By Pablo de Ronda

I’d always thought that one of the many advantages of getting older in Spain, in addition to retirement, grandchildren, mortgage paid off and time to travel, was significant tax breaks for over 65s.

I’d always thought that one of the many advantages of getting older in Spain, in addition to retirement, grandchildren, mortgage paid off and time to travel, was significant tax breaks for over 65s.

An alarming report in one of the free English-language newspapers down here in southern Spain – the Euro Weekly News - seems to indicate that may not be the case.

Selling your property

The Spanish tax office, Hacienda, has issued a reminder to homeowners over 65 about the dos and don’ts of selling property, warning they could have problems with the taxman if they’re not careful.

However, it’s not all doom and gloom – some golden exemptions could save savvy pensioners from paying a fortune in taxes.

Tax in general

A third of your income in Spain goes on taxes. A new study reveals that the average Spanish household spends between 31% and 35% of its income on taxes.

Valentí Pich, of Spain’s General Council of Economists, has called the findings “eye-opening,” pointing out that whether it’s council tax (IBI), vehicle duty, electricity levies, or IVA (VAT), families are feeling the squeeze.

Are pensioners in property paradise?

When it comes to selling your house, Hacienda has laid down the law. Homeowners must reconcile taxes on the profits from their property sale. This includes:

Capital gains tax (included in IRPF - Impuesto de la Renta sobre las Personas Físicas) on any profit made. But who makes a profit these days? When I sold a property in 2019 and made a small capital gain, the notary in Ronda remarked that mine was the first property sold in years in the town that had shown a capital gain.

Capital gains tax (included in IRPF - Impuesto de la Renta sobre las Personas Físicas) on any profit made. But who makes a profit these days? When I sold a property in 2019 and made a small capital gain, the notary in Ronda remarked that mine was the first property sold in years in the town that had shown a capital gain.

Municipal tax (plusvalía) on the rise in the value of the property.

Pro-rated IBI - This form of council tax is payable on a yearly basis. This is up for negotiation between seller and purchaser. When I sold the apartment referred to above, the IBI had just fallen due. We negotiated and the buyers agreed to take it on. Later in the year and that would be unlikely to happen, although a pro-rata arrangement sometimes works.

But here’s the silver lining for the silver generation. If you’re over 65 and selling your primary residence, or suffering from severe dependency, you should be able to dodge this tax bullet altogether.

‘Golden get-out clauses’ for those in their golden years

Hacienda provides generous exemptions for pensioners over 65 who sell their primary residence, helping them avoid hefty capital gains tax. Here’s how it works:

If you sell your home and receive payment as a lump sum or a lifetime annuity, any capital gains from the sale are exempt from taxation.

If you sell your home and receive payment as a lump sum or a lifetime annuity, any capital gains from the sale are exempt from taxation.

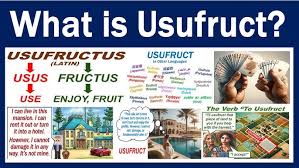

You can also sell the ownership rights (nuda propiedad) of your home while keeping the right to live there for life. This is called usufruct.

In this case, the sale qualifies for the exemption because the ownership transfer happens as part of the sale process.

What’s the catch?

The rules change if the property’s ownership is already split between two parties. For example, if one person owns the property (nudo propietario) and another person has the right to live there (usufructuario), neither party can claim the exemption, even if the property is their primary home.

This is a complex matter, so seek professional advice if you are in that situation. The best and cheapest option is the notary.

Note on “usufruct”:

Because I wholly own our domicilio (primary residence), my Spanish will states that my widow, although she has no financial interest in our home, would benefit from usufruct and could continue living there until she too dies or decides to leave. My heirs, my children, cannot force her to leave.

Watch out for unfair charges by Hacienda

Spanish homeowners were handed a lifeline by the courts in a trio of rulings that blew the lid off unfair plusvalía municipal charges.

In 2017, the Constitutional Court ruled (Sentencia 59/2017) that taxing a property sale with no profit – or even a loss – is unreasonable, allowing homeowners to challenge such demands.

In 2017, the Constitutional Court ruled (Sentencia 59/2017) that taxing a property sale with no profit – or even a loss – is unreasonable, allowing homeowners to challenge such demands.

Two years later, the court struck again (Sentencia 126/2019), declaring the tax unconstitutional if it exceeds the profit made from the sale, branding it ‘confiscatory.’

Then, in 2021, the Constitutional Court delivered another decisive ruling (Sentencia 182/2021), declaring that the method used to calculate the plusvalía municipal was fundamentally flawed.

The court found that it did not accurately measure the real increase – or lack thereof – in property value. As a result, the tax was suspended temporarily, forcing authorities to create a new and fairer calculation method before it could be reinstated.

The bottom line

If you’re over 65 or struggling to make ends meet, the rules might work in your favour.

If you’re over 65 or struggling to make ends meet, the rules might work in your favour.

But beware – there’s no room for mistakes. Mis-steps could see the taxman chasing you.

Once again, use the notary. Don’t waste money on expensive, and sometimes slapdash, lawyers.

And don't believe everything you read in the Euro Weekly News!

Pablo, Rita and their kitten Paulinchen

© Pablo de Ronda

Further reading:

Foreigners who pay tax in Spain stand to cash in from next year

HOW TO ….. do your Spanish INCOME TAX return?

N.B. Notary Bene

N.B. Nota(ry) bene - Secret Serrania de Ronda

Where there’s a WILL … the process in Spain - Secret Serrania de Ronda

Photos and images:

Premier Consultants

Shutterstock

Symbolic

TeleAdhesivo

URBGIS

YouTube

Acknowledgements:

Euro Weekly News

Eye on Spain

Marc Menéndez-Roche

Notaria Isabel Colominas Rivas

Secret Serrania

Tags:

capital gain, capital gains tax, Constitutional Court, council tax, dos and don’ts of selling property, electricity levies, English-language newspaper, Euro Weekly News, exempt from taxation, Eye on Spain, General Council of Economists, ‘golden get-out clause’, grandchildren, Hacienda, IBI, IRPF, IVA, Isabel Colominas Rivas, lifetime annuity, lump sum, Marc Menéndez-Roche , mortgage paid off, municipal tax, Notaria, nuda propiedad, ownership rights, Pablo de Ronda, Paul Whitelock, pensioners over 65, plusvalía, plusvalía municipal, Premier Consultants, primary residence, professional advice, retirement, Secret Serrania, selling your property, Shutterstock, silver generation, silver lining, Spanish taxman issues warning to pensioners, Symbolic, tax breaks, TeleAdhesivo, time to travel, URBGIS, usufruct, usufructario, Valentí Pich, VAT, vehicle duty, YouTube