Legal tip 776. Spain is already out of the Euro

Thursday, May 31, 2012

SPAIN IS ALREADY OUT OF THE EURO if we understand Spain as its real makers: spanish medium citizens. Maybe that is what big macroeconomy thinkers and calculators generally forget.

I fully agree with all contained in this interesting article by London based analyst Matthew Lynn mentioning six reasons why Spain should exit the euro. It is full with commun sense and sense of reality against many other economic theories we all are now very tired about. I would add maybe that being at the very North of Aftrica is also an addition to the future of the Spanish economy.

To believe in ourselves. That´s the real reform needed in Spain. Sometimes I believe more in my country and its possibilities after a conversation with any of you, foreign people in love with Spain, who are able to discover and enjoy our benefits much more than many spanish citizens. This is a great contribution. Thanks from deep in my heart.

What do you think of this all?

.jpg)

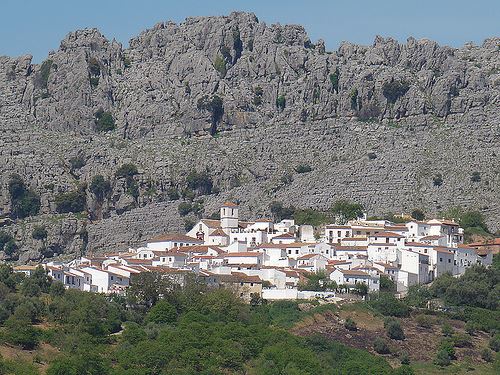

"Olvera. Spain - 15", Olvera, Cadiz, Spain, by Drumsara, at flickr.com

0

Like

Published at 12:36 PM Comments (0)

0

Like

Published at 12:36 PM Comments (0)

Legal tip 775. Of course

Thursday, May 31, 2012

.jpg)

"Olvera. Spain - 08", Olvera, Cadiz, Spain, by Drumsara, at flickr.com

0

Like

Published at 12:18 PM Comments (0)

0

Like

Published at 12:18 PM Comments (0)

Legal tip 774. Non resident taxes

Wednesday, May 30, 2012

Just in case you have yet not found this website

And if you have any doubt, do not doubt about emailing us: web@costaluzlawyers.es

Hasta luego,

María

.jpg)

"Olvera. Spain - 13", Olvera, Cadiz, Spain, by Drumsara, at flickr.com

0

Like

Published at 2:51 PM Comments (0)

0

Like

Published at 2:51 PM Comments (0)

Legal post 773. Asking the Bank

Tuesday, May 29, 2012

Bank which has repossessed the development where a client of us placed a deposit on. He has not formally been called to complete by developer and have not received either formal cancellation of contract. He is in that position we can call as " limbo"

Would the Bank will recognise its former deposit and offer the property to them at today´s prices. It would be wise enough to attract people, we have been considering this for a long time now. Still have not seen any example of this.

Certainly if actions against Bank, out of liabilities of law 57/68 expanded...

What foreign buyers are these Banks trying to attract?

.jpg)

"Playas de Sanlucar, desmbocadura del Guadalqivir", Sanlucar de Barrameda, Cádiz, Spain, by RAMONRAMON at flickr.com

0

Like

Published at 6:55 PM Comments (0)

0

Like

Published at 6:55 PM Comments (0)

Legal tip 772. Foreign buying offices in Spain

Tuesday, May 29, 2012

Office and commercial premises prices are already a 40% down. Experts think that final price decreases will happen within the coming months.

According to both Aguirre Newman and SP Berwin, Banks need to sell their estate through clear and transparent processes, with specialized agents who are able to solve complex situations under commercial, technical and zoning points of view.

At CostaLuz Lawyers, we are conscious of this need for our clients and have been working for a good number of months with property consultants which will add commercial and technical valuations to the legal assessment on properties we can provide.

.jpg)

"2011 Sanlucar de Barrameda", Sanlucar, Cadiz, Spain by jose_gonzalvo at flckr.com

0

Like

Published at 12:30 PM Comments (0)

0

Like

Published at 12:30 PM Comments (0)

Legal tip 770. Finca Parcs trial. A press release by Keith Rule

Friday, May 25, 2012

http://www.eyeonspain.com/forums/posts-long-15828.aspx

PRESS / MEDIA RELEASE - FOR IMMEDIATE RELEASE

FINCA PARCS ACTION GROUP vs CAJA DE AHORROS DEL MEDITERRÁNEO (CAM BANK) & SPANISH DEVELOPER, CLEYTON GES SL

REPORT ON THE ‘TRIAL OF THE YEAR’ IN HELLÍN

70 GROUP MEMBERS GATHERED IN HELLÍN FOR A TRIAL DESCRIBED IN THE LOCAL PRESS AS “THE TRIAL OF THE YEAR” (EL JUICIO DEL AÑO) AND “ONE OF THE LARGEST AND MOST COMPLEX TRIALS EVER HELD IN HELLÍN”

FINCA PARCS ACTION GROUP

● No legally required Bank Guarantees for Off-Plan deposits totalling 1.5 million Euros

● Lawsuit against CAM Bank & developer Cleyton GES SL filed in February 2011

● First Instance Court Preliminary Hearing held on 12 January 2012

● Trial commenced Monday 21 May 2012

OUR MISSION

To recover our Off-Plan Deposits paid in good faith to Cleyton GES SL & Caja de Ahorros del Mediterráneo (CAM Bank), which according to Spanish Law, in particular, LEY 57/68 Article 1.2, "must be deposited in a Special Account, with separation from any other funds belonging to the promoter, which may only contain funds deposited for the construction of dwellings. For the opening of these accounts or deposits the Banking institution or Savings bank (in this case CAM Bank), under its responsibility, will demand the bank guarantee to which the previous condition (Article 1.1) refers”.

FINCA PARCS ACTION GROUP GATHER IN SPAIN

70 members of the Finca Parcs Action Group arrived in Hellín on Sunday 20 May after being called to appear in person by CAM Bank – one of the co-defendants in Hellín’s ‘Trial of the Year’.

First stop for the group was a visit to the Las Higuericas Finca Parcs development which was abandoned in 2009 by Spanish property developer Cleyton GES SL, the other defendant in the trial.

THE EVE OF THE TRIAL

The trial scheduled to last 4 days commenced on Monday 21 May 2012 in the First Instance Court in Hellín following the filing in February 2011 of a 1000 page Lawsuit against property developer Cleyton GES SL and the sole financial entity of the project, Caja de Ahorros del Mediterráneo. The Lawsuit was filed in order to recover 1.5 million Euros of off-plan deposits paid to CAM Bank between 2005 and 2007 by FINCA PARCS ACTION GROUP members, in relation to their Sales Contracts for the Las Higuericas Finca Parcs development.

On the eve of the trial Juan Munoz, the lawyer representing developer Cleyton GES SL explained that:

“Cleyton GES SL is now in negative equity caused by different factors including lack of support from the financier of the project, CAM Bank”. Munoz says that although they will continue fighting for the ‘continuation of the project’, the current economic situation means they cannot fund the completion of infrastructure works or to fulfil the agreement with the Hellín Town Hall.

For this reason, he added, Cleyton GES decided “to seek a partnership formed with several partners and companies with a proven financial solvency and extensive experience in the construction sector”.

Cleyton GES also regret that, “CAM did not want to discuss the future of the project and therefore does not have any respect for the rights of the buyers. Cleyton GES hoped to expose those company representatives and despite everything hoped to reach a negotiated solution with “all sides lowering their claims to obtain an overall benefit”

In response, Keith Rule, co-ordinator of Finca Parcs Action Group stated: “We have suffered extreme stress and heartache over the past 5 years due to the actions of Cleyton GES and CAM Bank. We were promised a dream of owning a house in an idyllic location in a natural park with a lake, however that dream has turned into a nightmare. It is clear the project will never succeed while Cleyton GES and CAM are involved. They are unable to work together and we are the victims of their negligence, deception and illegal use of our off-plan deposits. We want nothing more than what is our inalienable legal right granted by Spanish Law, LEY 57/1968 which is a full refund of our deposit together with legal interest and costs”.

PROTEST

At 9:30am on Monday 21 May, 70 members of the Finca Parcs Action Group held a peaceful demonstration outside the CAM Branch on the Gran Via in Hellin. They held banners and placards demanding the return of their money and calling for the law guaranteeing these amounts to be enforced. The banner also quoted the words of the Bank of Spain Governor which described CAM as ‘Scandalous’ and ‘The Worst of The Worst’.

PROTEST OUTSIDE CAM BRANCH ON GRAN VIA IN HELLIN

From there they marched in an orderly manner to Hellin’s First Instance Court where they held a further peaceful protest prior to the commencement of the trial.

THE TRIAL – DAY ONE

The trial began at 10:45 with the presiding judge Consuelo Romero. The claimants, members of Finca Parcs Action Group were represented by Jaime de Castro. The defendants were represented by Pablo Toran for CAM Bank and Juan Munoz for Cleyton GES SL.

The first session allowed each of the parties to state their position. Although miles apart the positions are quite clear. Finca Parcs Action Group consider that all the promotional material and contracts confirm that the corresponding Bank Guarantees should have been issued by CAM as they did for other buyers in the project who had paid deposits to the same accounts. As no house was delivered both defendants should be made liable.

For Cleyton GES SL, its current owner, Pedro Jimenez Penalver explained that the company he took over about 3 years ago intended to finish the work and deliver the houses. He stated that he did not know what happened prior to his involvement in the company and therefore as the contracts subject to this litigation were signed between 2005 and 2007 he could not answer most of the questions put to him. The most repeated phrase in his testimony was ‘I have no idea’.

OBLIVIOUS

In the case of CAM their argument was that they have honoured Bank Guarantees which they issued to some buyers, but they have no relationship with members of the Finca Parcs Action Group as they did not formalise a contract of guarantee with the Bank.

One issue that gained most attention during the session was that of Bank Accounts. CAM’s Lawyer insisted that, by law, the amounts paid in advance for off-plan property should be deposited in a special account and the funds should be used exclusively for the building of the houses. But he said that Cleyton GES operated 3 accounts at CAM, two of which were ordinary current accounts and that legally bank guarantees can only be issued on money paid to the special account.

However, Keith Rule, who testified for the victims insisted that they were told by Cleyton GES that the 3 accounts were special accounts and in fact 200 Bank Guarantees were issued to other buyers in the project who paid into the same bank accounts as members of the Finca Parcs Action Group. Furthermore the 3 accounts were described as Cuenta Corriente Especial (Special Accounts) on each of the Bank Guarantees issued to other buyers.

Julian Herrera, asset manager of CAM, stated in his testimony that although the accounts may have been called ‘Special’ on other Bank Guarantees, the fact is that “there is only one special account for this promotion and the other two are just ordinary accounts”. He explained that CAM did not receive a request for Bank Guarantees from any of the victims and said that although the Sales Contracts stated that the Bank Guarantees would be issued by CAM, this did not make CAM liable to issue them.

He also confirmed that CAM demanded repeatedly that Cleyton GES transfer buyer’s deposits from the ordinary accounts to the special account, to avoid prejudicing the buyers. He stated that CAM was oblivious to the transactions going through the ordinary accounts.

Jaime de Castro, representing the members of Finca Parcs Action Group stated that although the Special Account was opened in November 2005 the account remained with a zero balance and was not used until June 2007. However, by the time of the first credit into the Special Account on 13 June 2007, CAM had already issued Bank Guarantees to other buyers on the development during the period November 2005 to May 2007 which amounted in value to over 4.5 million Euros.

Of the three persons who testified during Monday’s session, the one who spoke most strongly was Keith Rule, the co-ordinator of Finca Parcs Action Group who himself paid more than 50,000 Euros to CAM. With the help of a translator, he insisted that group members were encouraged to reserve at Finca Parcs due to the promise on all the promotional material and in the contract of Bank Guarantees issued by CAM, who at that time were described as the 4th biggest savings bank in Spain.

But he added that despite repeatedly demanding the Bank Guarantees during 2007 from Cleyton GES SL nothing was forthcoming, only broken promises. He demonstrated that in 2008 they demanded Bank Guarantees directly with CAM Bank via email to the CAM Manager, Fernando Martinez Hernandez at the Murcia Branch to which the money was transferred, however there was no response. He explained that they then demanded the Bank Guarantees from CAM’s London office and that in January 2009 they had a 3 hour meeting with the London Manager, Aurelio Pedros who advised them to submit the complaint directly to the Alicante head office of CAM. This they did in February 2009, however by the end of 2009 CAM denied any liability and they referred their complaint by email to Roberto Lopez Abad and Modesto Crespo, CAM’s CEO and President, respectively. An email reply was received in the names of Lopez-Abad and Crespo; however this stated that ‘if you do not have a Bank Guarantee then you have no relationship with this entity’.

The Judge decided with the agreement of all parties that after hearing the testimony from one claimant it was not necessary to repeat a similar questioning of each of the buyers. So the other 46 applicants did not have to testify.

THE SURPRISING OFFER “Would you accept a house from the ones that are built instead of money”

THE REPLY “We cannot trust any of you as we have been robbed and cheated for many years”

Juan Munoz, Lawyer for Cleyton GES, at one point in the interrogation of Keith Rule offered to the victims the possibility of existing houses instead of a refund. Mr Rule was especially forceful in responding to this offer, as he said that Cleyton GES and CAM have ‘stolen the money’, lied ‘over and over again’ throughout the years, violated Spanish Law and its own promises therefore we cannot trust you anymore.

Jaime de Castro responded on behalf of the victims by saying, “Cleyton GES cannot offer these properties simply because they are no longer yours to offer”. In his view the bank and developer have the “same level of responsibility” in this matter.

Pedro Jimenez Penalver, manager of Cleyton GES said that in Las Higuericas Finca Parcs, where he was planning to build more than 600 houses, that after 7 years there are 73 houses finished, and ‘seventy-something’ to which only needed 10 to 15% more work to complete. He also indicated that the urbanisation infrastructure is complete to around 75%-80%, and that the reason that no property has a Licence of First Occupation is because there was no way to solve problems such as the high tension electric cable which runs through the site for which Iberdrola should have carried out an environmental impact study and which was not done. He also criticised the attitude of CAM who took possession of the houses “which were the property of others”.

QUOTES FROM DAY ONE

“FINCA PARCS ACTION GROUP” - Those affected say they have had enough of broken promises. Their spokesman, Keith Rule, stated that they only want to enforce the Law and receive their money back that they paid for houses which were not delivered.

“CONFIDENCE IN SPANISH JUSTICE” – Keith Rule, one of the victims, who acted as spokesman for the Finca Parcs Action Group, together with their Lawyer Jaime de Castro insisted that they trust in Spanish Justice and that their legal rights will be upheld. “The buyers, said de Castro, trust in the Spanish courts and I will also say that the Bank will respond if they are sentenced to do so. Even in these times where there is so much distrust, to favourably resolve a case like this can be good for the image of Spain around the world”.

THE TRIAL – DAY TWO

On day two several witnesses appeared to testify and each of the three parties to this case delivered their conclusions.

THE LAWYERS

JAIME DE CASTRO for the FINCA PARCS ACTION GROUP

Calls for Cleyton GES and CAM to jointly refund the money

JUAN MUNOZ for Cleyton GES SL

He stressed that the firm is willing to continue the development

PABLO TORAN for Caja de Ahorros del Mediterraneo (CAM)

He claims that CAM has no direct relationship with the plaintiffs and owes nothing……

The trial of Las Higuericas Finca Parcs was completed on day 2, in half the time originally planned.

The plaintiffs, who claim their money was deposited in Cleyton GES accounts at the funding entity CAM, confirmed their evidence and must now wait for Judgment.

The three hours of Day 2 of the trial began at 10:30 with the witness testimony of Enrique Ros, representative of the company Lauara Europea SL (the company that has agreed to take over the obligations of completing the project).

Then ex-employees of Cleyton GES SL were called to testify. The first being Antonio Jose Veas Arteseros, who worked for Cleyton GES from 2004 until April 2009. He said that CAM was fully funding the project and fully endorsing and paying for everything relating to the urbanisation. His involvement with the Bank Guarantees was to send an application to CAM for each of the contracts.

All the witness interrogations, except for that of Patricia Ramos Calderon, architect from the Hellin Town Hall, focussed on the CAM bank accounts to which the buyer’s deposits were paid.

Gerardo Cantore, sales manager of Cleyton GES from 2004 to 2009 revealed that in relation to the Bank Guarantees he went to the CAM offices in person with two lawyers, “because first CAM said one thing and then changed their criteria”

Ramon Ramiro Mauleon, another ex-employee of Cleyton GES from 2001 to 2009 said that “when he initially presented the project to several banks, CAM agreed to fund the project in totality. Banks were queuing to fund the project”.

Fernando Martinez Hernandez, an employee of CAM confirmed that he was the business manager at the Branch in which the Cleyton GES accounts were operated. He confirmed that CAM issued Bank Guarantees for deposits which were not necessarily paid to the special account.

When shown copies of several Bank Guarantees, many of which he had signed, from the 200 that CAM had issued on the development for deposits paid to the same accounts as those deposits paid by members of the Finca Parcs Action Group he said he did not know why this happened and why on each bank guarantee the 3 accounts were described as ‘Special Accounts’.

Furthermore, Fernando Martinez, when shown several bank account extracts, was unable to explain why CAM authorised many withdrawals from the Special Account, in complete contravention of the requirements of LEY 57/1968 including a cash withdrawal in excess of 80,000 Euros.

He added that none of the buyers ever demanded Bank Guarantees directly with CAM and that this issue was only managed between the developer and the buyers.

When questioned he ‘could not remember’ receiving emails from Keith Rule in 2008 demanding CAM to issue Bank Guarantees nor ‘could he remember’ ever seeing Keith Rule or any other buyers at his CAM Branch to demand the Bank Guarantees in person.

Patricia Ramos Calderon, municipal architect, who had visited the site, stated that according to the environmental impact Law of 2007, there was a requirement for the removal of the high tension electricity cable running through the development, which was the obligation of the developer and that no First Occupation Licences could be issued until this was done.

The final witness was a representative from the electric company, Iberdrola. However, during the first question the Judge intervened to state that it was not necessary to question this witness as nothing he may say would affect the case.

After a break of 5 minutes, Jaime de Castro, Lawyer for the Finca Parcs Action Group delivered his conclusions in which he sated that “due to bad practices my clients have been harmed”. He argued that the actions of the Bank and developer must not affect the buyers and that all 3 accounts were presented as special and that it was always understood that deliveries to these accounts must have the corresponding Bank Guarantees, by Law.

He stressed that the involvement of CAM in the project was so intense, something that he had demonstrated since the beginning, that Cleyton GES and CAM “should be condemned jointly and severally” to repay the sums paid by the purchasers that never received their homes.

CAM’s Lawyer, Pablo Toran, argued just the opposite. He said Cleyton GES bore responsibility, accusing it of not fulfilling its commitments, especially when it came to handling money from the promotion in the special account and ordinary accounts. He pleaded therefore that CAM be absolved of any liability in this case, insisting that the plaintiffs did not have any contractual relationship with CAM.

In his concluding speech Juan Munoz, Lawyer for Cleyton GES SL said that there are available sufficient financial means to continue with the urbanisation and to fix the problem of the high tension Iberdrola electric cable. He opposed both the demands for contract cancellation and for refunds. He insisted that Cleyton GES ‘wants to move on’…………..

The trial was completed in 2 days and now sentencing is awaited which in principle may be delivered within 20 days.

Following the conclusion of the trial, Keith Rule, co-ordinator of the Finca Parcs Action Group comments:

“Our relationship with CAM is not primarily derived from the contract, but from the Law, LEY 57/1968. For the opening of the Special Accounts CAM must be vigilant. CAM is responsible for ensuring that all payments to the promoter for the construction of housing is credited to the special accounts, without deviation.

CAM was the sole financial entity of the Las Higuericas Finca Parcs project and received all the off-plan deposits though it’s branch in Murcia.

We must not suffer any prejudice or harm due to the failure in the relationship between CAM and Cleyton GES SL nor as a result of CAM’s negligence and lack of due diligence particularly in respect of its complete failure to observe the requirements of LEY57/1968.

There has been a fraudulent use of our off-plan deposit money which amounts to 1.5 million Euros and CAM has been a party to this fraud over a 5 year period.

CAM failed to control, supervise or audit the activities of Cleyton GES and this is evidenced by the fact that they allowed and authorised illegal withdrawals from the Special Account.

There has been a complete failure by both defendants to observe Spanish Law, in particular LEY 57/1968.

In approximately 25 court judgements during the past 2 years Cleyton GES has been declared as ‘Whereabouts Unknown’. However in this case, not only did they defend our Lawsuit but actually appeared in person at the trial.

We are the innocent victims of this corruption and we are confident that a verdict will be delivered condemning both defendants jointly and severally liable for the refund of our deposits, together with legal interest and costs.

Only then will it be possible for us once again to have trust and confidence in Spain.

I would like to thank all our group members who travelled to Spain at their own expense and who have, like me, suffered unnecessary stress and heartache over the past 5 years due to Cleyton GES SL and CAM Bank.

I also give thanks to our legal team without whom it would not have been possible to bring the defendants to trial. Maria de Castro from Costa Luz Lawyers has been a tower of strength throughout the last 4 years both with the initial study of our case and with the continuing study of Case Law related to Banks liabilities according to LEY 57/1968.

Our litigator, Jaime de Castro, from De Castro Gabinete Juridico has worked tirelessly on this issue which we feel resulted in a very comprehensive Lawsuit and a very strong delivery of the facts and evidence at the trial.

Finally thanks to Hotel Emilio in Hellin who provided us with superb facilities and service throughout our stay in Hellin. Our issues are not with the town or people of Hellin, but with the actions of Cleyton GES SL and Caja de Ahorros del Mediterraneo.

We now await the verdict with interest.

.jpg)

"Campos de Andalucia", Andalucía, Spain, by Micheo, at flickr.com

0

Like

Published at 5:54 PM Comments (1)

0

Like

Published at 5:54 PM Comments (1)

Legal tip 769. Opening a Business is easy in Spain

Friday, May 25, 2012

Government is approving today the “Express license” for the opening of shops without administrative burdens

Just three requisites will be necessary:

1) -A declaration of liability on meeting of legality

2) - A report of an architect or engineer about the premises

3) -Payment of corresponding fee at the Local Council

For all businesses meeting these features:

1) -Less than 300 squared meters of surface

2) - Less than 250 employees

3) - Less than 50 million of Euros of yearly invoicing

Not applicable to hotel industry or any other business where dangerous substances are used or which affect patrimony.

Government is convinced that this Law will have a positive impact on Spanish economy.

.jpg)

"Juzcar, el pueblo pitufo", Juzcar, Málaga, Spain, by Landahlauts, at flickr.com

0

Like

Published at 1:39 PM Comments (1)

0

Like

Published at 1:39 PM Comments (1)

Legal tip 768. Humanistic Leadership

Thursday, May 24, 2012

From time to time, I like posting an article publiched by friends at IESE:

Humanistic Leadership: Lessons From Latin America

Dávila, A.; Elvira Rojo, Marta

Publisher: Elsevier

Original document: Humanistic leadership: Lessons from Latin America

Year: 2012

Language: English

Latin Americans tend to score high on personal authority and collective or group-related cultural dimensions and values relative to people in the United States or Europe.

This cultural trend has given rise to a "paternalistic" leadership style in which personal and social relationships are key to working and leading employees effectively.

In their paper, "Humanistic Leadership: Lessons From Latin America," published in the Journal of World Business, Anabella Davila of EGADE Business School, Mexico, and IESE Prof. Marta M. Elvira review the psychological, sociological and historical factors behind this leadership style.

They also introduce alternative theoretical frameworks, providing fruitful avenues for further research in this area.

A Paternalistic Model

From a historical perspective, the roots of this leadership style can be traced back to the old hacienda -- or privately owned agricultural estate -- in which the patrón -- or owner/boss -- besides paying wages, took care of the workers by providing housing and food for them and their families.

The community living on the hacienda developed strong familial bonds, which crystallized into specific social structures, such as the jeitinho in Brazil or compadrazgo in Chile and in Mexico.

Jeitinho refers to a Brazilian cultural trait used as an adaptive strategy for problem solving. It facilitates action via emotional mechanisms and avoids confrontation.

Similarly, the compadrazgo is a social relationship based on a dyadic informal contract among relatives or friends identified among the Chilean urban middle class.

Both types of relationships rely on a continuous exchange of favors based primarily on friendship, and work well under a paternalistic leadership style because they include the required emotional tie to the in-group.

After the wars of independence in the 19th century, labor markets functioned under a "debt peonage" system. This meant that workers were assigned to the owner of a hacienda for an unlimited period of time, and part of their wages was retained to pay for shelter or other needs.

Sometimes workers were paid so little that they needed to borrow from owners who, in turn, tried to ensure that workers would not be able to pay back their loans and thus remained on the hacienda.

Reciprocity and Stakeholder Management

Haciendas offered resident housing, medical care and, in some cases, education for the children. Although the work environment was often coercive and favored the owner's interests, workers were still free to make certain choices, and owners had to offer them incentives that included salaries and other additional payments.

This system generated a reciprocal relationship that developed into mutual responsibilities and loyalties. Both owner and workers had social obligations, such as incentives for job performance, protection during downturns and participation in family events.

Taking a stakeholder perspective of management, the authors draw on previous research to identify three essential features of this uniquely Latin American brand of leadership:

- Investment in employees, including salary, benefits, education, training and development

- Cooperative efforts in labor relations

- Community-centered CSR practices

Workers' rights are generally unprotected by labor institutions, but derive instead from psychological contracts with employers, who, besides providing their employees with salaries and benefits, also offer them extensive long-term training.

New Humanism in Leadership

The authors believe this quid-pro-quo approach could underscore a new brand of humanistic leadership. Prior research suggests that in Latin America, management practices place the individual at the center of the organization and society.

Such an approach represents a radical departure from today's dominant economic view of leadership, which depicts leaders as conducting constant negotiations to clarify goals and outcomes with their subordinates, who tend to be viewed as mere resources rather than individual human beings.

The value placed on community development in Latin America increasingly challenges organizations to integrate their business goals with those of the wider community through CSR programs.

Combining a paternalistic leadership style with a community-focused approach helps to foster institutional arrangements that legitimize the social contract between individuals and organizations.

Case studies have shown that leadership effectiveness in the region is further bolstered when managers develop horizontal relationships with employees in contrast to a vertical relationship of subordination.

Leaders need to acknowledge the role of each individual within the workgroup and the organization within its community and society at large.

This style of leadership requires showing genuine concern for workers, including in such areas as their quality of life, family and community welfare -- in effect, viewing employees as full stakeholders in the management process.

When this happens, workers generally respond with high levels of productivity and commitment to the organization.

Diversity Is Key

Diversity is deeply embedded in the Latin American region, where the early colonizers encountered a diverse land, both in terms of geography and ethnicity.

However, the model of colonization they implemented favored a tiny minority of elites, resulting in pervasive social and economic inequality that has remained to this day.

Regional leaders acknowledge the distinctive characteristics of a diverse workforce and how these can translate into broadly diverse aspirations and demands.

As economic forces and pressures take their toll, companies must be mindful of the unique social and cultural norms of the regions in which they are operating.

For example, recent changes in Mexican society -- particularly in terms of its growing internationalization and evolving education and technology-based training -- are demanding new work skills that, in turn, could allow Mexicans to exert greater control over their lives.

Similar trends have been identified in Chile. The more educated the workers, the more independent and self-confident they are, and the more focused they are likely to be on workplace productivity and performance.

To understand the human dimension and individual roles in the context of leadership studies in Latin America, the authors propose disciplinary approaches that go beyond limited cross-cultural business theories.

For managers, this synthesis of paternalism as a leadership style in Latin America highlights the value of developing personal and social bonds with employees.

However, one must remember that these bonds have grown out of relationships within unique cultural contexts.

For example, many traditional values that may have lost ground in other parts of the world, such as hierarchy and paternalism, are still a major influence in Latin American organizations.

Ultimately, for leaders to be effective, such cultural norms should be respected.

Top

.jpg)

"Cartajima", Malaga, Spain, by Excursiones Renacentistas, at flickr.com

0

Like

Published at 1:53 PM Comments (0)

0

Like

Published at 1:53 PM Comments (0)

Legal tip 766. Trust in Spanish Justice system

Wednesday, May 23, 2012

Published in " La verdad de Albacete" yesterday, the 22nd of May.

Trust in Spanish Justice.

Both Keith Rule, spokesperson of victims ( he bought two houses that he never received) and Lawyer Jaime de Castro insisted on trusting Justice and on their rights to be recognized.

" Buyers- said Lawyer Jaime de Castro- trust the Spanish Justice system and I also have said to them that also Banks will answer their liabilities if a Court decission asked them so. Even in these times where trust is so missed, to solve in favour of buyers a case like this one, might be good for Spain´s image"

.jpg)

"El Rompido.Port. Huelva.Andalusia, Spain", Huelva, Spain, by Tomas Fano, at flickr.com

0

Like

Published at 3:42 PM Comments (0)

0

Like

Published at 3:42 PM Comments (0)

Legal tip 765. Keith Rule´s legacy

Wednesday, May 23, 2012

His job was mainly over yesterday with the second part of the hearing for Las Higuericas, Finca Parcs case against Cleyton Ges and CAM. They are now waiting for the Court decission. Let´s wish the best for them. They deserve it.

I have been a witness of the faculties and determination of this UK person since September 08 when he first emailed us wanting a case against the Bank which received his deposit and those of other members of the Finca Parcs group ( then 8, today more than 60). Not being a law professional but being indeed a man with a remarkable sense of justice he saw clearly from the beginning that the main risponsable people were those of the financial institution involved in the development. They have, in a great extent, trust the project because of the presence of the CAM and therefore there should be a way to legally blame them of this big dissapointment.

From then, he encouraged us to go and study the case at a deeper level and we started our job which have consisted in continuous study of legal doctrine and case Law also with the help of Law Professors. Today there are more than 15 Court decissions all over Spain making clear the extent of liabilities of Banks in respect of amounts advanced in off plan projects.

I was happy to hear today, when talking to Keith on the phone that he was satisfied with the judicial system and that he was enocuraged by support commentaries of many spanish people.

He has been during the last years for us all at Costa Luz and De Castro Law Firms an incredible example of truth, honesty, leadership and determination. I do think that the Judge and even the adversary lawyer was able to see the clear claim for justice he was doing as we saw it in 2008.

Thanks Keith Rule.

Maria and the Costa Luz/ De Castro team

This is the link to regional TV ( minuyes 8,44 to 10,40) but they were also on National Telediario 21/05/2012 at 21:00

.jpg)

"Amanecer en Los Caños de Meca", Barbate, Cadiz, Spain, by Jesu d´Alange, at flickr.com

0

Like

Published at 12:13 PM Comments (0)

0

Like

Published at 12:13 PM Comments (0)

Legal tip 764. 70% Strong Spanish Banks

Tuesday, May 22, 2012

IMF is publishing a report within the first two couples of June where it sttaes that Spanish Banks are 70% strong.

This report explains that our financial entities are safe even if the GDP fell a 4%

Just nacionalized BANKIA was the half of the other 30% which would need capital reinforcement.

No bad news at all! Let´s hope IMF is accurate this time!

.jpg)

"Cartaya", Huelva, Spain, by Manuel M. Ramos, at flickr.com

0

Like

Published at 1:33 PM Comments (0)

0

Like

Published at 1:33 PM Comments (0)

Legal post 763. Commun sense

Tuesday, May 22, 2012

I am just copying the wise post from a client today. What can you add...?

Hi Maria

Many thanks for your update below.

In the whole grand scheme of things it would be very sensible for the Developers/Banks to work together and go back to people like us, where there is still a possibility of striking a deal. However and like I have said below, they would have to be extremely sensible and realistic in what they would want for us to complete on say a 2 Bed 2 Bath apartment on Mar Menor 2 in our case and with the amount of money that we have already paid them.

Over the last couple of years I have watched the property market very closely in Span and especially the Polaris/Mar Menor 2 site. The very obvious thing that stands out is the fact that they are still not selling many properties at all, and this is after huge price reductions from the original selling prices. Surely somewhere along the Developers who are still around and the Banks will have to do something with these properties, as looking at the current sales activity it would take them years to clear the backlog of properties, and every year that the Banks still have a property on their books then it is costing them lots of money. On Mar Menor 2 the Banks now own most of the properties, and when I have tried to negotiate with Polaris in the past they have had very little to offer. It needs the Banks and Polaris to work on this together and on the back of the work that people you like are doing.

The whole thing would be a catalyst to getting things moving in Spain, because if we could do a deal then I would have to furnish the apartment, use good Lawyers like you, pay tax to the Government, Pay Community Fees, Pay for Water/Electricity and more importantly we would be holidaying in Spain and we would look to rent out to our Friends and Family who would all contribute to the local economy.

It all sounds too easy Maria….Look forward to seeing if you get anything back from Polaris etc…

Many Thanks

xxxxxxx

.jpg)

"Castellar, Cadiz", Castellar, Cadiz, Spain, by quinocho, at flickr.com

0

Like

Published at 12:55 PM Comments (2)

0

Like

Published at 12:55 PM Comments (2)

Legal tip 762. How much would you pay to complete now?

Tuesday, May 22, 2012

A question some developers are making to buyers who did not complete 4 years ago and whose contracts has not been cancelled.

.jpg)

"Castellar de la Frontera", Cadiz, Spain, by TeamGeist, at flickr.com

0

Like

Published at 8:10 AM Comments (0)

0

Like

Published at 8:10 AM Comments (0)

Legal tip 760. Finca Parcs´4 days hearing starting today

Monday, May 21, 2012

As recently announced on papers. Finca Parcs claimers have already arrived to Hellín por the 4 days trial. Jaime de Castro , barrister working for CostaLuz Lawyers is representing them in Courts.

We will keep you posted on developments.

Five-year battle for off-plan deposit refund

UK-based property buyers face the CAM bank and their developer in court

By Dave Jones – COSTA BLANCA NEWS

A TOTAL of 70 property buyers from the UK and Ireland are travelling to Spain next week to fight to get back deposits they put down at the abandoned Las Higuericas Finca Parcs development.

A four-day trial - the result of lawsuit filed against CAM Bank and developer Cleyton GES SL by Finca Parcs Action Group – is due to start on Monday, May 21.

The 70 buyers have all been summoned to attend the First Instance Court in Hellín following a request by CAM Bank.

They are seeking to recover off-plan deposits totalling 1.5 million euros for which, they argue, there were no legally required bank guarantees.

These were paid between 2005 and 2007 ‘in good faith to Cleyton GES SL and the CAM which according to Spanish Law, in particular, LEY 57/68 Article 1.2 must be deposited in a special account, with separation from any other funds belonging to the promoter, which may only contain funds deposited for the construction of dwellings’.

Action group co-ordinator Keith Rule said they have been demanding their money back for five years.

“It is our inalienable right under Spanish Law, LEY 57/1968, to have our off-plan deposits held in a special escrow account and protected by way of individual bank guarantees,” said Mr Rule.

“Contrary to Spanish Law the developer, Cleyton GES SL together with CAM Bank, who funded the project and accepted the off-plan deposits, failed to protect our money.”

He added that despite abandoning the project in 2009, neither the developer nor CAM bank returned their money.

“For the past three years the developer has been declared on various court judgments as ‘whereabouts unknown’,” stated Mr Rule.

“Therefore we were forced into this lengthy, expensive and very stressful legal battle.”

The inland development, close to the village of Agramón, is around 15km from Hellín and 80km from Albacete and Murcia.

The site with 617 plots divided into five phases still remains abandoned with just 50 phase 1 properties completed, added Mr Rule.

He concluded: “It has been a huge logistical exercise arranging flights, accommodation and airport transfers for the 70 group members; however with all plans finally in place we are now ready to face the developer and bank in court.”

.jpg)

"Lepe", Huelva, Spain, by Pablo G. Pando, at flickr.com

0

Like

Published at 10:08 AM Comments (4)

0

Like

Published at 10:08 AM Comments (4)

Legal tip 759. Cantabria speaks out on fraud of Law by Banks and developers

Tuesday, May 15, 2012

So bright !

This case Law passed by Section 4th of Cantabria Case Law on 17th of March 2010 (a Saint Patrick´s day ;) clearly describes how banks and developers tried to get around Law 57/68

Even brighter the correct interpretation that Magistrates do of liabilities of the depositer Bank under this law, which makes them liable of:

- Existence of Bank Guarantees or Insurance Policies for the refund of off plan deposits

- Deposit of amounts in the right account

- Use of deposits for building purposes

Excellent, truly excellent.

Congratulations Cantabria!

.jpg)

"Aracena, España", Huelva, Spain, by Julia Folsom, at flickr.com

0

Like

Published at 1:59 PM Comments (1)

0

Like

Published at 1:59 PM Comments (1)

Legal tip 758. More Case Law on Bank´s liabilities for off plan refunds

Tuesday, May 15, 2012

SAP Murcia, 6 Febrero 2012

SAP Valladolid,17 Enero 2012

SAP Murcia, 22 septiembre 2011

SAP Burgos, 29 julio 2011

SAP Almería, 28 junio 2011,

SAP Valencia, 17 junio 2011

SAP Burgos, 3 mayo 2011

SAP Alicante, 25 Junio 2010

SAP Cantabria, 17 Marzo 2010

S 16 abril 2010 JPI nº 57 de Madrid

SAP León, 24 julio 2009

SAP Soria, 3 noviembre 2006

SAP Málaga, 30 junio 2005

Related Supreme Court Case LAw:

STS 7 de Junio de 1983

STS 22 de Septiembre de 1997

STS de 1 de diciembre de 1998

STS 30 de diciembre de 1998

STS de 8 de marzo de 2001

STS de 19 de julio de 2004

STS de 7 de febrero de 2006

Navarra Higher Court Case Law ,22 Diciembre 2008

.jpg)

"Aracena", Huelva, Spain, by David Domingo, at flickr.com

0

Like

Published at 1:02 PM Comments (0)

0

Like

Published at 1:02 PM Comments (0)

Legal tip 757. After reading Krugman´s Stop this Depression now

Sunday, May 13, 2012

I am reinforced in the idea that philosophers of the economy are needed. Personalist philosophers bringing to the science the orientation this needs.

Principles such as solidarity, commun good, general interests, overcoming of poverty, equal oportunities.... need to be at the root of every organisation of finances and economy. This does not impede the legitimate competition for the productivity of companies and countries but,it helps these to be performed in a healthy, balanced and pro-person way.

.jpg)

"Punta Umbría", Huelva, Spain, by rafa_uoc, at flickr.com

0

Like

Published at 2:54 PM Comments (0)

0

Like

Published at 2:54 PM Comments (0)

Legal tip 756. Krugman´s Stop This Depression Now

Friday, May 11, 2012

Definitely a MUST READ. I am at the middle of it and determined to finish it this weekend.

It was very energizing for me to see how Krugman sees Spain´s problem as De Grauwe saw it from 1998.

Also it is good to read that the worldwide crisis problem is of easy solution. Much related to balance, regulation ... as almost every crisis in life.

Do not miss it, he was 2008 Economy Nobel Prize

Have a great weekend!

.jpg)

"Exhausted / Rendida", Tarragona, Spain, by SantiMB, at flickr.com

0

Like

Published at 2:56 PM Comments (0)

0

Like

Published at 2:56 PM Comments (0)

Legal tip 755. If you cannot meet mortgage instalments

Monday, May 7, 2012

Together with the offer to the Bank to give keys back to them

It is good that you try to sell the property at the same time that you communicate your situation to the Bank. This really makes them feel more comfortable with the dation procedure, specially if your selling agent collaborates closely with the manager of the branch on the sale of the same.

We are offering this service to our clients through a team of property consultants of our full trust who can help you to find a buyer for your property. Please email us if you want more information on this.

Kindest,

Maria

.jpg)

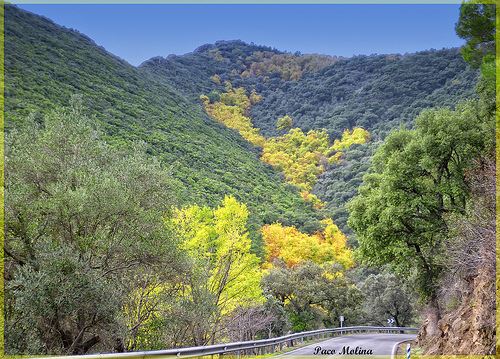

"PARQUE NATURAL" (Sierra de Aracena y Picos de Aroche), Linares de la Sierra, Huelva, Spain, by Paco_Molina, at flickr.com

0

Like

Published at 10:49 PM Comments (2)

0

Like

Published at 10:49 PM Comments (2)

Legal tip 754. You need to buy again in Spain

Thursday, May 3, 2012

We have been fighting bravely along the years in order to have Banks liabilities recognised and these afflicted the corresponding legal punishments according to Law 57/68. ( Thanks Keith Rule for your encouragement on this)

We see the national elements which contributed to the Spanish disaster ( mainly lack of control by Bank of Spain) as we stated in this old post dated 8th of March 2009:

"As one of the majors causers of the current financial unbalance and as excessive earners as they were during the real estate boom, it is time for them to offer a social help in order to bring normality back to the real estate arena and the financial status of the world. Time to reduce those obscene benefits in favour or restoration of financial order. I think this is where most of the needed oxygen needs to come from. But I am not an economist and have no expert knowledge. It is just a common sense thought related to balance and equilibrium".

but we also see the International/ European roots of the same.,as explained in this other post dated last May 2011

"I think of Paul de Grauwe´s statements made in 1998 and wonder what he thinks of current situation of Spain. I guess he thinks that Europeans need to complete the Spanish dream, as it is not a dream we spaniards had alone.

We dreamt together, let´s work together for it to be completed:

This is a very telling paragraph of De Grauwe´s thinking, written, as you know, back in 1998, before everything started:

Suppose a country, which we arbitrarily call Spain, experiences a boom which is stronger than in the rest of the euro-area. As a result of the boom, output and prices grow faster in Spain than in the other euro-countries. This also leads to a real estate boom and a general asset inflation in Spain. Since the ECB looks at euro-wide data, it cannot do anything to restrain the booming conditions in Spain. In fact the existence of a monetary union is likely to intensify the asset inflation in Spain. Unhindered by exchange risk vast amounts of capital are attracted from the rest of the euro-area. Spanish banks that still dominate the Spanish markets, are pulled into the game and increase their lending. They are driven by the high rates of return produced by ever increasing Spanish asset prices, and by the fact that in a monetary union, they can borrow funds at the same interest rate as banks in Germany, France etc. After the boom comes the bust. Asset prices collapse, creating a crisis in the Spanish banking system.

http://www.eyeonspain.com/blogs/costaluz/5546/legal-tip-527-on-europe-banks-and-spain.as

This is why, we think that, after the effort made by the current governemnt for Banks to bring correction to the real estate market, you, Europeans, need to buy again in Spain.

I am asking this to you kindly and firmly: the product was made for you, inflated by lack of control, but once Banks are paying their sins and selling the products at real market´s prices. You need to buy again in Spain. :

Prices are fair and good enough now

Comments?

.jpg)

"2011 Matalascañas.El Tapón", Matalascañas, Huelva, Spain, by jose_gonzalvo, at flickr.com

0

Like

Published at 3:55 PM Comments (9)

0

Like

Published at 3:55 PM Comments (9)

Legal tip 753. Five Thanks to our clients

Thursday, May 3, 2012

Thanks to each of you trusting our services.

Thanks to all who have sent along the years wonderful words of kind appreciation

Thanks to those who wrote testimonials in regards to their experirence with CostaLuz

And thanks too to those who provided positive criticism, which spurrs us to grow in excellence even at this so difficult times in Spain.

Thanks mainly and always,

Maria

.jpg)

"2011 Matalascañas", Huelva, Spain, by jose_gonzalvo, at flickr.com

0

Like

Published at 2:20 PM Comments (0)

0

Like

Published at 2:20 PM Comments (0)

Spam post or Abuse? Please let us know

|

|