National Park. Its architecture, heavily influenced by artist César Manrique, blends seamlessly with the natural environment. It's known for its unique vineyards and black sand beaches.

- Fuerteventura: Renowned for its exceptionally long, white sandy beaches and consistent strong winds, making it a mecca for windsurfing and kitesurfing enthusiasts. It's the second-largest island and relatively sparsely populated.

- La Palma: Known as "La Isla Bonita" (The Beautiful Island) due to its lush green forests, dramatic volcanic craters, and stunning stargazing opportunities thanks to its clear skies and astronomical observatory.

- La Gomera: A circular island with deep ravines and dense laurel forests, famous for Garajonay National Park and its ancient whistling language, Silbo Gomero. It's a hiker's paradise.

- El Hierro: The smallest of the main islands, El Hierro is a UNESCO Biosphere Reserve and Geopark, celebrated for its sustainable tourism, dramatic cliffs, and rich marine life, making it a diver's dream.

How They Are Different: The most striking difference lies in their geological formation and resulting landscapes. The Balearics are extensions of the Iberian Peninsula's mountain ranges, primarily limestone, leading to rolling hills, fertile plains, and dramatic cliff faces. The Canaries, on the other hand, are volcanic in origin, resulting in more rugged, often dramatic, and diverse terrain with black, red, and golden sands. Their geographical separation also plays a crucial role in their climates and ecosystems, as we'll explore.

Beaches: Sandy Shores and Volcanic Vistas

Both archipelagos boast incredible beaches, but their characteristics vary significantly, reflecting their geological differences.

Balearic Islands Beaches: Generally, the Balearics are famous for their white or golden sandy beaches and crystal-clear turquoise waters, reminiscent of classic Mediterranean postcards.

- Mallorca: Offers an incredibly diverse range, from long stretches of family-friendly golden sand (e.g., Alcúdia, Playa de Palma) to secluded, picturesque coves (calas) nestled between pine forests and rocky cliffs (e.g., Cala Mondragó, Sa Calobra). The water is typically calm and perfect for swimming and snorkelling.

- Menorca: Renowned for its pristine, unspoiled beaches, many of which are only accessible by foot or boat (e.g., Cala Macarella, Cala Mitjana). The sand is generally white and fine, and the waters are exceptionally clear.

- Ibiza: While known for its lively beach clubs, Ibiza also features stunning natural beaches. Cala Comte and Cala Salada offer beautiful golden sands and incredible sunsets, while the north has more tranquil coves.

- Formentera: Often hailed as having some of the best beaches in Europe, comparable to the Caribbean, with powdery white sand and astonishingly clear, shallow turquoise waters (e.g., Ses Illetes, Cala Saona).

Canary Islands Beaches: The volcanic origin of the Canaries means their beaches are more varied in colour and texture, often featuring golden, black, or reddish sands.

- Tenerife: Offers a mix. The south has popular golden sand beaches (some artificially imported, like Playa de las Teresitas near Santa Cruz), while the north features dramatic black sand beaches, often wilder and more exposed to Atlantic waves (e.g., El Bollullo, Benijo).

- Gran Canaria: Famous for the vast golden dunes of Maspalomas in the south, creating a desert-like landscape. Other southern beaches are golden and family-friendly (e.g., Playa del Inglés), while the north has smaller coves and some black sand beaches.

- Lanzarote: Characterised by its unique volcanic beaches. Playa Blanca and Papagayo (a series of unspoiled coves) in the south have stunning golden sand and clear waters. However, many other beaches are striking black sand (e.g., El Golfo, Playa Quemada), offering a dramatic contrast.

- Fuerteventura: The undisputed champion of long, expansive golden sandy beaches. Its coastline is blessed with miles of unspoiled, wide beaches, perfect for watersports and relaxation (e.g., Sotavento, Cofete). The sand is generally fine and light-coloured.

- La Palma, La Gomera, El Hierro: Primarily feature dramatic black sand beaches, often set against rugged cliffs, offering a wilder and more natural experience. These are less about sunbathing and more about dramatic scenery and unique swimming spots.

Similarities and Differences: Both archipelagos offer a huge variety of beaches, from bustling resort fronts to secluded coves. The main difference lies in the dominant sand colour and the surrounding landscape. The Balearics generally offer the classic Mediterranean 'white sand and blue sea' aesthetic, while the Canaries provide a more dramatic, often volcanic-influenced, palette of black, red, and golden sands, with bigger waves from the Atlantic.

Climate Contrasts: Mediterranean Sunshine vs. Perpetual Spring

The weather is often a decisive factor for those considering a holiday, and here, the Balearics and Canaries present distinctly different climates.

Balearic Islands Weather: Experience a typical Mediterranean climate characterised by hot, dry summers and mild, somewhat wetter winters.

- Summers (June to August): Hot and sunny, with average daily temperatures ranging from 25∘C to 30∘C, often peaking higher. Humidity can be present, and rainfall is rare. Perfect for beach holidays and outdoor activities.

- Autumn (September to November): Temperatures gradually cool, from the low 20s∘C in September to 15∘C to 20∘C in November. There's an increased chance of rainfall, particularly in October, which can sometimes be heavy.

- Winters (December to February): Mild, with average daily temperatures around 10∘C to 15∘C. While it rarely freezes, nights can be cool. There are sunny days, but also periods of cloudiness and rain.

- Spring (March to May): Temperatures steadily rise, from around 15∘C in March to 20∘C to 25∘C in May. The islands blossom, and it's a pleasant time with less intense heat and moderate rainfall.

The Balearics experience distinct seasons, with significant temperature fluctuations throughout the year.

Canary Islands Weather: Famous for their "eternal spring" climate, meaning stable, pleasant temperatures year-round with less seasonal variation than the Balearics. This is due to their proximity to the African coast and the influence of the Azores High and trade winds.

- Temperatures: Average daily temperatures generally hover between 20∘C and 25∘C throughout the year, with very little deviation between summer and winter. The south of the islands (e.g., south Tenerife, south Gran Canaria, Fuerteventura, Lanzarote) tends to be slightly warmer and sunnier due to shielding from the trade winds by mountainous terrain.

- Rainfall: Generally very low, especially in the southern parts of the islands. When it does rain, it's typically short-lived and more frequent in the northern, greener areas and during the winter months.

- Sunshine: Abundant year-round.

- Winds: The trade winds are a constant feature, especially in Fuerteventura, making it ideal for wind sports but also providing a refreshing breeze that mitigates the heat.

Differences: The most significant difference is the lack of extreme seasonal variation in the Canaries. If you crave consistent warmth and sunshine every day of the year, the Canaries are a clear winner. The Balearics offer a more traditional four-season experience, with hot summers and cooler, wetter winters, making them perhaps more appealing to those who appreciate seasonal changes and don't mind cooler periods. For year-round outdoor living and activities, the Canaries' climate is often preferred.

Property Prices

For those considering a longer stay or investing in a holiday home, property is a major consideration. Generally speaking, the Balearics tend to be more expensive, particularly for prime locations and luxury properties.

Balearic Islands Property Market: The Balearics are considered a premium property market within Spain, often commanding higher prices due to their established tourism and desirability.

- Mallorca: Palma and its surrounding areas, as well as the southwest coast (e.g., Port Andratx, Santa Ponsa), are among the most expensive areas in Spain. Rural properties in the centre and north can also be pricey.

- Ibiza: Commands some of the highest property prices in Spain, particularly for villas and luxury homes. The island's global reputation drives prices upwards.

- Menorca: Generally more affordable than Majorca and Ibiza, but still considered a high-value market.

- Formentera: Due to its small size and strict building regulations, property is extremely rare and exceptionally expensive.

Canary Islands Property Market: While certainly not 'cheap', the Canary Islands generally offer more accessible property prices compared to the Balearics, especially when considering the excellent year-round climate.

- Tenerife: The most active market in the Canaries. The south (e.g., Costa Adeje, Los Cristianos) is popular with tourists, and prices here are higher, particularly for apartments and villas with sea views. The north tends to be more affordable.

- Gran Canaria: Similar to Tenerife, the south (e.g., Maspalomas, Mogán) is more expensive due to tourism, while the capital, Las Palmas, offers a range of urban apartments.

- Lanzarote: Property prices have seen steady growth but remain generally lower than in the prime areas of Tenerife and Gran Canaria. Puerto del Carmen, Playa Blanca, and Costa Teguise are popular coastal areas.

- Fuerteventura: Often considered one of the more affordable islands in the Canaries, particularly inland or in smaller coastal towns.

- La Palma, La Gomera, El Hierro: These smaller, greener islands generally have the most affordable property prices in the Canaries, appealing to those seeking a quieter, more authentic island life away from mass tourism.

Differences: The Balearics, particularly Majorca and Ibiza, operate at a significantly higher price point, attracting a more affluent buyer base. The Canaries offer a wider range of prices, making property ownership more attainable for a broader spectrum of budgets, especially in the less touristy areas or on the smaller islands. If budget is a primary concern for a holiday home or a longer stay, the Canaries generally offer more for your money.

Cost of Living: Everyday Expenses Compared

Beyond property, the cost of daily life is a crucial factor for tourists, especially for longer stays. While both archipelagos are part of Spain, and therefore benefit from EU pricing on many goods, subtle differences can impact your holiday budget.

Balearic Islands Cost of Living: Generally higher than mainland Spain and, in many aspects, higher than the Canary Islands. This is due to several factors:

- Tourism Impact: High demand from tourism drives up prices for many goods and services, especially in peak season.

- Island Logistics: Goods often need to be imported, incurring higher transport costs.

- Groceries: Supermarket prices can be slightly elevated compared to the mainland. Local markets might offer better value for fresh produce.

- Dining Out/Entertainment: Expect higher prices in restaurants, bars, and for activities, particularly in tourist hotspots.

Canary Islands Cost of Living: Generally lower than the Balearic Islands, and in some aspects, even lower than mainland Spain. This is largely due to their unique tax regime.

- Canary Islands Special Zone (ZEC): The Canaries benefit from a special economic and fiscal regime (REF) that includes lower VAT (IGIC - Impuesto General Indirecto Canario) at a general rate of 7% compared to Spain's 21% VAT. This directly impacts the price of many goods and services.

- Groceries: Often more affordable than the Balearics due to the lower IGIC. Local produce can be very reasonably priced.

- Dining Out/Entertainment: Generally more affordable than the Balearics, especially in non-touristy areas.

- Fuel: Significantly cheaper than mainland Spain and the Balearics due to the lower tax on hydrocarbons. This is a noticeable saving for car rental.

Differences: The most significant factor in the difference in cost of living is the tax regime (IGIC vs. VAT), which makes most consumer goods, services, and fuel cheaper in the Canaries. While both are Spanish islands, the Canaries generally offer a more economical holiday or living experience, particularly for everyday expenses and fuel.

Travel Times from Main European Cities

The duration of travel is a key consideration for tourists, especially those planning short breaks or with limited travel time.

Balearic Islands Travel Times: Due to their Mediterranean location, the Balearics are relatively quick and easy to reach from most major European cities.

- Flight Durations (from London, as an example):

- Mallorca (Palma de Mallorca Airport - PMI): Approximately 2 hours 15 minutes to 2 hours 30 minutes.

- Ibiza (Ibiza Airport - IBZ): Approximately 2 hours 15 minutes to 2 hours 30 minutes.

- Menorca (Mahon Airport - MAH): Approximately 2 hours 15 minutes to 2 hours 30 minutes.

- Frequency: High frequency of direct flights, especially during the summer season, from numerous European cities. Even in winter, there are good connections.

- Accessibility: Their proximity to mainland Spain also means easy ferry connections from Barcelona, Valencia, and Denia, offering an alternative travel option for those who prefer not to fly or wish to bring a car.

Canary Islands Travel Times: Being further out in the Atlantic, the Canary Islands require longer flight durations from mainland Europe.

- Flight Durations (from London, as an example):

- Tenerife (Tenerife South Airport - TFS; Tenerife North Airport - TFN): Approximately 4 hours to 4 hours 30 minutes.

- Gran Canaria (Gran Canaria Airport - LPA): Approximately 4 hours to 4 hours 30 minutes.

- Lanzarote (Lanzarote Airport - ACE): Approximately 4 hours to 4 hours 15 minutes.

- Fuerteventura (Fuerteventura Airport - FUE): Approximately 4 hours 15 minutes to 4 hours 30 minutes.

- La Palma (La Palma Airport - SPC): Approximately 4 hours 30 minutes to 5 hours (often requiring a connection in Tenerife or Gran Canaria for direct flights from smaller European cities).

- La Gomera (La Gomera Airport - GMZ) & El Hierro (El Hierro Airport - VDE): Require an internal flight connection from Tenerife North, adding significant travel time.

- Frequency: While popular, the frequency of direct flights from European cities might be slightly less in the quieter months compared to the Balearics, though major islands still have good connections.

- Accessibility: No direct ferry connections from mainland Europe; all travel is by air or via cruise. Internal island hopping is common via ferry or inter-island flights for tourists wishing to explore multiple islands.

Differences: The Balearics are significantly closer to main European cities, meaning shorter flight times (around half) and often more frequent and potentially cheaper flights, especially for short breaks. If quick, easy access from Europe is a high priority, the Balearics offer a distinct advantage. The Canaries, while very accessible by air, require a longer commitment for travel, making them more suitable for longer holidays.

Culinary Delights: A Taste of the Islands

Food is an integral part of any holiday experience, and both archipelagos offer distinct culinary adventures, influenced by their geographical location and historical ties.

Balearic Islands Food: Rooted in classic Mediterranean cuisine, with strong Catalan influences and an emphasis on fresh seafood, pork, and local produce.

- Sopas Mallorquinas: A hearty dish of thinly sliced bread, vegetables (cabbage, cauliflower, beans), and often meat, simmered in a rich broth.

- Frito Mallorquín: A traditional Majorcan dish made with fried lamb or pork (or sometimes seafood), potatoes, peppers, onions, and often offal.

- Arroz Brut: Literally "dirty rice," a soupy rice dish with meat (pork, rabbit, chicken), vegetables, and saffron.

- Sobrasada: A raw, cured sausage from Majorca, made from ground pork, paprika, salt, and other spices, often spread on bread.

- Ensaimada: A coiled pastry, iconic of Majorca, dusted with icing sugar. It comes in various sizes and can be filled with cream, chocolate, or pumpkin jam.

- Seafood: Abundant and fresh, including grilled fish, paella, and various seafood stews.

- Wine: Local wines are gaining recognition, particularly from Majorca.

- Olives & Olive Oil: Excellent quality, reflecting the Mediterranean climate.

Canary Islands Food: Characterised by simpler, more rustic flavours, with influences from Latin America and North Africa, alongside traditional Spanish elements. Fresh fish and local produce are key.

- Papas Arrugadas con Mojo: "Wrinkled potatoes" boiled in salty water until tender, served with two traditional sauces: Mojo Rojo (red, spicy, made with paprika, garlic, and chilli) and Mojo Verde (green, made with coriander or parsley, garlic, and olive oil). This is arguably the most iconic Canarian dish.

- Gofio: A versatile flour made from roasted grains (wheat, barley, corn). It's a staple and used in various ways: as a thickener for stews, mixed with milk for breakfast, or kneaded into a dough-like consistency.

- Fresh Fish & Seafood: Given the islands' Atlantic location, fresh fish is paramount. Common dishes include Pescado a la Sal (salt-baked fish), grilled sardines, and various seafood stews.

- Sancocho Canario: A salted fish stew, typically with dried fish (often cod), potatoes, sweet potatoes, and served with mojo.

- Bienmesabe: A sweet, paste-like dessert made from almonds, honey, egg yolks, and lemon zest.

- Canarian Cheeses: Excellent goat and sheep cheeses, particularly from Fuerteventura and La Palma, with distinct flavours.

- Tropical Fruits: Due to the climate, a wider variety of tropical fruits are grown, including bananas (Plátano de Canarias), papayas, mangoes, and avocados.

- Canarian Wines: Distinctive wines, particularly from Lanzarote (from vines grown in volcanic ash) and La Palma.

Differences: The Balearic cuisine leans more towards a classic Mediterranean diet with richer, often pork-based dishes, and a strong emphasis on olive oil and cured meats. The Canarian diet is simpler, with a focus on fresh fish, potatoes, and the ubiquitous mojo sauces. The use of gofio and a wider array of tropical fruits are also defining characteristics of Canarian food, reflecting its unique climate and historical connections. If you prefer rich, traditional Spanish/Mediterranean flavours, the Balearics might appeal more. If you enjoy fresh, lighter, and more unique island flavours with a hint of spicy zest, the Canaries will be a culinary adventure.

Are the Balearic or Canary Islands Better?

There is no single "better" island group; the choice hinges entirely on your personal preferences...

Choose the Balearic Islands if:

- You prefer a classic Mediterranean climate: Hot, dry summers and cooler, distinct winters, perfect for summer beach holidays.

- You value shorter flight times from mainland Europe: Ideal for weekend breaks or shorter holidays.

- You are looking for a more established European holiday feel: With vibrant resorts, historical towns, and diverse entertainment options.

- You appreciate a more refined, upscale environment: Particularly in Majorca and Ibiza, which offer luxury resorts and fine dining.

- You enjoy the Mediterranean culinary style: With its emphasis on fresh seafood, cured meats, and traditional Spanish dishes.

- You love white/golden sand beaches and calm, turquoise waters.

Choose the Canary Islands if:

- You crave year-round sunshine and a stable, mild climate: The "eternal spring" is perfect for winter sun holidays or consistent pleasant weather.

- You are seeking a more affordable holiday: Thanks to the lower IGIC tax impacting the cost of goods and services.

- You appreciate a more diverse, dramatic, and volcanic landscape: With black, red, and golden sand beaches, and unique natural wonders like volcanoes and lava fields.

- You enjoy outdoor activities year-round: Hiking, watersports (especially windsurfing and kitesurfing), and exploring unique natural parks are more comfortable in the consistent climate.

- You prefer a mix of European and more unique island influences in your cuisine: With fresh fish, mojo sauces, and tropical fruits.

- You don't mind longer flight times from mainland Europe, as the consistent warm weather often justifies the extra travel.

- You appreciate the unique and distinct character of each island, offering a vast array of experiences within one archipelago, ideal for island hopping.

Final Thoughts:

Both the Balearic and Canary Islands offer an exceptional holiday experience, stunning natural beauty, and a welcoming culture. Your decision will ultimately come down to the nuances: do you prefer the quintessential Mediterranean charm, or the unique, perpetual spring of the Atlantic? Do you prioritise quick European accessibility, or do you value a more affordable holiday and dramatic landscapes? Consider visiting both, if possible, to truly experience their distinct atmospheres.

0

Like

Published at 11:22 AM Comments (1)

0

Like

Published at 11:22 AM Comments (1)

Driving in Spain - All you need to know

Friday, May 23, 2025

Navigating Spain's roads as a foreign visitor requires a comprehensive understanding of its traffic laws and regulations to ensure a safe, compliant, and enjoyable journey. This guide summarises the essential rules, from fundamental driving practices to specific requirements for parking, child safety, and navigating urban zones.

Fundamental Driving Rules and Safety

In Spain, vehicles operate on the right side of the road. Safety belts are mandatory for all occupants, both front and rear. The use of mobile phones while driving is strictly forbidden without a hands-free device, and physically handling a device is prohibited. Motorcyclists may use certified wireless devices integrated into their helmets for communication or navigation, provided safety is not compromised. Overtaking is only permitted on the left side of the vehicle being overtaken. Helmets are mandatory for riders of motorbikes, mopeds, and bicycles. Visitors should also be aware that electric scooters are subject to specific regulations that can vary by municipality.

Speed Limits and Alcohol Regulations

Spain enforces clear speed limits based on road type :

-

Dual carriageways and motorways: 120 km/h.

-

Conventional roads: 90 km/h.

-

Urban areas: Range from 20 to 50 km/h, depending on specific signage and street design.

Strict alcohol limits are in place for drivers :

-

General drivers: 0.5 grams per litre (g/l) of alcohol in blood, or 0.25 milligrams per litre (mg/l) in exhaled air.

-

Professional and novice drivers (less than two years of experience): 0.3 g/l in blood, or 0.15 mg/l in exhaled air. These low limits imply a near-zero tolerance for impaired driving, making it safest for drivers to abstain from alcohol entirely.

Child Safety in Vehicles: Car Seats and Restraints

Spain has rigorous laws concerning child safety in vehicles. Children under 135 centimetres (approx. 5 feet) in height must use an approved child restraint system (CRS) suitable for their height and weight. It is recommended that children continue using a restraint system with a back until they exceed 150 centimetres. Infants must be secured in an approved, rear-facing car seat until they reach 9 kilograms (around one year of age), with a strong recommendation to remain rear-facing for as long as possible, ideally up to four years or 18 kilograms.

Children under 135 cm are not permitted to sit in the front seat unless all rear seats are already occupied by other children in car seats. If a child must occupy the front passenger seat under this exception, an appropriate CRS must be used, and the vehicle's airbag on that side must be deactivated.

For taxis, child car seats are not legally required for city trips within urban limits, though highly recommended for safety. However, if a taxi journey involves intercity motorways, the same car seat rules as private vehicles apply. Other transfer services like Uber and Cabify typically require a child to be in a car seat or for one to be reserved in advance. All car seats used in Spain must hold ECE R44/R129 approval. The Isofix system has been obligatory in all newly manufactured cars since 2021, simplifying installation. For tourists renting cars, it is a legal requirement that an appropriate car seat be provided for children under 1.35m tall.

Parking Regulations and Zones

Parking in Spanish cities is often regulated and not always free. Parking spaces are commonly delineated by colored lines, each with specific rules :

-

White Lines (Zona Blanca): Typically denote free parking spaces, though they can be hard to find in city centres.

-

Blue Lines (Zona Azul): Indicate paid parking areas with limited duration. Payment must be made at a parking meter, and the ticket displayed on the dashboard.

-

Green Lines (Zona Verde): Primarily reserved for residents of a specific neighborhood. Visitors are generally not permitted to use these spaces and risk a fine.

-

Yellow Lines: Unequivocally indicate parking bans. Parking here is strictly prohibited and can lead to fines or towing.

To avoid parking fines, it is crucial to pay attention to signs, use official parking areas, check parking hours, consider pre-booking parking, display tickets clearly, adhere to time limits, and avoid disabled spots.

Traffic Fines: Understanding, Payment, and Appeals

Official notifications of fines are primarily issued by post by the Directorate-General for Traffic (DGT), or published on the Tablón Edictal (TEU) if the driver's address is unknown. Electronic notifications are also possible via the Dirección Electrónica Vial (DEV).

Drivers must be vigilant against traffic fine scams, which often involve SMS or email messages with direct payment links, misspellings, or a lack of key information like file or vehicle registration numbers. Authenticity should always be verified directly with the issuing authority (DGT, town hall, or regional government) through official channels.

Regarding payment procedures and discounts: A 50% reduction is available if the driver acknowledges responsibility and pays within a voluntary period of 20 calendar days from notification. Paying within this period waives the right to appeal. If unpaid or unappealed within 20 days, the fine enters the ordinary procedure, allowing an additional 45 days for full (100%) payment. Unpaid fines after this period are forwarded to the State Agency for Tax Administration with an additional 20% surcharge.

The process for appealing a fine is structured: An initial objection can be lodged within 20 calendar days of notification, but this forfeits the 50% discount. If the objection is rejected, a driver can pursue an appeal for reconsideration within one month. If still unresolved, a contentious-administrative appeal can be made directly to court, requiring a lawyer and solicitor. A new EU Directive (2024/3237) aims to strengthen drivers' rights by stipulating that fine notifications should be in plain language, explain the offense and options, and be available in the vehicle's country of registration language.

Mandatory Vehicle Equipment and Documentation

The minimum driving age in Spain is 18 years. Several items are mandatory vehicle equipment :

-

One Reflective Vest: Must be worn if exiting the vehicle on interurban roads during an emergency and stored inside the car.

-

Two Warning Triangles: Mandatory to carry. One placed 50 meters in front and one 50 meters behind on two-way roads; only rear on one-way or multi-lane roads.

-

Flashing Light Signal (V-16 device): Since July 1, 2021, this orange flashing light can be used in place of triangles. It is placed on the highest part of the vehicle for safety. A transition period allows both until January 1, 2026, after which the V-16 light signal with geolocation will be the sole permitted device.

-

Beam Deflectors: Necessary for UK-registered vehicles to adjust headlight beams for right-hand driving.

-

UK Sticker or UK Symbol on Number Plate: Required for UK-registered vehicles. Recommended items include spare bulbs and a spare wheel or puncture repair kit.

Several required documentation items must be carried :

-

Valid Driving License: EU licenses are valid. For non-EU licenses, an International Driving Permit (IDP) is recommended and must be presented alongside the national license.

-

Vehicle Registration Documents: V5C logbook for personal vehicles or the rental contract for hired vehicles.

-

Proof of Insurance: While number plates serve as proof for EU-insured vehicles, carrying the receipt and full insurance documentation is advisable. A Green Card is recommended but not mandatory.

-

Vehicle Technical Inspection (ITV): Personal vehicles must have a valid ITV certificate; driving without one incurs a fine.

Toll Roads and Low Emission Zones (LEZs)

Spain's motorway network includes both toll roads and toll-free expressways. Toll roads, known as Autopistas, are privately managed and identified by blue motorway signs with "AP" or "PEAJE". Publicly managed Autovías are generally toll-free. Toll amounts vary by vehicle type, distance, and sometimes time or payment method.

Various payment methods are available at toll stations: cash, widely accepted debit/credit cards, and electronic tolls (OBE/Bip & Go badge / VIA-T / Telepeaje). Drivers without an electronic device should avoid lanes marked solely "VIA-T" or "Telepeaje". Some regions, like the Basque Country, use free-flow toll systems requiring advance license plate registration linked to a bank card or a compatible toll tag. Non-payment can lead to additional interest and fees.

Low Emission Zones (ZBEs - Zonas de Bajas Emisiones) are increasingly prevalent, particularly in major cities like Madrid and Barcelona, aiming to improve urban air quality. As of January 1, 2024, there are 149 cities in Spain with established LEZs, including all municipalities with a population exceeding 50,000.

Spain classifies vehicles based on DGT environmental stickers (Distintivos Ambientales), which dictate LEZ access :

-

Zero Emissions (Blue): Electric, hydrogen, plug-in hybrids (>40km range) – unrestricted access.

-

ECO (Green & Blue): Mild hybrids, LPG, natural gas, plug-in hybrids (<40km range) – generally good access.

-

C (Green): Newer petrol (from 2006), diesel (from 2014) – access depends on city rules.

-

B (Yellow): Older petrol (2000-2006), diesel (2006-2014) – most limited access.

-

A (No sticker): Older, non-compliant vehicles – banned from all ZBEs.

A critical point for foreign-plated vehicles in LEZs is that they are not eligible for Spanish DGT environmental stickers. To gain entry to ZBEs in cities like Barcelona and Madrid, foreign cars must be registered to confirm their emissions category and apply for authorisation before driving within these restricted areas. While some European environmental stickers may be considered for equivalency, this is not universally guaranteed. Compliance is monitored automatically, and fines for violations start at €200.

Key Takeaways for a Safe Trip

Driving in Spain as a foreign visitor demands proactive preparation. Prioritising familiarity with Spanish driving regulations, including mandatory equipment, documentation, and urban zone restrictions, is essential. Safety must be paramount, with strict adherence to speed limits, stringent alcohol limits, and comprehensive child safety regulations. Navigating parking wisely by understanding colour-coded zones is crucial to avoid fines. Vigilance against traffic fine scams and planning for urban access, especially concerning Low Emission Zones and their registration requirements for foreign vehicles, are also vital. A quick check for the latest updates before a trip can ensure complete compliance and a stress-free journey.

0

Like

Published at 8:04 PM Comments (1)

0

Like

Published at 8:04 PM Comments (1)

Most relaxing areas to retire in Spain, away from the crowds.

Friday, April 18, 2025

Spain has long been a favourite destination for retirees seeking sun, sea, and a laid-back lifestyle. However, many of the well-known coastal areas have become increasingly crowded and touristy over the years. For those looking to escape the hustle and bustle and truly embrace the tranquil Spanish way of life, there are still plenty of hidden gems to be found. In this article, we'll explore some of the most relaxing areas to retire in Spain, far from the madding crowd.

Before we delve into specific locations, it's worth considering why Spain remains such an attractive option for retirees. The country boasts a fantastic climate, with long, sunny summers and mild winters in many regions. The cost of living is generally lower than in many other Western European countries, and the healthcare system is excellent. Add to this the rich culture, delicious cuisine, and warm, welcoming locals, and it's easy to see why Spain continues to draw retirees from around the world.

However, the key to finding true relaxation in retirement is often about discovering those lesser-known areas that offer all the benefits of Spanish living without the drawbacks of over-tourism. Let's explore some of these hidden treasures.

Costa de la Luz, Andalusia

While many flock to the Costa del Sol, those in the know head west to the Costa de la Luz. This "Coast of Light" in Andalusia offers miles of pristine beaches, charming white-washed villages, and a more authentic Spanish experience.

Highlights:

Conil de la Frontera: A picturesque town with beautiful beaches and a relaxed vibe.

Vejer de la Frontera: A hilltop white village with stunning views and a rich history.

Doñana National Park: A vast natural reserve perfect for birdwatching and nature walks.

The Costa de la Luz offers a slower pace of life, with plenty of opportunities for outdoor activities and cultural experiences. The area is less developed than other coastal regions, meaning you can enjoy unspoiled beaches and a more traditional way of life.

Sierra de Gredos, Castilla y León

For those who prefer mountains to beaches, the Sierra de Gredos in central Spain offers breathtaking scenery and a tranquil retreat from the world.

Highlights:

Arenas de San Pedro: A charming town nestled in the mountains with a rich cultural heritage.

Navarredonda de Gredos: A small village perfect for hiking and nature enthusiasts.

La Plataforma: A stunning viewpoint offering panoramic vistas of the mountain range.

The Sierra de Gredos is ideal for retirees who enjoy outdoor activities such as hiking, birdwatching, and stargazing. The clean mountain air and peaceful surroundings make it a perfect place to unwind and embrace a slower pace of life.

Maestrazgo, Aragon

The Maestrazgo region in Aragon is one of Spain's best-kept secrets. This rugged, mountainous area is dotted with medieval villages and offers a glimpse into Spain's rich history.

Highlights:

Cantavieja: A beautifully preserved medieval town with stunning architecture.

Mirambel: A small village surrounded by ancient walls, offering a step back in time.

Iglesuela del Cid: Home to impressive Renaissance buildings and a peaceful atmosphere.

The Maestrazgo region is perfect for retirees who appreciate history, architecture, and a quiet way of life. The area is relatively undiscovered by tourists, allowing for a truly authentic Spanish experience.

Ribeira Sacra, Galicia

In the lush, green region of Galicia, the Ribeira Sacra offers a unique retirement destination. Known for its deep river canyons, ancient monasteries, and excellent wines, this area provides a peaceful retreat in a stunning natural setting.

Highlights:

Monforte de Lemos: A charming town with a rich history and excellent local cuisine.

Sil Canyon: Breathtaking views and boat trips through dramatic gorges.

Santo Estevo de Ribas de Sil: A former monastery turned luxury hotel, perfect for a special treat.

The Ribeira Sacra is ideal for retirees who appreciate good food and wine, beautiful landscapes, and a cooler climate than southern Spain. The area's Celtic heritage adds an interesting cultural dimension to life here.

Albarracín, Aragon

Often described as one of the most beautiful villages in Spain, Albarracín in the province of Teruel offers a magical setting for retirement.

Highlights:

Medieval architecture: The entire town is a living museum of medieval and Renaissance architecture.

Surrounding nature: The town is surrounded by pine forests and rugged landscapes perfect for hiking.

Cultural events: Despite its small size, Albarracín hosts numerous cultural events throughout the year.

Albarracín provides a unique retirement experience, combining history, culture, and natural beauty. The town's small size and relative isolation make it perfect for those seeking peace and tranquillity.

Practical Considerations for Retiring in Spain

While these lesser-known areas offer a more relaxed and authentic Spanish experience, there are some practical considerations to keep in mind:

Language: In many of these areas, English is less widely spoken than in more touristy regions. Learning Spanish will greatly enhance your experience and help you integrate into the local community.

Healthcare: While Spain has excellent healthcare, some rural areas may have fewer medical facilities. It's important to research the healthcare options in your chosen area and consider private health insurance.

Transport: Public transport in rural areas can be limited. Having a car might be necessary, especially if you choose a more remote location.

Community: These areas may have smaller expat communities than more popular retirement destinations. This can be a positive for those seeking an authentic experience but may require more effort to build a social network.

Property: While property prices in these areas are often lower than in more touristy regions, the housing stock may be older and require renovation. It's crucial to do thorough research and possibly rent before buying.

Visa requirements: Non-EU citizens will need to obtain the appropriate visa to retire in Spain. The most common is the Non-Lucrative Visa, which requires proof of sufficient income and private health insurance.

Embracing the Spanish Lifestyle

Retiring in one of Spain's hidden gems offers the opportunity to fully embrace the Spanish lifestyle. This means adapting to local customs and rhythms, which can be a delightful part of the retirement experience.

The Spanish are known for their relaxed attitude towards time, epitomised by the siesta culture. While not as prevalent as it once was, many small towns and villages still observe this midday break. Embracing this slower pace of life can be one of the joys of retiring in Spain.

Food plays a central role in Spanish culture, and each region has its own specialities. From the seafood of Galicia to the hearty stews of Castilla y León, exploring local cuisine can be a wonderful way to immerse yourself in your new home.

Social life in Spain often revolves around the town square or plaza, especially in smaller towns and villages. Sitting at a café, watching the world go by, and chatting with neighbours is a quintessential Spanish experience that embodies the relaxed lifestyle many retirees seek.

Retiring in Spain doesn't have to mean joining the crowds in well-known expat havens. By venturing off the beaten path to areas like the Costa de la Luz, Sierra de Gredos, Maestrazgo, Ribeira Sacra, or Albarracín, retirees can discover a more authentic, relaxed, and enriching Spanish experience.

These hidden gems offer the chance to immerse oneself in Spanish culture, enjoy stunning natural beauty, and embrace a slower pace of life. While they may require a bit more effort in terms of language learning and integration, the rewards of living in these beautiful, tranquil areas can be immeasurable.

Ultimately, retiring in one of Spain's lesser-known regions provides an opportunity not just to live in Spain, but to truly become a part of it. It's a chance to write a new chapter in life, filled with discovery, relaxation, and the simple pleasures of Spanish living. Whether you're drawn to mountain villages, historic towns, or quiet coastal areas, Spain's hidden gems have something to offer every retiree seeking tranquillity and authenticity in their golden years.

2

Like

Published at 8:00 PM Comments (0)

2

Like

Published at 8:00 PM Comments (0)

The cheapest places to live in Spain close to the beach.

Friday, April 11, 2025

Spain, with its sun-drenched coastlines, vibrant culture, and relaxed lifestyle, has long been a favourite destination for expats and retirees seeking a slice of Mediterranean paradise. However, many assume that living near the beach in Spain has a hefty price tag. Fortunately, that's not always the case. There are still plenty of affordable coastal areas where you can enjoy the Spanish way of life without breaking the bank. In this article, we'll explore some of the cheapest places to live in Spain close to the beach, offering insights into the cost of living, local culture, and what to expect in each location.

Alicante Province

Nestled along the Costa Blanca, the Alicante Province offers a perfect blend of affordability and coastal charm. While the city of Alicante itself can be pricier, numerous smaller towns and villages in the province provide excellent value for money.

Torrevieja: This coastal city is known for its salt lakes and beautiful beaches. Property prices here are remarkably affordable, with many apartments available under €100,000. The cost of living is generally low, with groceries and dining out being remarkably inexpensive.

El Campello: Just north of Alicante city, El Campello offers a more laid-back atmosphere with its long stretches of sandy beaches. While slightly more expensive than Torrevieja, it's still considerably cheaper than many other coastal areas in Spain.

Living in the Alicante Province allows you to enjoy a typical Mediterranean climate with hot summers and mild winters. The area is well-connected, with Alicante-Elche Airport providing easy access to the rest of Europe.

Murcia Region

The Murcia region, often overlooked by international buyers, offers some of the best value coastal living in Spain. With its unspoiled beaches and authentic Spanish atmosphere, it's a hidden gem for those seeking affordability near the sea.

Águilas: This charming fishing town boasts beautiful beaches and a rich history. Property prices here are very competitive, and the cost of living is notably low. The town has a strong Spanish feel, perfect for those looking to immerse themselves in the local culture.

Mazarrón: Another coastal gem in Murcia, Mazarrón offers a combination of beautiful beaches and affordable living. The area is known for its excellent climate, with over 300 days of sunshine annually.

The Murcia region benefits from a dry, warm climate and is less developed than some of the more popular coastal areas. It offers a more authentic Spanish experience. The new Murcia International Airport has improved accessibility to the region, making it an increasingly attractive option for international residents.

Costa del Sol (Málaga Province)

While parts of the Costa del Sol are known for luxury and high prices, there are still pockets of affordability to be found, especially if you're willing to look beyond the most famous resorts.

Torrox: Often called the 'healthiest place to live in Europe' due to its microclimate, Torrox offers a blend of beach life and traditional Andalusian charm. Property prices here are much lower than in nearby tourist hotspots like Nerja.

Vélez-Málaga: The capital of the Axarquía region, Vélez-Málaga, is located just inland but close to the beaches of Torre del Mar. It offers a more authentic Spanish lifestyle with lower living costs than the more touristy coastal areas.

Living on the Costa del Sol provides excellent amenities, a large expat community, and easy access to Málaga city and its international airport. The region enjoys a subtropical Mediterranean climate with mild winters and hot summers.

Costa de Almería

The Costa de Almería in southeastern Spain offers some of the most affordable coastal living in the country. This region is less developed and touristy than other coastal areas, providing a more authentic Spanish experience.

Mojácar: This picturesque white village perched on a hill near the coast offers stunning views and beautiful beaches. Property prices in Mojácar are very reasonable, and the cost of living is low compared to more popular coastal destinations.

Garrucha: This small fishing town provides an authentic Spanish coastal experience at affordable prices. It's known for its seafood and beautiful beaches.

The Costa de Almería boasts a dry, sunny climate and is home to Europe's only desert, the Tabernas Desert. The region offers a slower pace of life and is ideal for those seeking tranquillity and affordability.

Costa de la Luz (Huelva Province)

Located in southwestern Spain, bordering Portugal, the Costa de la Luz in Huelva Province offers some of the country's most pristine beaches at very reasonable prices.

Isla Cristina: This coastal town is known for its beautiful beaches and is one of the most important fishing ports in Andalusia. Property prices here are very competitive, and the cost of living is low.

Ayamonte: Situated on the border with Portugal, Ayamonte offers the best of both countries. It's a charming town with affordable property prices and a low cost of living.

The Costa de la Luz enjoys a warm climate with Atlantic breezes, making it cooler in summer than some Mediterranean coast areas. The region is less developed touristically, offering a more authentic Spanish experience.

Considerations When Choosing a Location

While these areas offer affordable coastal living, it's essential to consider several factors when deciding where to settle:

Year-round living vs. holiday destinations: Some cheaper coastal areas may be quiet during the off-season. Consider whether you're looking for a bustling year-round community or are happy with a more seasonal atmosphere.

Healthcare: While Spain has excellent public healthcare, some smaller towns may have limited medical facilities. Ensure you research the healthcare options in your chosen area, especially if you have specific medical needs.

Transport links: Consider how well-connected the area is. Are there good public transport options? How far is the nearest airport? This can be particularly important if you plan to travel frequently or expect visitors from abroad.

Language: In some less touristy areas, English may not be widely spoken. If you're moving to a more authentic Spanish area, consider your Spanish language skills and willingness to learn.

Work opportunities: If you need to work, research the job market in your chosen area. Some smaller coastal towns may have limited employment options, especially for non-Spanish speakers.

Community: If having fellow international residents nearby is important to you, look into the existing expat community in the area. Some areas have large, established expat communities, while others are predominantly Spanish.

Cost of Living in Coastal Spain

While these areas offer more affordable living compared to popular tourist destinations or major cities, it's important to have a realistic understanding of the costs involved in living in coastal Spain.

Accommodation: Rental prices can vary significantly depending on the specific location and type of property. In many of the areas mentioned, one-bedroom apartments are available for rent from around €400-€600 per month, with purchase prices for similar properties starting from around €70,000-€100,000.

Utilities: Monthly utilities (electricity, heating, cooling, water, garbage) for a small apartment typically range from €80-€120.

Food and Dining: Grocery prices in Spain are generally reasonable, especially if you shop at local markets and buy seasonal produce. A meal at an inexpensive restaurant might cost around €10-€15 per person.

Transportation: Public transport is generally affordable in Spain. A monthly pass for local transport typically costs between €30 and €50.

Healthcare: If you're a resident contributing to the Spanish social security system, you'll have access to public healthcare. Private health insurance is also available and relatively affordable, with basic plans starting from around €50-€100 per month.

Remember that while these areas offer more affordable living, costs can still add up. It's crucial to budget carefully and consider all expenses, including potential property taxes, income taxes, and healthcare costs.

Spain's coastline offers a diverse range of affordable living options for those dreaming of a life by the sea. From the Costa Blanca to the Costa de la Luz, there are numerous locations where you can enjoy beautiful beaches, warm weather, and the famous Spanish lifestyle without spending a fortune.

However, it's essential to do thorough research before making a move. Visit your potential new home at different times of the year, speak to locals and expats already living there, and carefully consider your personal needs and preferences.

Whether you're looking for a bustling town with a large expat community or a quiet fishing village where you can immerse yourself in Spanish culture, there's likely an affordable coastal area in Spain that's perfect for you. With careful planning and consideration, your dream of affordable beach living in Spain can become a reality.

1

Like

Published at 11:10 PM Comments (0)

1

Like

Published at 11:10 PM Comments (0)

Mark Your Calendars: Spain's Clock Change in 2025

Saturday, March 29, 2025

As winter starts fading away, bringing along the promise of sunnier and longer days, it's time for the annual adjustment of our clocks. Spain is set to transition to daylight saving time (DST) soon, and it's always helpful to know exactly when these changes will occur so we can prepare ourselves. If you're in Spain or planning a visit, here's everything you need to know about the clock change in 2025.

When Does Spain Switch to Daylight Saving Time in 2025?

In 2025, Spain will move the clocks forward by one hour during the night of Saturday 29 March to Sunday 30 March. At precisely 2:00 am, the time will leap ahead to 3:00 am, marking the official start of summer time. This means you'll lose one hour of sleep; however, you’ll be compensated with longer daylight in the evenings, which many find delightful.

When Does Spain Return to Standard Time?

The daylight saving period will continue throughout the spring and summer seasons, concluding on Sunday 26 October. On this day, the clocks will be set back by one hour at 3:00 am, rolling back to 2:00 am, and we'll return to what is often referred to as "winter time". This biannual adjustment aims to make better use of natural daylight and optimise energy use.

Why Does Spain Change the Clocks Twice a Year?

The concept of changing the clocks, initially introduced to make better use of daylight, was intended to save energy. By shifting the time forward one hour in spring, people could enjoy longer afternoons and shorter nights, thus reducing the need for artificial lighting in the evenings.

Despite the original energy-saving motivations, not all countries around the world follow this practice. In fact, according to surveys, fewer than 40% of countries globally still observe daylight saving time. For instance, countries such as Japan, Russia, and most African countries (bar Egypt) do not adjust their clocks.

Interestingly, even within some countries, the practice can vary. The United States has a patchwork system where some states do not participate in DST. Similarly, in China, only the region of Xinjiang unofficially follows a variant of daylight time changes.

Will Spain End Daylight Saving Time?

The discussion around daylight saving time's relevance in the modern age has been a hot topic over the past few years. In 2019, the European Commission proposed ending the biannual clock change, citing that the benefits are now minimal. The proposal suggested that each country would permanently choose either summer or winter time. However, this change has yet to be fully realised across the European Union, and countries continue with the current system for the time being.

As for Spain, no definitive decision has been made to discontinue daylight saving time. Official bulletins have affirmed that clocks will continue to change in 2025 and 2026 in line with the established practice.

Adapting to the Clock Change

While the loss of an hour's sleep on 30 March 2025 might be a small inconvenience, many look forward to the extended evening daylight that summer time provides. It allows for more outdoor activities, longer evening strolls, and quite simply, more time to bask in the sunlight.

As a rule of thumb, here are some tips to help ease the transition:

- Adjust Gradually: Try moving your bedtime earlier by 15 minutes a few days before the clock change. This small adjustment can help your body adjust more smoothly.

- Embrace the Daylight: Spend time outside during daylight hours to help reset your internal clock. Natural light exposure can ease the transition and align your circadian rhythm.

- Maintain Consistent Routines: Keep a consistent schedule for meals, exercise, and other daily activities. This regularity can help your body adapt to the new time more effectively.

Keep Updated with Local News

Staying informed about important changes like daylight saving time is essential, especially if you have busy schedules or travel plans. For the latest updates and news about Spain, keep an eye on reliable news sources.

Mark your calendars for Spain's upcoming clock changes: setting your clocks forward on 29 March 2025 and back again on 26 October 2025. Despite ongoing discussions about possibly ending daylight saving time within the European Union, for now, these adjustments remain part of our annual routine.

2

Like

Published at 10:54 AM Comments (1)

2

Like

Published at 10:54 AM Comments (1)

Understanding Driving Licence Codes in Spain

Wednesday, February 19, 2025

Whether you are a new driver or have been driving for years, the series of letters and numbers on the back of your driving licence can be confusing. These codes are more than just random assortments of characters; they carry significant information regarding your driving privileges and restrictions.

For any driver navigating Spain’s roads, understanding these codes is essential. It helps ensure compliance with transportation regulations and prevents any misunderstandings. Let's delve into what these driving licence codes mean, their importance, and what happens if you don’t follow them.

What are Driving Licence Codes?

Driving licence codes are standardised identifiers applied across the European Union, including Spain. These codes are assigned either during the licence issuance process or afterward, typically following a medical assessment or other evaluations. They offer a vital means to communicate specific limitations, adaptations, or conditions related to both the driver and the vehicle they are authorised to operate.

What Do the Codes on a Driving Licence Mean?

These codes cover a range of scenarios, from vehicle types to necessary adaptations for drivers with disabilities. Below, we provide a detailed explanation of various driving licence codes you may encounter on your Spanish driving permit:

Administrative Codes

- 70: Permit exchange number. This code is used when a driving licence is exchanged between countries, with an example being

70.0123456789.NL, indicating an exchange with the Netherlands.

- 71: Duplicate permit number, such as

71.987654321.HR for a duplicate issued in Croatia.

- 72: Restriction to driving only category A vehicles with a maximum cylinder capacity of 125 cm³ and a maximum power of 11 kW (A1).

- 73: Limitation to driving only category B tricycle or motor quadricycle type vehicles (B1).

- 74: Restricted to category C vehicles whose maximum authorised mass does not exceed 7500 kg (C1).

- 75: Limitation to driving category D vehicles with no more than 16 seats, excluding the driver's seat (D1).

- 76: Restriction to category C vehicles (maximum mass 7500 kg) towing a trailer exceeding 750 kg, provided certain conditions are met (C1+E).

- 77: Restricted to driving category D vehicles with up to 16 seats (excluding the driver's seat) towing a trailer over 750 kg, given specific criteria are met (D1+E).

Adaptation Codes

- 78: Limited to vehicles without a clutch pedal or manually operated lever for motorcycles.

- 79: Restricted to vehicles meeting specified requirements under EU legislation.

- 90.x: Adaptations related to the controls of the vehicle, such as

90.01: to the left for a hand control on the left.

- 95: Indicates a driver has passed an aptitude test under the professional competence requirements, valid for a certain period.

- 96: Signifies that the driver has completed full training or passed an aptitude and behaviour test.

National Codes

These codes pertain specifically to regulations within Spain:

- 101: Applicable to class D and D + E licences, limiting driving buses to routes within a certain radius.

- 105: Administrative speed limits imposed on the driver:

- 70 km/h

- 80 km/h

- 90 km/h

- 100 km/h

- 106: Pertains to the date of the first licence issue for various scenarios, like military or police licence exchanges.

- 107: Category AM licences limited to three-wheeled vehicles and lightweight quadricycles.

- 200: Requires the licence holder to carry documentation issued by the Provincial Traffic Department outlining conditions for vehicle use.

- 201: The licence is not valid without an accompanying document detailing suspension periods.

- 202: Restricted to driving certain police vehicles and buses, valid until a specific date.

Importance of Compliance

It is crucial to adhere to the conditions and limitations indicated by these codes. Failing to comply is considered a serious offence under Spanish law and can result in a fine of up to €200. According to Article 3 of the General Regulations for Drivers, "the holder of a driving permit or licence, as well as any other authorisation or document that enables driving, must adhere to the mentions, adaptations, restrictions, and other limitations relevant to the person, vehicle, or traffic conditions specified on the licence."

In conclusion, driving licence codes are a pivotal aspect of the driving regulatory framework in Spain and the broader European Union. They ensure that drivers operate within the boundaries of their capabilities and that vehicles are used safely and appropriately. Taking the time to understand these codes can help avoid legal hassles and ensure a smoother driving experience.

0

Like

Published at 6:37 PM Comments (0)

0

Like

Published at 6:37 PM Comments (0)

Exploring the Digital Nomad Visa Opportunities Across Europe:

Thursday, February 6, 2025

In the ever-evolving landscape of remote work, digital nomad visas have become increasingly popular. These visas provide professionals who work remotely the opportunity to live and work in foreign countries legally. While many European countries have adopted digital nomad visa schemes, the income requirements for obtaining these visas can vary significantly. Notably, Finland, Montenegro, and Albania stand out for their relatively low-income thresholds, making them attractive destinations for digital nomads seeking to explore Europe without the burden of exorbitant financial prerequisites.

Spain’s Digital Nomad Visa: A Comparative Baseline

To understand how the income requirements across Europe compare, it's beneficial to establish a baseline with Spain’s digital nomad visa. Recent government adjustments have linked the income threshold to Spain's minimum wage, which saw a 4.4% increase in 2025. This adjustment raised the monthly earning requirement to €1,381.33, equating to an annual gross income of €16,576. For digital nomad visa applicants, this translates to a need to demonstrate earnings of at least €2,762 per month—double the minimum wage.

Despite this increase, Spain’s requirements remain lower than some European countries, such as Iceland and Estonia, but higher than others, including Finland, Montenegro, and Albania.

Iceland: The Highest Income Requirement for Digital Nomads

At the upper end of the spectrum, Iceland offers a remote work visa catering specifically to high-income individuals. Applicants need to earn a minimum of €7,075 per month, the highest threshold in Europe. This visa is accessible to both employees of foreign companies and freelancers and is valid for up to six months. During this period, applicants are considered tax residents, subject to local tax regulations.

Similarly, Estonia's digital nomad visa requires a gross monthly income of €4,500, allowing remote workers to stay for up to one year. Should they remain longer than six months, they too become subject to local taxes.

Romania follows with its digital nomad visa aimed at non-EU citizens, stipulating a monthly income threshold of €3,950. This figure is approximately three times the country’s average gross salary. Recent legislative changes ensure that digital nomads staying for extended periods in Romania enjoy exemptions from income tax, social security, and social health insurance contributions.

Finland: Low-Income Requirement Despite High Living Costs

Finland's digital nomad visa is particularly notable for its accessibility, requiring a minimum monthly income of just €1,220. This is remarkably low, especially considering Finland’s high living costs. The visa is designed for non-EU entrepreneurs who are self-employed or run independent businesses. This low financial barrier makes Finland an attractive option for digital nomads seeking to experience the vibrant culture and high living standards of one of Northern Europe's most advanced nations.

Montenegro: Combining Low-Income Requirements with Long-Term Residency

Montenegro offers another appealing option for digital nomads, requiring a monthly income of around €1,400. The nation’s digital nomad visa scheme allows participants to reside in the country for up to four years, a significantly longer period than most other European digital nomad visas provide. Additionally, digital nomads in Montenegro may be eligible for tax breaks, although the specific details of these benefits are still under development. This combination of a low-income threshold and long-term residency potential positions Montenegro as an attractive destination for remote workers.

Albania: Flexibility with the Unique Permit

Albania, too, has embraced the digital nomad trend with its Unique Permit, introduced in early 2022. This permit allows digital nomads to live and work in the country for up to one year, with the possibility of renewal for up to five consecutive years. To qualify, applicants must present proof of an employment contract with a foreign company that permits remote work, alongside evidence of sufficient funds to sustain themselves, estimated to be around €9,800 annually. Albania’s flexible approach and modest financial requirements make it an enticing destination for digital nomads seeking affordability combined with the charm of a Mediterranean lifestyle.

Making the Right Choice for a Digital Nomad Visa

Choosing the right digital nomad visa depends on various factors, including income requirements, tax policies, and the duration of permitted stay. While nations like Iceland and Estonia cater to higher-income individuals, countries such as Finland, Montenegro, and Albania offer more accessible options with lower financial barriers.

Finland stands out with its low monthly income requirement of €1,220, making it feasible for many digital nomads despite the higher living costs. Meanwhile, Montenegro provides a balanced offer with a €1,400 requirement and the advantage of a four-year residency, complemented by potential tax breaks. Albania’s Unique Permit offers flexibility and a moderate annual financial requirement of €9,800, suitable for those favouring a longer-term stay without extensive financial commitments.

Ultimately, the choice of destination will depend on personal preferences, professional needs, and financial capabilities. By assessing these factors alongside the specific visa requirements, digital nomads can find the most suitable European country to live and work in, making their remote work journey a blend of productivity and adventure.

0

Like

Published at 12:18 AM Comments (0)

0

Like

Published at 12:18 AM Comments (0)

New Year's Eve in Spain: A Celebration of Superstitions

Thursday, December 26, 2024

New Year's Eve in Spain, known as Nochevieja, is a vibrant and exciting celebration steeped in unique traditions and superstitions. While people around the world celebrate the end of the year and the beginning of a new one, Spain stands out with its distinctive customs and beliefs surrounding this special night. From the iconic twelve grapes of luck to the symbolic act of starting the year on the right foot, Spaniards embrace a variety of superstitions to ensure good fortune and prosperity in the coming year. These superstitions offer a glimpse into the rich cultural heritage of Spain and its people's deep-rooted belief in luck, fortune, and the importance of starting the year with positive intentions. Let’s take a look at the most common:

-

Eating twelve grapes: The most iconic New Year's Eve tradition in Spain is eating twelve grapes, one for each chime of the clock at midnight1. These grapes, known as "las doce uvas de la suerte" (the twelve grapes of luck), are believed to bring good luck for each month of the coming year.

-

Wearing red or yellow underwear: In addition to red underwear for love, some Spaniards also wear yellow underwear to attract money and prosperity in the new year. The colour yellow is associated with gold and wealth, making it a popular choice for those seeking financial fortune.

-

Starting the year on the right foot: To ensure a positive start to the year, many Spaniards believe that the first step you take after the bells chime should be with your right foot. This symbolic act is believed to set the tone for a year filled with good luck and positive experiences.

-

Dropping a gold object in Cava: Some Spaniards drop a gold object, such as a ring or coin, into their glass of Cava before the midnight toast. This superstition is believed to bring good fortune and financial prosperity in the new year. To ensure the good luck charm works, you must drink the entire glass of Cava after the toast and retrieve the gold object.

-

Burning coloured candles: In some regions of Spain, people burn coloured candles on New Year's Eve to attract different types of luck. For example, yellow candles are burned for abundance, orange for intelligence, green for health, and white for clarity.

-

Putting money in your shoe: For those seeking economic prosperity, there's a superstition of putting money in a shoe before midnight. This practice is believed to attract wealth and financial abundance in the coming year.

-

Burning a list of desires: Some people write down a list of up to three desires and stick it somewhere on their body before the last dinner of the year. Like with the red underwear, the list must be burned immediately after midnight to symbolize the release of those desires and the hope for their fulfilment in the new year.

-

Cleaning the house: On the last day of the year, it is customary to clean the house thoroughly with a broom to remove all bad energy and start the new year fresh. This practice is believed to cleanse the home of any negativity and prepare it for good fortune in the coming year.

The various superstitions, from the twelve grapes to the red underwear, offer a unique and memorable experience for those who participate. Whether you believe in the magic or not, embracing these customs allows you to connect with the Spanish culture on a deeper level and appreciate the importance of hope, renewal, and community in welcoming the new year.

As the clock strikes midnight and the fireworks illuminate the sky, remember to eat your grapes, raise a glass of Cava, and step into the new year with your right foot, embracing the spirit of Nochevieja and all the good fortune it may bring!

1

Like

Published at 12:47 PM Comments (0)

1

Like

Published at 12:47 PM Comments (0)

Understanding the Spanish Christmas Calendar

Thursday, December 19, 2024

Celebrating Christmas in Spain offers a unique experience that differs significantly from other parts of the world. For expats, understanding the Spanish Christmas calendar with its numerous festivities and traditions is essential to fully immerse yourself in the local culture. Here’s a detailed guide to the key dates and their significance, from early December to the Epiphany.

December 8: Feast of the Immaculate Conception

The Christmas season in Spain officially kicks off on December 8 with the Feast of the Immaculate Conception. This is a public holiday celebrating the belief in the Immaculate Conception of the Virgin Mary. In Seville, the day is marked with a grand procession, while other cities and towns hold various church services and public events.

December 22: El Gordo (The Fat One)

One of the most eagerly awaited events of the Spanish Christmas calendar is the "El Gordo" lottery draw on December 22. Known as the world's largest and oldest lottery, El Gordo captures the entire nation’s attention. Many Spaniards participate in this tradition by buying lottery tickets and hoping to win substantial cash prizes. The lottery draw is a festive event, often watched by families together.

December 24: La Nochebuena (Christmas Eve)

Christmas Eve, or "La Nochebuena," is a time for family gatherings and elaborate feasts. Traditional foods such as roast lamb, seafood, and various tapas are commonly enjoyed. Despite the festive atmosphere, the evening often includes attending Midnight Mass, known as "La Misa del Gallo" (The Rooster’s Mass), symbolizing the rooster that crowed at midnight when Christ was born.

December 25: Christmas Day

Christmas Day is a quieter affair compared to Christmas Eve. Many families come together again to enjoy a relaxed meal and exchange gifts. It's a day of reflection and spending quality time with loved ones. Although Christmas Day is less commercially oriented in Spain, the spirit of togetherness and joy is ever-present.

December 28: Día de los Santos Inocentes (Day of the Holy Innocents)

Spain's version of April Fool’s Day, "Día de los Santos Inocentes," is observed on December 28. The day commemorates the biblical event of King Herod's massacre of infants. However, it is celebrated with practical jokes and pranks. It's a light-hearted day where even the media joins in with hoax news stories, and people try to outdo each other with their playful tricks.

December 31: Nochevieja (New Year’s Eve)

New Year’s Eve or "Nochevieja" is celebrated with vibrant festivities. A unique tradition involves eating twelve grapes at the stroke of midnight—one for each chime of the clock—to bring good luck for the coming year. Major city squares, such as Madrid’s Puerta del Sol, become hubs of celebration filled with joyous crowds, fireworks, and the ringing of bells.

January 1: New Year’s Day

New Year's Day is a public holiday marked by quiet family gatherings, resting after the previous night's celebrations, and preparing for the continuation of the festive season.

January 5: La Cabalgata de los Reyes (Parade of the Three Kings)

On the eve of Epiphany, spectacular parades known as "La Cabalgata de los Reyes" take place throughout Spain. The Three Kings, or "Los Reyes Magos," ride through towns and cities on elaborate floats, distributing sweets and small gifts to children. This event generates great excitement and marks the high point of the Christmas festivities.

January 6: Día de los Reyes (Epiphany)

Epiphany, or "Día de los Reyes," on January 6, is possibly the most significant day in the Spanish Christmas calendar. Celebrating the arrival of the Three Kings who brought gifts to the baby Jesus, this day is marked by the exchange of gifts among family and friends. Children wake up to find presents left by the Three Kings, and families enjoy a special cake called "Roscón de Reyes," a ring-shaped pastry decorated with candied fruits.

- Copy 1.jpeg)

The Spanish Christmas calendar is filled with rich traditions and meaningful celebrations that create a festive atmosphere lasting well beyond December 25. For expats, understanding and participating in these local customs can enhance your experience and appreciation of the Spanish holiday season, making Christmas in Spain truly unforgettable.

1

Like

Published at 5:18 PM Comments (0)

1

Like

Published at 5:18 PM Comments (0)

Renovating an Old House in Spain

Friday, May 24, 2024

Embarking on the journey of purchasing and renovating an old house in Spain is both an exciting adventure and a unique investment opportunity. Rich in history, culture, and architectural wonders, Spain offers a picturesque setting that many dream of calling home. This guide aims to explore the multifaceted road to buying, revitalising, and savouring the essence of old Spanish homes. Whether you're seeking a new personal abode or an investment vessel, this guide is your ally through the intricacies of the Spanish property market, legal landscapes, and renovation endeavours.

Why Spain?

The Appeal of the Spanish Real Estate Market

Spain captivates with its warm climate, vibrant culture, and an inviting property market. Despite its developed economy, it boasts property prices significantly lower than many of its European counterparts. This discrepancy opens the doors wide for those harbouring renovation ambitions, be it for resale or rental purposes.

The Charm of Old Spanish Architecture