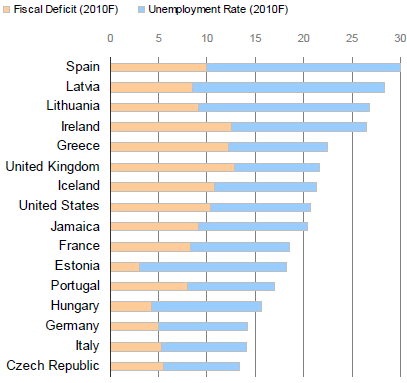

Spain Tops Misery Index

Friday, December 18, 2009 @ 10:21 AM

The economist Arthur Okun coined the “misery index” in the 1960s. It was the sum of the unemployment rate and inflation at any given time. Today, Spain is at the top of it.

Pairing these two indicators made sense not only because both are economic phenomena that hurt regular people, but also because efforts to reduce unemployment can elevate inflation, and vice versa. Keeping both numbers low and steady is a delicate balancing act.

When both are big, as happened in the ’70s and early ’80s when the index peaked, the effect is painful and hard to fix.

But today inflation fears are relatively quiet, and yet there is still another factor that is complicating efforts to bring downSpain's unemployment rate.

Given this new balancing act, and the fact that both unemployment and unmanageable debt arguably lead to economic misery, analysts at Moody’s have proposed a new misery index. This one instead uses the unemployment rate and the fiscal deficit as a percent of gross domestic product.

In Moody's new league of misery, Spain tops the charts thanks to its unemployment rate of close to 30%.

Spain's high unemployment rate is very closely linked to the collapse of the Spanish property market - which, until 2007, kept much of the nation working directly, or in associated industries.

Story from NY Times

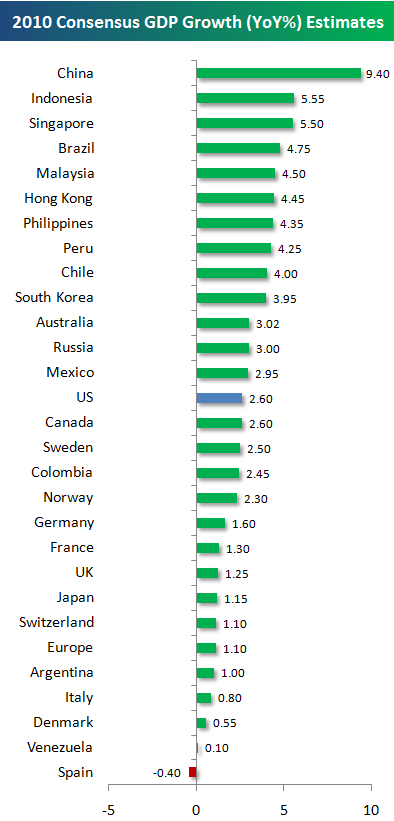

Spain is also at the bottom of another league - this time a Bloomberg's survey of economists.

All but one country is expected to see GDP growth in 2010. Spain is the lone country expected to see a decline in GDP at -0.40%.

Source: Kyero.com