Isaac Newton also lost a fortune in a bubble

Wednesday, August 26, 2009

Trias de Bes goes on in his book: “The man who changed his home for a tulip”, after analyzing the bubble produced by the Company of the South Seas (1711-1720) in England, the crack of 1929 in the U.S., the Japanese bubble in the nineties in Japan and the subprime crisis of 2006, that the foundation of value growth of assets during a bubble is never solidly founded: it is enough that someone important or famous purchase of these assets so that the demand is triggered. Trias de Bes tells how Isaac Newton lost 20,000 pounds in the Company of the South Seas (for the years 1711-1720: a fortune), hence his phrase: "I can calculate the motions of heavenly bodies but not the madness of people".

Another important finding of the author is that during the bubbles, it is believed that the asset´s value will go up indefinitely and those who buy the commodity which is speculated with are considered more creditworthy. The collapse of bubbles is usually sudden and without obeying exact criteria.

0

Like

Published at 11:49 AM Comments (0)

0

Like

Published at 11:49 AM Comments (0)

Legal tip 128. A squatter in my house! What to do?

Tuesday, August 25, 2009

Possession Recover injunctions in Spain .

The "Interdicto" action to recover possession can only be used for the discussion of the following:

1) Whether the claimant is in possession of the thing

2) If the claimant has been stripped from it by the defendant or by another person on behalf of the defendant

3) If the acts of restlessness or dispossession by the defendant have been accomplished within the year before the bringing of the injuction ( the action expiration deadline is of one year)

4) An spiritual element, a real “animus expoliandi” ( dispossessing will ) , which is generally implied from the fact of the disturbance.

It is a summary procedure for the protection of the fact of possession and not of the right of ownership, which needs a more elaborated judicial procedure (declarative).

Valencian Flowers by Laurenatclemson at Flickr.com

0

Like

Published at 4:10 PM Comments (0)

0

Like

Published at 4:10 PM Comments (0)

Just about irresponsability

Tuesday, August 25, 2009

What about some external impacts to the current status of Courts in Spain?

For instance: how about the behaviour of irresponsible lenders which irresponsibly allowed irresponsible builders build and irresponsible buyers buy?? Now some of these buyers ( foreign and nationals) are waiting the long, slow queue of justice. Some of the credit easiness came and infected us from abroad actually... but does not exempt us from risponsability.

It is true that many buyers chose a lawyer to advise them in the purchase but they made it in the middle of a huge irresponsability epidemic and therefore they chose it irresponsably:

I never want to negate the abysmal performance of some irresponsable legal advisors but..... did buyers really care during the real estate boom about the legal quality of the contracts? or at least as much as they cared about the finantial potential profit of the contract?

Cancellation rights? Who cared about them then? They would never cancel as the property would magicly go higher and higher in price ( typical behaviour of people within the buble syndrome)

Of course I know many of you were not speculators but people looking for a good oportunity in Spain and with mixed plans regarding the property. But... do not tell me those happy years were not filled up with conversartions about the finacial growth of property in Spain and not a word on Consumers safety or legal quality.

Children at Valdevaquero beach, Tarifa, Spain

0

Like

Published at 3:05 PM Comments (0)

0

Like

Published at 3:05 PM Comments (0)

Just for those interested: the itineray of Costaluzlawyers

Saturday, August 22, 2009

In relation of " commercial interests" of EOS contributors and as a result of an insistent colleague accusing me ( before a client) that I just have illegitimate commercial interests in this site:

The Costaluzlawyers´itinerary

I firstly need to assert I am not very fond of spending time at deffending myself but it is true that sometimes it is necessary(- my whole team has encouraged me to do so-). Also as a matter of being just human ( hi Magicmeg!), let me explain to you where we are and what are our interests in EOS.

When I started Costaluzlawyers in March-April 2006 I was very lonely ( with no office, no staff, no nothing...) . just a`n old laptop, my legal formation and my legal experience at DeCastro. The great guy from Tarifa ( thanks Juan!) who designed my initial 80€ cost blog advised me to introduce constant and relevant good legal information in the blog and to link it with similarly -oriented websites in order to enhance my position in Google.

I was working from home and well...just wanted to have some non resident, english speaking clients to help with their " spanish dream" in Costa de la Luz and make some money for my family: a little local business. My husband does not have a remunerated job as he is in charge of housekeeping, logistics, children´s care.... and a lot of other assignments at home ( thanks Luis!) ; so, with 24000 € to live with received from my grandma´s inheritance ( thanks grandma!) and a baby already in the world... I had to really make the business work.

And I started... with some articles on Real Estate Consumer protection and then one on... Bank Guarantees.

In May-June 2006 and through another forum I used to contribute with I found Justin and EOS. I sent an email to him, offering legal support to EOS members and after a phone call he offered me to start with some articles to be published in the site and see what happens ( thanks Justin!).

In August of same year and due to a general ignorance of rights to guarantees for money return among english speaking real estate buyers in Spain.... the Bank Guarantee article filled my inbox with dozens of emails of people wanting to know. They were my first clients.

In some months I already had a good number of people to help and again just myself and no office, no staff... so, after much consideration ( as I did not want to initially return to the Law firm owned by my family I used to work for)... I talked to brother Nacho ( thanks Nacho!) and he offered to me his invaluable help with Court cases.

Cases started to come and come, people who contacted me showed a commun point: ignorance of cancellation rights despite they already had a lawyer working on their cases.Very sad. That´s how Costaluzlawyers ( initially intended to help peopel to buy and settle in Costa de la Luz) turned to an office for custormer service and legal information for people with weak legal proptection in Costa del Sol, Costa Cálida and Costa Blanca mainly.

We kept our contribution in EOS and some other forums too and finally decided to concentrate forces on EOS ( the most of our clients came from the site, we liked the style and after meeting Justin and Susan personally, we get specially and freely- no payment any of the two ways-committed with the site).

And well, since then , we have just been having lots of fun while working VERY HARD in the mission. Hard work has made a profitable business and we have now 5 employees in the customer service department, 6 lawyers in the litigation department and 2 great administrative persons. We did no intend to grow that much and that rapidly but I need to admitt I love the human resources and I very quickly started to cherish the idea of having a small team working with me and to start a foundation for social aid. That, together with the family needs I had and have to covered ( first and too) have been my driving forces since 2006 to now. Commercial interests? Well, yes... I need money for good things.

I have been always tried to be fully respectful with our proffession´s deothological code in terms of publicity, promotion of services, relationships with colleagues... It is true thatonlince legal advise is a new brand stuff, and sometimes I need to ellaborate my own ethical conclusions out of what is already stablished in the Ethical Code but I think I have done it quite reasonably.

My frustration ( and my challenge) is the lack of confidence of you on the Spanish legal system. That makes many conversations with great team members ( thanks Steven, Rocio, Almudena, Patricia and Mar) as we are very proud of being spaniards and would like to show to you the real good things of our country. I am sure, and I have constantly repeated that in the forums and the blog that there are dozens and dozens of magnificient, honest, proffessional lawyers in Spain and that we all want the system to work in favour of Law. If we have mentioned our success it has been for the sake of offering to you that hope and confidence.

Regarding other colleagues contributing here: I am not the person to allow them or not.. but of course Justin and Susan are always welcoming them and I believe that as far as the good, friendly tone is preserved... we are all happy to see them. Loyal competency is necessary for the good working of businesses and the market.

Anyhow... please have a good weekend!

Best,

Maria

web@costaluzlawyers.es

www.costaluzlawyers.es

Bouganvillas in El Palmar ( Cádiz) by Secret Tenerife at Flickr.com

0

Like

Published at 12:07 PM Comments (2)

0

Like

Published at 12:07 PM Comments (2)

Legal tip 127. Beware of distressed properties on sale

Thursday, August 20, 2009

Some distressed properties are being sold by developers/ agents, whose initial buyers did not come to the completion of the property ( due to lack of finances, developer´s delay or any other cancellatory breach...),at a much reduced price: the fall of the market and the fact of a 30% deposit being already at the seller´s pocket make this possible.

The danger is here: the 1st buyer still has on the property:

- 15 years to act for contract cancellation and refund of money paid ( if there is ground for contract cancelaltion) or

- No deadline to finally buy, as long as his contract is not cancelled the buyer keeps buying rights on the property.

Imagine you buy ( 2nd buyer) a distressed property now and in two years´ time, once there is some recovery in the financial industry, the first buyer wants now to buy what has been offered and bought by you at a much reduced price. According to a contract he has with developer and which has not been formally cancelled, he has buying rights on the property you also bought. Initially the problems will not fall into you if you bought according to Land Registry information but....

It is always advisable to have a good independent lawyer checking on all details. Believe me!

Maria

web@costaluzlawyers.es

www.costaluzlawyers.es

Toalla en Aguadulce, CostaBallena, Cádiz by Photo Javi at Flickr.com

0

Like

Published at 11:46 AM Comments (0)

0

Like

Published at 11:46 AM Comments (0)

Legal tip 126. A stop to abusive appeals

Wednesday, August 19, 2009

Both the Secretary of Justice and the General Council of Judicial Power agree on these measures being needed in Spain in order to decrease the level of litigiousness.

• To enhance the operation of the arbitration. The aim is to download the courts of all matters that are not jurisdictional themselves, enhancing procedures such as arbitration, conciliation or mediation through which certain types of disputes can be solved more efficiently.

There is a project for a new Law of Voluntary Jurisdiction based on the project which was already submitted during the last legislature. The aim of this law is to remove the judge from non judicial duties and to project an easy and quick procedure that will allow the solution of files by judicial clerks, notaries and registrars.

• To rethink the appeals system. In order to modify the existing system and to tackle the abuse of Law that does so much harm to justice. It is necessary to simplify the existing system and to set some measures to restrain those that so unreasonable and repeatedly use the appeals just as a delaying game to the detriment of others.

The measure,proposed by theSecretary of Justice to the Parliament by which a small deposit is compulsory prior to the application for appealing, has been approved by most of the political groups.

The Secretary explained that the revenue from this deposit will be linked to the financing of the justice system and will cover the process of modernizing the administration of justice, in particular the construction of a platform for connectivity of the various systems for management of judicial processes process, something that has been insistently called by Judicial clerks as well as improving the legal aid system.

0

Like

Published at 2:25 PM Comments (0)

0

Like

Published at 2:25 PM Comments (0)

The man who exchanged his house for a tulip II: Tulips fever

Tuesday, August 18, 2009

Trias de Bes explains in his “El hombre que cambió su casa por un tulipán” ( The man who traded his home for a tulip, Ediciones Temas de Hoy 2009) that in Holland during the seventeenth century, there were bourgeois who pledged his house, his one year´s salary for ... a tulip bulb who was suppossed to flourish after a few months.

The business worked fine for several years........

[A simple mechanism:

Mr. Van A gave 10 for the option to buy a tulip ( a bulb actually) with the commitment to pay the rest of the price (100) at the flourishing of it.

Mr. Van A sold the bulb to Mr Van B for 20 and this committed to give 200 to Mr Van A at the flourishing of it

And successively...]

till, no one knows exactly way, even several hipothesis being in place, the speculative market fell down to a real market where the tulip was worth ..... “a tulip”.

It should be noted that the tulips were at that time a symbol of social and economic distinction between the Dutch bourgeoisie.

Sounds familiar?

As "lessons" of the tulip bubble Trias de Bes exposes:

- Deferred payments encourage the increasing of prices as it enables to buy and resell goods or assets in exchange of minor disbursements.

- It is dangerous to speculate from intermediaries at prices that no one pays on the final market yet.

-Bubbles fatten in objects of desire that people surround with glamor

- The unsustainability of the price is not questioned. It is just assumed that prices will continue its meteoric rise: it can be offered a home for a tulip if you think the tulip is going to rise in price.

- In a speculative market professionals come from other industries, leaving their usual occupations.

( to be continued with the Bubble of South Seas)

Tulips in Madrid by chrisbastian44 at flickr.com

0

Like

Published at 7:28 PM Comments (0)

0

Like

Published at 7:28 PM Comments (0)

Legal tip 125. Community problems solved in 25 days

Tuesday, August 18, 2009

Nearly 188,000 communities of owners in Spain, equivalent to 15% of the total, have one or more payment defaulters, and the number of arrears continues to grow due to the current economic climate.

A speedy, efficient and economical solution to this problem is the submission of disputes in a community of owners to Arbitration. This submission to arbitration needs to be approved by majority of the owners. The arbitration can be among the owners themselves or between them and the Community.

The conflicts that can be resolved by arbitration can be of any kind:

- Non-payment of quotas.

- Conflicts regarding common areas.

- Breach of the rules of the Community ...

The decision is in place in 25 days, and therefore the time saving is of 6 months at least, if we compare this with a judicial procedure. This arbitration possibility is regulated by the Arbitration Act 60/2003.

Every owner just need to make a single payment of around 9 € and this cover arbitration, as well as a Procurator of Tribunals and a solicitor in the event that the award requires enforcement.

0

Like

Published at 12:25 PM Comments (2)

0

Like

Published at 12:25 PM Comments (2)

Legal tip 124. Some answers to Neil Morrison at www.journalonline.co.uk

Monday, August 17, 2009

My comments to this article are, as always, below in bold green.....

Scottish buyers of Spanish property face a Herculean task to recover bank guarantee deposits

by Neil Morrison

Thousands of Scots have bought villas or apartments in the south of Spain, within the last few years. Many of them, perhaps inspired by TV shows like A Place in the Sun, intended to use the property as a long-term investment, holiday home or retirement home.

However the recent Spanish property boom has turned to bust in light of the global economic downturn, and many of Spain’s largest developers have gone into administration. Not many of the developer companies of our claimers have gone into administration. The majority of buyers who paid deposits on plots of land have been left with unfinished properties or have been told the property will not be delivered on time. As a result, most buyers are now seeking the return of their deposits, which can be as much as 50,000 or 100,000 euro, depending on the value of the property.

Guaranteed - or not?

The Spanish Government enacted a bank guarantee law (57/1968) to protect consumers in the event that ( a developer goes into administration) uncorrect: Law 57/68 protects buyers if houses are not started/finished on time or breaches contract by missing the delivery deadline. The law places an obligation on the developer to ( return deposit plus legal interest and) provide to the buyer a bank guarantee (aval bancario). The guarantee secures the buyer’s deposit and stage payments plus 6% ( the General Building Act of 1999 changed this into legal interest rate) interest from the bank underwriting the guarantee. As the bank guarantee is an executive title, a fast-track executive court procedure (three months) can be enrolled to reclaim the deposit.

However, as there is no court procedure in Spain to force a developer to provide purchasers with their bank guarantee even if one has been issued, buyers are at the mercy of the developers. No contract should have been signed without it. That is the forcing tool. Also, a cancellation and refund is possible if the Bank gaurantee was not handed over and refunds can be performed without Bank Guarantees. I understand and agree that this might be no sufficient so the non delivery of these Guarantees it should be a crime as it was in the past. I would extent that criminial risponsability to Banks too. Many buyers requesting the return of their deposit are discovering to their horror that bank guarantees have never been issued by the developer, despite their private purchase contract (PPC) what were their lawyers doing? stipulating that all payments are guaranteed by the bank.

Anyhow, out of law 57/68, money needs to be returmed even without Bank Guarantee.

Even if developers provide the bank guarantee, many buyers are subsequently finding their guarantee is invalid or has expired ( These Bank Guarantees do not expire by Law till the First Occupation License is granted and the house handed to the buyer).. Even those buyers with valid bank guarantees are being refused refunds by demoralised banks reeling from the credit crunch. Judicial executive procedures against the Bank are often succesful.

The Bank of Spain has publicly stated in the Spanish daily newspaper El Pais that financial institutions underwriting the guarantees must pay out in full if developers are in breach of contract. However the banks have been instructing large legal firms to scrutinise the wording, and in some cases it has been found that the bank guarantee can only be reclaimed on completion of the property. Law is clear and a good petition based on it is very oftenly sucessful.

Where the bank guarantee can be reclaimed immediately, the banks have delayed paying out the deposits, for example by stating that they can’t pay out when a developer has gone into administration. This can be opposed abd Banks will be forced to pay. It has no legal grounds.Yet even this stance by the banks is questionable, as Fernando Herrero, Vice President of Aidcae Association of Bank Users explained in El Pais: “The law is clear. If the conditions of the guarantee are satisfied, execution is obligatory, regardless of the situation of the developer”. This is absolutely correct.

The litigation option

So what can frustrated buyers do to reclaim their deposits? If negotiation with the developer or bank has failed, the last resort is to litigate. However Spanish law differs greatly from Scots law in relation to breach of contract and the judicial process. There are many pitfalls awaiting those buyers brave enough to pursue their deposit through the courts.

First, buyers should change their Spanish lawyer. Their existing lawyer is likely to have been assigned to them by the developer’s agent. A conflict of interest arises, with the lawyer having duties to act in the interest of both the developer and client. In such circumstances, the lawyer is likely to act in the best interest of the property developer to ensure continued referrals. It is for this reason that many buyers have found their appointed lawyer to be disinterested in reclaiming their deposit, or even acting against their best interests by requesting they extend the delivery date. Buyers should take immediate steps to find a new lawyer and conduct a simple conflicts check to ensure their prospective lawyer has never been referred buying clients by a developers’ agent, developer or developer’s bank. Wise. Correct.

Secondly, under Scots law if there has been a material breach such as non-delivery of a property after the date of delivery then the buyer would be entitled to raise court proceedings for damages. However under Spanish law, the party in breach is allowed a reasonable period of grace to deliver the property, which is generally 9-12 months. Non correct. Automatic contract extensions are forbidden by Spanish Law. Once there is a delay, the buyer/consumer is entitled to cancelaltion or price reduction by his choice. If court proceedings are raised immediately after the delivery date, there is a high risk the Spanish judge will throw out the case because no period of grace has been given. This is true, unfortunately,as it is clear against Law. Appeal is needed. Appeal courts are more sensitive towards Consumers rights and many of those cases are reversed in the second instance ( Provintial Appeal Court) The chances of this happening increase depending on how close the property is to being granted a certificate of occupancy by the local town hall (ayuntamiento). However if the developer has never started constructing the apartment and the site is still parched scrubland, then once the developer exceeds the delivery date, a buyer may pull out, terminate the contract and litigate for a full refund of the stage payments plus interest.

Events, events

A further pitfall may be found in the PPC, which could have a “force majeure” clause. This clause exists in various guises in the majority of legal systems, including Spain and Scotland. The clause excludes liability where unforeseen events beyond a party’s control prevent the performance of their contractual obligations.

Our Supreme Court has clearly stated already which is a force majeure in an off plan building process, excluding strikes, rains... Many events argued by developers as "force majeure" has been expressly classified as " commun events a good builder needs to take into account when valuating the timing of the work"

Generally such events include earthquakes, floods, terrorist acts, general strikes etc. However the scope of the clause could include failure of suppliers to provide building materials. Arguably, the global economic meltdown is an unforeseen event of significant magnitude to trigger the force majeure clause.

The Global Economic meltdown and the unpossibility to obtain financiation is a reason for contract cancellation by consumer and refund of deposit paid.

It is likely that Scottish courts would be reluctant to allow a force majeure clause except in exceptional cases where an “act of God” has occurred. However the approach taken by Spanish courts is less clear, and if the developer can successfully prove that a force majeure has taken place while the property was being constructed then the delivery date can be extended. ( non correct: see comments above)

In addition, a buyer’s case can be jeopardised if a certificate of occupancy (certificado de habitación) has been granted by the local Spanish town hall stating that the property complies with the original building licence granted by the town hall. Once the certificate been granted, the property is deemed legally ready for human habitation. Therefore as the developer has fulfilled the main obligation of delivering the property, there is no breach and any snagging issues will not be deemed sufficiently material to warrant breach of contract. There will be sufficient material for breach of contract if there are enough quality lacks such as a size difference of 10% between meters promised in the PPC and unit actually delivered. Or the lack of commun elements: pool, sport courts, gardens...

More legal snags

Many buyers may inadvertently damage their case by stalling on their regular stage payments to the developer. If buyers do not pay further instalments then they are in fundamental breach of their contractual obligation to pay regular stage payments and it is unlikely a judge will take a favourable view of their case when they themselves have breached the contract. No, if they can prove that the breach of the developer was prior to theirs.

Of course, buyers will not wish to give the developers any further payments, so what can they do? Well, the buyer should pay all future payments into a Spanish notary or Spanish court bank account until the developer releases the bank guarantee deposit. The buyer cannot be viewed as breaching the contract, as the payments are continuing to be made, while at the same time the funds are secure because they are in an escrow account beyond the reach of the developer. That will depend on how serious the breach by developer is as in some cases, the consumer can just notify irrefutably to developer that the payments are not being done due to previous breach by the developer.

Furthermore a buyer should be wary of litigating where there is a lack of documentary evidence supporting the claim. Buyers should ensure that the following documents are obtained prior to raising court proceedings: copy of villa/apartment PPC, original invoices of stage payments, bank statements proving the transfer of funds, and a copy of the bank guarantee certificate if one exists. Correct. I would add publicity material to that.

Under Scots law if an obligatory guarantee was not issued there would indeed be a legal avenue to claim damages, such as under unjustified enrichment. However under Spanish law there is no legal avenue to pursue on the grounds of failure to issue an obligatory bank guarantee. If a buyer were to raise a court action on this ground, it would very likely be dismissed. It is changing, some judges attribute the effect of contract cancelaltion to the lack of Bank Guarantees. Specially if the building process/ contrach history is in early stages.

It should also be borne in mind that if the buyer has purchased more than one property or an action is raised after waiting only a year, the judge might no longer consider that the Spanish consumer protection law applies, as the properties could be viewed as a commercial enterprise or the buyers ironically viewed as shrewd investors. Not always.

Damages and costs

The Spanish legal system is quite different from the Scottish legal system in many respects. A marked difference is that damages sought in a Spanish court action can be deemed excessive by a judge, who may then order the pursuer to pay the legal expenses of the other party even if the pursuer was successful. What? Never a succesful party pay legal costs in Spain. Had the damages sought been considered reasonable, the defender would have had to meet the expenses of both parties.The rule is to impose legal costs to the loser if he lose without enough legal grounds. If he actually fights with a reasonable approach but the Judge deems the other party to win, the Judge might impose each one his own legal costs.

However the judge can order the defender to pay additional “moral damages” to the pursuer, which is similar to the Scots’ “injury to feelings” award in respect of the uncertainty and mental anguish endured by the buyer as a result of the breach of contract. Correct, if they are asked by the claimer. In same or different action.

Legal costs in Spain are assessed by using a guidance table issued by the local college of lawyers and tend to be less than the market rates charged by lawyers. There may be a shortfall should the pursuer be successful. In addition to the lawyer’s fee, a fee must also be paid to a procurador, who is an independent legal professional instructed by lawyers to appear in court, somewhat analogous to an advocate in Scotland.

Where a valid guarantee exists, as mentioned earlier, the executive procedure can be enrolled to reclaim the deposit. Although the procedure is quite straightforward, buyers should be aware that all anticipated legal costs must be paid before the action commences, which can dissuade many buyers from proceeding with their claim. Just a provision of funds is needed to start with. Then, the rest of the fee is actually paid by the Guarantoor which is generally imposed to pay both legal costs, so the claimer ends up recouping all the money spent in legal costs. Regrettably, as many of the developers are in administration there may be difficulties if the developer has no assets. It is vital, therefore, to check that the company has sufficient assets to cover the value of the bank guarantee deposit prior to litigation. If you act a Bank Gaurantee, the status of the developer is irrelevant as the claim is directed towards the Guarantoor ( Bank, Insurance company)

On raising a court action, the buyer’s lawyer must identify the developer’s assets and place a charge upon them (embargo preventivo), essentially freezing the assets to prevent them being sold off by the administrator. However it should be emphasised that the charge will not make the buyer a secured creditor; it will only place the buyer higher up the ranking of creditors. When a creditor´s meeting start, embargoes do not count any more. The good new is that Law per e, deffends those creditors arising from a cancellatory breach of contract by developers.

Recovering a Spanish bank guarantee might fairly be described as a Herculean task, but it can be done. However buyers should keep in mind that their court action ultimately could fail, litigation can be costly and Spanish court procedure tends to be somewhat slower than the Scottish courts, taking approximately two years to obtain a final judgment.

The secret is of a technically correct legal work being done in each case. Spanish Law covers the protection of buyers quite sufficiently. I am not saying a good reform is needed but we can play with what we currently have too.

Sue in Scotland?

Another option available to Scottish buyers is to raise a court action against the Spanish developers in Scotland. What? Usually those contracts have express jurisdiction being agreed in Spain and if not, the legal jurisdiction is wher the house is located ( was supposed to be located). I cannot see how these procedures can be acted in Scotland. However the Scottish court judgment will require to be enforced against the developer in Spain, which will still be expensive and time consuming. If a buyer is considering this option, the overall cost implications should be weighed against the value of the judgment and the possibilities of enforcement. The main difficulty will be preventing the disposal of the developer´s assets before enforcement is granted.

However the enforcement of Scottish judgements in Spain has been greatly simplified since the implementation of the Brussels Convention on Jurisdiction and Enforcement of Judgments in Civil and Commercial Matters. In addition to enforcing the judgment, a power of attorney will be required to start proceedings in Spain, authorising a local lawyer and procurador, who will invariably ask for all fees and expenses to be paid in advance.

Scots contemplating buying property in Spain should consult a bilingual lawyer who can evaluate the PPC and title deed (escritura) prior to signing, and explain the content. Yes, very important to choose a lawyer, independent from developers or agents.The lawyer should also make the necessary enquiries with the land register, notary public and local town hall. Above all, buyers should request an indemnity from the developer that a valid bank guarantee will exist on payment of the deposit, and that a copy guarantee clearly stating the expiry date will be issued to them. If the aforementioned steps are taken, there is less likelihood that a buyer’s Spanish property dream will turn into a nightmare.

Neil Morrison is a solicitor at Wright, Johnston & Mackenzie LLP and is a fluent Spanish speaker.

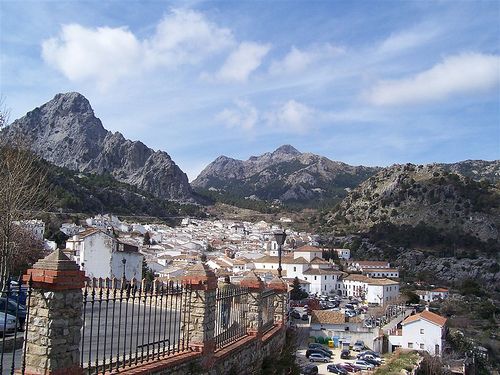

Grazalema ( Cádiz) by Elholgazan at Flickr.com

Grazalema ( Cádiz) by Elholgazan at Flickr.com

0

Like

Published at 1:44 PM Comments (0)

0

Like

Published at 1:44 PM Comments (0)

Trias de Bes´The Man who traded his home for a tulip I

Monday, August 17, 2009

I am reading this book: "Fernando Trias de Bes´The man who traded his home for a tulip" and thought that as there is still no english version of it, I thought you would enjoy the translation of some of the most important ideas and arguments of the book. I would be adding some legal commentaries to the commentaries, according to current Spanish Law.

The author, Fernando Trias de Bes, has received the 2009 award by the publishing house " Temas de Hoy". He is an Economist and MBA who writes tales.

The booK analyzes the most irrational bubles of the History. From there, it offers the keys of the curent times with the following goals:

*To obtain conclusions

*To avoid future bubles and financial euphorias and,

*To face our present and future with enough gurantees.

Tulips in Madrid, By YoTuT at Flickr.com

0

Like

Published at 10:47 AM Comments (0)

0

Like

Published at 10:47 AM Comments (0)

Three "there are-s" and a view from the top

Saturday, August 15, 2009

Three "there are-s" and a view from the top

There are many experiences of developers having a Court ruling against them and imposed an obligation to refund ( money+legal interests+legal costs) with and without a Bank Guarantee being in place. And Court decission´s being obeyed and money being actually back in client´s accounts.

Of course there are rulings in the opposite way, but Appeal Courts ( Malaga among them) are being more and more sensitive with the pro-consumer approach.

I do not want to say that all is easy and clear cut, but a good fight usually gives good results: and the fight is needed as an increasing number of Case Law will set a clear pro-buyer interpretation for this off-plan purchases where so much is risked. It is an uphill work but we cannot wait to see the view from the top.

I am sure there are many good lawyers doing an excellent and succesful job already.

Sierra de Grazalema by Néstor at Flickr.com

0

Like

Published at 1:54 AM Comments (0)

0

Like

Published at 1:54 AM Comments (0)

Legal tip 123. To form a company in 24 hours?

Friday, August 14, 2009

"In Spain it is possible establish a company through telematic means in 24 hours in a Notary office". "The Notary has the technological tools to provide this service, without sacrificing any of the legal security ", said Antonio Ojeda, President of the General Council of Notaries, at the closing of the seminar "Building companies” that took place in Universidad Internacional Menéndez Pelayo, Santander.

Ojeda pointed out that establishment and setting to operation of the company are two different concepts:

1 .- Constitution ( establishment) means creating the necessary legal entity

2 .- Setting to operation comprises a number of administrative, local and regional licenses in the vast majority - without which it is not possible the start of economic activity.

Establishment:

Regarding the first phase (establishment), it is possible to electronically obtain from a Notary office in Spain:

1. - The reservation of the company name - almost 10,000 names were reserved last year.

2. - The provisional Tax Identification Number (around 35,000 provisional Tax Numbers were obtained in 2008)

3.-To draft the deeds and the statutes, sending them electronically to the provincial trade register.

4.-In certain communities, to pay the corresponding tax on the same day.

All this can be done in just twenty-four hours or at most in two days, including the time it takes for the Central Commercial Registry to issue the reservation of the name.

For Antonio Ojeda, "The delay in the establishment of companies in Spain is due to instances such as Registration and winding up of taxes, currently decentralized in Spain in relation to tax corporate operations. The registrar still has an inordinate time-fifteen working days - for the approval of a business which has been previously screened by a public official, such as the Notary. Also, the Provincial Registrar needs to inform the Central Trade Register, within the three days immediately after the registration of the act or transaction, all the data business registered for publication in the BORME. (Official Gazette).

In other countries of Europe there is no duplication of controls, so, just one on legality at the time that the partners give their consent to form a society. In these countries, the document which has been electronically pre-controlled is deposited in a single central business register. The transfer of this model to Spain would turn the system into a much simpler and cheaper one as the public official who can perform all these steps by telematic means already exists and is called “Notario”.

A solicitor or any person trained in Administrative burocracy will be needed for the rest of the requirements. It is advisable though to use a lawyer with Administrative Law formation who will be able to overcome possible pitfalls or administative errors.

Menorca ( Islas Baleares) sunshade by peamasher at Flickr.com

0

Like

Published at 11:25 AM Comments (2)

0

Like

Published at 11:25 AM Comments (2)

Legal tip 122. Do I need a license to rent out my apartment? ( Valencia Region)

Thursday, August 13, 2009

Do I need a license for renting my apartment in Valencia Region?

The matter has been very recently re-covered by Decree 92/2009 of 3rd of July 2009 .

A tourist house is the building of whatever kind, which is habitually rented out for tourism, leisure and entertainment purposes.

According to the Decree, habituality exists under one of the following circumstances:

a) The house is marketed to the tourists by tourist housing management companies.

b) The house is available to users by their owners or tour operators, irrespectively of the contract time period and provide services of the catering industry.

c) The house is offered through the tourism marketing channels, ie, when it is carried out through tour operators or any other sales channel for tourism, including the Internet or other new technologies.

This Decree stablishes standards for quality of the apartments and ways of regulating the internal use of both apartments and facilities. It offers too some rules for the classification of the touristic houses into grades acording to requirements fixed in its annex ( described below in this article)

According tho the new regulation prices will be adequate to the quality of goods and services and any related taxes need to be inlcuded in the amount showed in the publicity. Deposits will never be higher to 250 € unless othersise freely agreed by both parties.

Provision 8 of the new Decree stablishes that there is an obligation of communicating the touristic character of the house and to apply for the registration and classification if you are marketing more than one touristic house. If you are marketing just one unit, the house will need to meet the requirements for the standard ( lower) category according to this Decree.

ANEX. TECHNICAL REQUIREMENTS FOR THE CLASSIFICATION OF TOURIST HOUSES.

1. Acceses, comunications and parkings

|

·

|

Superior

|

First

|

Standard

|

|

· Clients´ entrance

|

Yes

|

Yes

|

Yes

|

|

· Lifts

|

Yes

|

Yes

|

Yes

|

|

- From ( Number of floors)

|

Ground+2

|

Ground+3

|

Ground+4

|

|

· Clients´stairs

|

Yes

|

Yes

|

Yes

|

|

· Párking for clients

|

Yes

|

Yes

|

-

|

2. Facilities and services

|

·

|

Superior

|

First

|

Standard

|

|

· Thermical and acustic insulation in every area (*)

|

Yes

|

Yes

|

Yes

|

|

· Audio-ambient level by facilities (**)

|

|

|

|

|

· Power points in every room including voltage (***)

|

Yes

|

Yes

|

Yes

|

|

· Medium lighting level

|

|

|

|

|

According to recommendations by the Valencian Enenrgy Agency

|

|

|

|

|

· Cooling system (****)

|

|

|

|

|

Bedrooms

|

Yes

|

-

|

-

|

|

Commun rooms

|

Yes

|

Yes

|

-

|

|

· Central Heating (****)

|

|

|

|

|

Bedrooms

|

Yes

|

Yes

|

-

|

|

Commun rooms

|

Yes

|

Yes

|

-

|

|

· Telephone or Internet connection

|

Yes

|

-

|

-

|

|

· Hot water

|

Yes

|

Yes

|

Yes

|

|

· Commun gardens

|

Yes

|

-

|

-

|

|

· Pool ( replaceable by forward edge of beach)

|

Yes

|

Yes

|

-

|

|

· Individual safety boxes

|

Yes

|

Yes

|

-

|

|

· Evacuation plan posted on house entrance

|

Yes

|

Yes

|

Yes

|

|

· List of important telephone numbers in visible place

|

Yes

|

Yes

|

Yes

|

Cleaning, laundry, lingerie change, reparations, maintenance and trash removals will be accordiong to agreements between parties.

(*) According to applicable legislation.

(**) According to Law 7/2002, of Valencian region on acustic contamination.

(***) Voltage indicator and power points can be replaced by a general indication on voltage on the whole dwelling, placed in a visible area.

(****) Always with the possibility of obtaining a certain temperature according to the applicable legislation on energy saving. Control in “ superior” category can be made for each enclosure and , for the rest of the categories, can be commun for the whole house.

3. House sizes

|

·

|

Superior

|

First

|

Standard

|

|

· Double bedroom in Squared meters ( m2), closet including

|

12

|

10

|

8

|

|

· Main bedroom in m²(*), closet including

|

14

|

12

|

10

|

|

· Single bedroom in m2, closet including

|

9

|

8

|

6

|

|

- For each bunk bed, addittional m2

|

-

|

4,50

|

3,50

|

|

· Living-Dining room/Kitchen in m²

|

26

|

22

|

18

|

|

· Living-dining room in m²

|

20

|

17

|

14

|

|

· Bathrooms or toilets (**)

|

Yes

|

Yes

|

Yes

|

|

- Surface in m²

|

6

|

5

|

4,5

|

|

- Number according to occupancy:

|

+ 4 people

1 bathroom

1 bathroom

or toilet.

|

+6 people

2 bathrooms or toilets

|

-

1 bathrom or toilet

|

|

· Kitchen in m²

|

8

|

7

|

5

|

|

· Laundry room

|

Yes

|

-

|

-

|

|

· Studio apartment (***) in m² (****)

|

34

|

29

|

24

|

(*) One per house as minimum.

(**) Bathrooms will have bathtub with shower, washbasin and toilet.

In superior category, if there is just pone hygiene room, it will be a bathroom ( with bathtub and shower) if two existing: one will be a bathroom and the other one a bathroom or a toilet..

(***) House units composed by a jopinmt living room and bedroom, kitchen and bathroom.

(****) Bathroom not included .

4. House´s equipment

· Houses will have, in general, all the furnitures, cutlery, household items, lingerie and items needed for the necessities of the occupants according to its capacity.

· All bedrooms will have a closet, regardless the category of the apartment.

· Houses of superior and first category will have a Colour TV.

· Kitchen will have:

|

·

|

Superior

|

First

|

Standard

|

|

- Cooker (*)

|

Yes

|

Yes

|

Yes

|

|

- Fridge

|

Yes

|

Yes

|

Yes

|

|

- Electric iron

|

Yes

|

Yes

|

Yes

|

|

- Oven/Microwave

|

Yes

|

Yes

|

Yes

|

|

- Range hood.

|

Yes

|

Yes

|

Yes

|

|

- Automatic washing machine

|

Yes

|

Yes

|

-

|

|

- Dishwasher

|

Yes

|

-

|

-

|

(*) Cooker will have at least two burners when the occupancy is not higher to 4 people, and 3 or more burners if the occupancy does not exceed 4 people.

0

Like

Published at 2:00 PM Comments (4)

0

Like

Published at 2:00 PM Comments (4)

Legal tip 121. Ground clauses and the fierce beast

Tuesday, August 11, 2009

“Ground clauses" on a mortgage´s interest rate indicates the level of final interest rate (Euribor plus spread and relevant) to be paid by the client, regardless of the level at which the index is at the time of the review. So even if the index falls to zero, the borrower still pays at least a minimum established interest rate.

The "ground clause" is a permitted and legal condition of the loan if the parties freely agree to it, as are the "roofs" of the mortgage´s interest rate, i.e., the maximum rate that can be paid on a variable interest mortgage.

In any case, for the financial institution to act in accordance with the new law 2 / 2009 of March 31st, the information must be sufficiently clear in accordance with annex 2 of the Order dated May 5th, 1994.

For more information regarding this law:

If you are looking for a mortgage, it is best to choose one that provides the benefits of a falling Euribor, without limiting its descent. This would eliminate the ground level interest rate and provide borrowers with an interest rate based directly on the index.

If you already have a mortgage loan, look under the "Interest rates" paragraph of the (1)binding offer, (2)contract with the Bank and (3)Notary deeds to see if your institution is applying this restriction.

Customers often sign their mortgages without being aware of this clause and learn only when it is applied to them. Then, once the Euribor is falling, they expect that their mortgage payment will decrease sharply upon their next review. It comes as an unpleasant surprise when there is only a modest decrease in their monthly payment. This is because their payments are now based on the ¨ground clauses¨ limit and not directly on the index.

In accordance with Consumer Law it is possible to ask for the removal of these clauses if they have not been freely agreed to by the parties. The burden of proof rests with the Bank: this new era needs to be a pro-consumers one: ordinary people: the weak side of the market which has already proved to be a fierce beast.

________________________________

By María L. de Castro and Christin Murphy

Christin Murphy is a GMBA Candidate, International Finance in Suffolk University, Boston MA. United States.

0

Like

Published at 2:41 PM Comments (0)

0

Like

Published at 2:41 PM Comments (0)

Legal ethics? Worth it?

Monday, August 10, 2009

Need to ask if that is an obligatory subject...it sounds boring!

That´s maybe the most interesting comment I heard around the sun loungers during my vacations in Zahara de los Atunes and Grazalema this year. It was made by a student who has just finished her first year in LawSchool. She was discussing subjects to choose for the second year with her mom. I need to say that, interestingly, the mom seemed to be much more stressed out than the young 19 y/o girl about the choosing. What are we raising?

The specific question was about Legal Deonthology (The Ethic science for legal professionals) and if this "deon-whatever-subject" was..... really worth taking or not. Anyhow....was it obligatory?

Many questions showed up behind my sunshade then....

Hum.... Should her mom advise her to take it?

More.....Should she need her mom to advise her to or not to take it?

More......Should the State make it obligatory for all Law students?

More....What does she mean by: "Worth it? Is that the real question to be asked about Ethics for the profession you will be practicing for the common good and the rest of your life?

And more....is the profession for the common good? Is it part of our identity?

Worthiness. That is, in my opinion, the clue, the real important point. After so much consuming we are now blind to see further than financial worthiness and that is the reason we, the homo-financiens, are so lost in the post-modern jungle! A crisis was needed. We are having it.

My goodness!.... what exciting times we have ahead of us... it seems so many classic/basic understandings need to be reviewed, rethought, remembered, and retaught.

Socrates... Aristotles.....

Tumbonas by Montuno at Flickr.com

0

Like

Published at 2:49 PM Comments (1)

0

Like

Published at 2:49 PM Comments (1)

Spam post or Abuse? Please let us know

|

|