Legal tip 1338. Forget all worries when renting in Spain I

Thursday, October 29, 2015

Forget all worries when renting in Spain.

We are explaining applicable rules for the renting of urban properties intended for housing or uses other than housing as this is the criteria, ( an not number of months) which decide between different applicable law.

|

At the end of this serie, you will get all knowledge for the safest rental in Spain

|

What does housing rental means?

It means the rental of a habitable building which main purpose is to satisfy the permanent need of housing of the tenant

Does same law apply to storages or garages?

Yes, it does. Rules governing the renting of housing will be also applied to furniture, storage, garages and any other rooms, rented spaces or services rented as accessories of the property by the landlord.

What does Renting for use other than housing means?

It means that the destination of the rental is not the permanent need of housing of the tenant.

For instance: Seasonal contracts, or those held to carry out an industrial, commercial, craft, professional, recreational, assistance , cultural or teaching activity in the property whoever are the people carrying them out.

Is there an obligatory regime applicable when renting my house?

Renting of housing will be governed by the agreements, clauses and conditions decided by the will of the parties, under the provisions of Urban Rental Act and complementarily, by the provisions of the Civil Code.

Renting for use other than housing are governed by the will of the parties, failing that, by the provisions of the Rental Urban Act and, complementarily, by the provisions of the Civil Code.

This means that free will is restricted or limited in regards to housing rentals but not in regards to rentals for other than housing.

Parties can agree on exclusion of specific aspects of law, if possible, in an express way.

Can parties agree on submitting conflict to arbitration?

Parties will be able to agree the submission to mediation or arbitration of those disputes which because of their nature can be solved by these forms of conflicts solution, in accordance with the provisions of the legislation governing the mediation in civil and commercial matters and arbitration.

Is email communication possible when renting?

Parties will be allowed to indicate an email address for the purpose of making notifications under this law, as long as it is guaranteed the authenticity of the communication and its contents and it remains reliable evidence of the whole remittance and receipt and of the moment when they were done.

What types of rentals are not regulated by the Urban Rental Act?

- Housings that doormen, guards, salaried employees, employees and civil servants, are assigned on the basis of the position they hold or the service they provide.

- Military housings, regardless of their qualification and regime, which will be governed by the provisions of its specific legislation.

- Contracts in which, renting a property with house-room, it is the agricultural, livestock or forestry use of the land, the main purpose of the renting. These contracts will be governed by the provisions of the law applicable on rural renting.

- The use of university housings, when they have been expressly qualified as such by the University, owner or responsible of them, that are assigned to students enrolled in the University and to the teaching and administrative staff and services dependent of it, because of the link established between each of them and the respective University, to which will correspond in each case to establish the rules to which their use will be subject.

- The temporary transfer of use of the whole housing furnished and equipped for immediate use, marketed or promoted in touristic offer channels and carried out for profit, when it is subject to a specific regime, derived from its sectorial regulations.

|

Are you or any of your friends or relatives renting his house in Spain?

You can contact us for the integral renting service for Landlords we provide a Costaluz.

- Revision of rental contract

- Submission of rental contract to arbitration and hiring of an insurance for your protection

- Tax advise

- Registration of property for rental, if necessary

- 100% free initial claim if a rental problem happens.

|

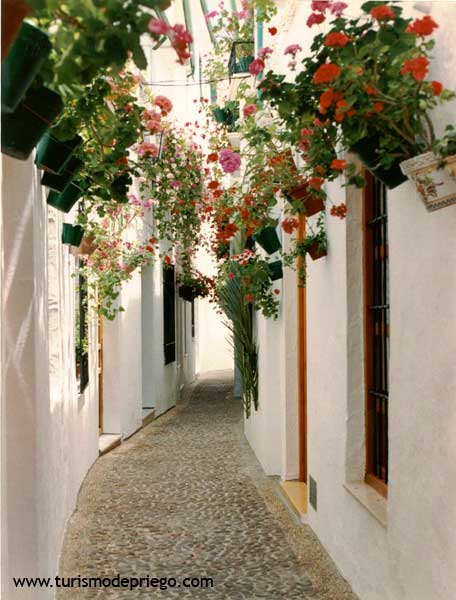

A street in Priego, Cuenca, Castilla-La Mancha, Spain

0

Like

Published at 4:48 PM Comments (0)

0

Like

Published at 4:48 PM Comments (0)

Legal tip 1337.NEW! Supreme Court protection when off-plan developer goes Bankrupt

Wednesday, October 28, 2015

NEW! Supreme Court protection when off-plan developer goes BANKRUPT.

You have been immersed in a developer´s Creditors meeting for years and still nothing to show?

These below are the words that will convince you!

Literal words from recent Supreme Court decision on off plan buyers and bankruptcy.

“In accordance with rules governing the assumption of the obligation to guarantee the repayment of amounts paid on account, under art. 1 of Law 57/1968, the adhesion/ agreement of buyers to the proposal of Bankruptcy administrators does not alter the right of these buyers to go against the insurer (…)”

So….no more time to be spent there….An strong case is waiting for you against the Bank.

|

If you or any of your friends is still trying to recover funds from Bankruptcy proceedings… it is now the time to start action against the Bank (either guarantor Bank or Bank which received amounts in account).

|

A landscape in Spain

1

Like

Published at 3:28 PM Comments (0)

1

Like

Published at 3:28 PM Comments (0)

Legal tip 1336. What is Padrón in Spain?

Monday, October 26, 2015

Padrón is a local record of residency in a certain municipality. Residency needs to be proved in order to get registered.

Info from the Statistics National Institute:

The Municipal Register is the administrative register of residents of the municipality. Its data constitutes proof of residence in the municipality and habitual residence in the same.

Everyone who lives in Spain is obliged to register in the Register of the municipality where he usually resides. Anyone living in several municipalities, must register only where he is living longer each year.

Registration in the Municipal Register requires only the following mandatory data for each neighbor:

a) Name

b) Sex

c) Regular Address

d) Nationality

e) Place and Date of Birth

f) Number of National Identity Card or, for foreigners, the document replacing it.

The formation, maintenance, and custody of the Municipal Register corresponds to the Council, in accordance with the rules adopted jointly by the Ministry of Finance and the Ministry of Public Administration at the proposal of the Registration Council, obtaining the Municipal Register Review reference to January 1 of each year.

Law 7/1985, of 2 April, Regulating the Bases of Local Government and Regulation of Population and Territorial Demarcation of local entities establishes that the municipalities must submit, by computer or electronic means, the monthly variations that will be producing data on their Municipal Registers to the the National Institute of Statistics so that it, in compliance with the obligations under Article 17.3 of that Basic Law, perform the appropriate checks to correct errors and duplications and so Official figures resulting from the annual revisions can be declared official.

0

Like

Published at 12:43 PM Comments (0)

0

Like

Published at 12:43 PM Comments (0)

Legal tip 1334. Recent Changes in NON RESIDENT taxes obligations in Spain

Tuesday, October 20, 2015

Main Changes in the Income Tax for Non-Residents (Chapter two Law 26/2014 and Royal Decree 9/2015 dated 10th of July)

1. - Reduction in tax rates for non-residents.

Tax rates for non-residents with no business in Spain:

|

|

2014

|

2015

|

From July 15 2015

|

2016

|

|

EU residents

|

24,75%

|

20%

|

19,5%

|

19%

|

|

NON EU residents

|

24,75%

|

24%

|

24%

|

24%

|

|

Capital Gains tax ( for all)

|

21%

|

20%

|

19,5%

|

19%

|

2. International property reinvestment Spain-EU country:

From 1.01.2015, if a Spanish resident sells his home, where he has lived for more than 3 years and move to another EU country and buys a home with funds obtained on the sale of the Spanish one, there will be no capital gains to pay, neither, despite the fact that he would be a non-resident for that year.

If the reinvestment is partial, the exemption will also be partial

Take into account that from 2015 on, residents in Spain are exempt of capital gains if- as always- they sell their first residency and reinvest in first residency within two years or:

You are over 65 years old and:

a) Sell your first residency even if you do not reinvest in first residency.

b) Sell any real estate asset and invest these funds in a life annuity as a complement of your pension, with a maximum limit of 240.000 Euros

3. – Choosing Spain for Income tax

Nonresidents of Spain, who live in the E.U., who have worked in Spain, will have the option to pay the Income Tax as residents in Spain.

4. - Tax rate for “Permanent Establishments” of non-residents

Is reduced from 30% in 2014 to the applicable rate of tax for Spanish Companies (which will be of a maximum of 28% in 2015 and 25% in 2014)

- - Updating coefficient

On the property price at the purchase disappears, which will increase the tax on the capital gains in many cases.

- - “Coeficiente de abatimiento”)

Which reduced income tax for properties bought before 1994, December 31st is now limited to a total and unique accumulated figure of 400.000 euros per tax payer

- - IRNR drafts from Tax Offices

Non-residents who do not have a tax representative in Spain and pay their own taxes will have the option to ask the Spanish Tax Office to send them a draft of their IRNR to be paid.

|

Any doubt with your NON RESIDENT Taxes….?

Tax Planning description and first year tax payments both for the price of one.

|

Frigiliana, Malaga, South eastern Spain

0

Like

Published at 12:23 PM Comments (0)

0

Like

Published at 12:23 PM Comments (0)

Legal tip 1333. New IHT benefits in Murcia Region

Monday, October 19, 2015

|

From August 8th 2015, there are new tax benefits for IHT in Murcia

|

In regards to real estate:

Inheritance

a) 99% reduction of taxable amount on the acquisition of property for the creation or expansion of individual enterprise, professional business or the acquisition of shares in companies. This reduction must meet the following requirements:

1. The acquisition will be formalized in Notary deeds and it will be expressly stated that the building will be allocated by acquirer to the creation or expansion of an individual enterprise, professional business or acquisition of shares in entities which meet the remaining requirements.

2. In the case of individuals, for the consideration of the economic activity, rules will be those provided in the regulations governing personal income tax.

3. The establishment or expansion of individual company or professional business, or the acquisition of holdings, will have to occur within a maximum period of 6 months from the date of acquisition of the property.

4. The created, extended or investee entity, whether or not a corporate entity, should not be primarily involved in the management of real estate or furniture

5. The property should be earmarked for that activity for the next five years from the date of acquisition, unless the buyer dies within that period.

6. The legal address of the company, business or investee must be located in the territory of the Autonomous Community of Murcia and maintained for the next five years from the date of the deed of acquisition.

7. In the case of acquisition of shares of an entity, except for investments in social economy enterprises, worker cooperatives or labor companies, must be fulfilled, in turn, the following requirements:

- The acquired shares must represent at least 50% of the share capital of the entity

- The acquirer has to effectively exercise management functions of the entity.

8. In the event that the same property is acquired by several taxpayers, this reduction shall be applied on the acquired portion, to those which individually meet the conditions specified in the preceding paragraphs.

b) A deduction of 50% in the tax fee is reinstated for acquisitions by inheritance of any type of property in favor of the descendants or adopted of 21 years/old or older, spouses and parents or adoptive parents.

Donations

Reductions when an estate is donated for the development of entrepreneurship:

a) It is expressly included, expansion of individual company or business and professional course for the implementation of the reduction.

b) Reduction is applicable to investment in any company, business or entity without having to be the first investment of the taxpayer.

c) Maximum limit of the reduction base is suppressed.

d) Circumstances in which the requirements of the public document formalizing the operation are fulfilled are specifically defined.

|

Willing to have an International Tax plan for your specific needs? Costaluz can help.

Tax Planning description and first year tax payments both for the price of one.

|

Murcia, East of Spain

0

Like

Published at 3:41 PM Comments (2)

0

Like

Published at 3:41 PM Comments (2)

Legal tip 1332. NEW! WON CASE in PROVINCIAL APPEAL COURT AGAINST CAIXABANK FOR PROMOCIONES EUROHOUSE 2010 S.L. BUYERS AT ‘RESIDENCIAL FORTUNA GOLF RESORT’

Thursday, October 8, 2015

WON CASE in PROVINCIAL APPEAL COURT AGAINST CAIXABANK FOR PROMOCIONES EUROHOUSE 2010 S.L. BUYERS AT ‘RESIDENCIAL FORTUNA GOLF RESORT’

We were pleased to our clients today that we had won their case against Caixabank in the Provincial Appeal Court. The clients did not receive an individual Guarantee from the developer, Promociones Eurohouse 2010 S.L. or from the Bank to which their off-plan deposit was paid, CAIXABANK (formerly LA CAIXA).

Re: YOUR CASE AGAINST CAIXABANK S.A.

Please find attached Sentence number XXX/15 from the Provincial Appeal Court of Alicante Section 9 in Elche.

I am very pleased to advise you that the Appeal filed by CAIXABANK has been dismissed and the Sentence issued by the First Instance Court No.4 in Orihuela has been confirmed in full.

The final paragraph of the First Instance Sentence delivered on 17 December 2014 and notified on 23 December 2014 stated:

“Partially estimating the Lawsuit filed on behalf of XXXXXX XXXXXXX and XXXXXXX XXXXXX & XXXXXXX XXXXXX against CAIXABANK S.A., and must condemn the defendant to the repayment of the amount of XX,XXX Euros, this amount to be paid to the claimants according to the second claim of the Lawsuit, plus legal interest from the date of payment to the developer until full payment. No imposition of costs is made”

The final paragraph of the Provincial Appeal Court Sentence delivered on 18 September 2015 states:

“That dismissing the Appeal filed on behalf of CAIXABANK S.A. against the Sentence dated 17 December 2014 from the First Instance Court No. 4 of Orihuela in Ordinary Trial number XXXX/2012, we confirm that sentence in its entirety. The costs of this appeal are imposed on the appellant”

So the Appeal filed by CAIXABANK has been dismissed and the First Instance Sentence has been upheld in full.

The Provincial Appeal Court Sentence quotes extensively from other recent Sentences issued by the Alicante Provincial Appeal Court in relation to the interpretation and application of LEY 57/1968 which it considers are entirely applicable to this case.

In conclusion the Provincial Appeal Court states:

“The doctrine expounded is applicable to the case discussed, as confirmed by the First Instance Court and accepted in this appeal, that regarding the type of income to the developer’s bank account the Director of the Office 4271 of Orihuela when speaking as a witness said that he did not know the amounts accepted into the developer’s account were for payments on account of the price of off-plan housing promoted by his client, as it was a normal current account and not a special account.

However, the fact remains that he knew perfectly well in which type of business his commercial client was engaged (he said that they were selling 2000 homes a year, although he did not have a record of all the promotions) but did not give a satisfactory reason why large quantities paid for homes were held in the current account, but coming to recognize that in the end, it is normal that his client paid into the account the proceeds of their sales, although in his bank they have never opened special accounts in 16 years, because developers do not ask for such accounts.

It is evident that we have a special account, though not from the official title of such account, but from the origin and destination of the funds paid to that account. The fact that neither the developer nor the bank was concerned about the legal obligation to issue individual guarantees, in no way can harm the consumer.

In short, the bank should not allow the opening of special accounts and making deposits in it without first making sure that the promoter has assumed a legal obligation to ensure the return of the amounts paid in advance, and if the Bank fails in this legal duty, it is liable for the losses caused to the buyers”

Orihuela, province of Alicante, Comunity of Valencia, East of Spain

1

Like

Published at 3:38 PM Comments (6)

1

Like

Published at 3:38 PM Comments (6)

Legal tip 1331. NEW! WON CASE in PROVINCIAL APPEAL COURT AGAINST SGR & BBVA FOR HERRADA DEL TOLLO S.L. BUYER AT ‘RESIDENCIAL SANTA ANA DEL MONTE’

Thursday, October 8, 2015

WON CASE in PROVINCIAL APPEAL COURT AGAINST SGR & BBVA FOR HERRADA DEL TOLLO S.L. BUYER AT ‘RESIDENCIAL SANTA ANA DEL MONTE’

We were pleased to our client today that we had won their case against SGR & BBVA in the Provincial Appeal Court. The client did not receive an individual Guarantee from the developer, Herrada del Tollo S.L. or from the Bank to which their off-plan deposit was paid, BBVA or from the General Guarantor of the development, SGR.

Re: YOUR CASE AGAINST SGR & BBVA

Please find attached Sentence number xxx/15 from the Provincial Appeal Court of Alicante Section 9 in Elche.

I am very pleased to advise you that the Appeals filed by SGR & BBVA have been dismissed and the Sentence issued by the First Instance Court No.1 in Orihuela has been confirmed in full.

The final paragraph of the First Instance Sentence delivered on 27 June 2014 and notified on 2 July 2014 stated:

“Estimating the Lawsuit filed on behalf of XXXXXXX XXXXXXX & XXXXXXX XXXXXXX against SOCIEDAD DE GARANTÍA RECÍPROCA DE LA COMUNIDAD VALENCIANA & BANCO BILBAO VIZCAYA ARGENTARIA S.A. I condemn in solidarity the defendants to pay to the plaintiffs the amount of XX,XXX Euro plus legal interest from the date of payment of the amounts in the accounts of BBVA S.A. until full payment. No pronouncement on the imposition of costs”

The final paragraph of the Provincial Appeal Court Sentence delivered on 21 September 2015 states:

“That dismissing the Appeals filed on behalf of SGR & BBVA against the Sentence dated 27 June 2014 from the First Instance Court No. 1 of Orihuela in Ordinary Trial number XXXX/2012, we fully confirm that sentence, without making any express imposition of costs of this Appeal”

So the Appeals filed by SGR & BBVA have been dismissed and the First Instance Sentence has been upheld in full.

There was no pronouncement regarding the imposition of costs relating to the Provincial Court Appeal or for the First Instance Procedure, therefore each party will pay its own costs for both the First Instance & Appeal.

The First Instance Sentence, now confirmed in full by the Provincial Appeal Court, explained in great detail the liability of BBVA & SGR according to their obligations under LEY 57/1968. Importantly the Sentence stated that even if a buyer signed the agreement to accept partial future payments from the bankrupt developer, the inalienable rights granted to the buyer by LEY 57/1968 are not affected.

Particular points of interest stated by the Judge in the First Instance Sentence were:

“When interpreting and applying the Law 57/1968 of 27 July 1968 relating to amounts paid in advance for the construction of housing, we should not forget the aim of this Law which is to protect consumers from real estate fraud. Specifically the preamble of this Law from 1968 explains about the justified public alarm to repeated real estate abuses that in part constitute severe impairment of social interaction and other obvious crimes, besides causing irreparable damage to confidence and good faith.

The correct interpretation of the Law 57/1968 is not restricted by formalistic interpretations. The terms of the guarantee will always have to provide full and complete protection for the buyer.

Therefore, we should not forget that although insurance companies and financial institutions are not party to the contract of sale between the Promotor and Purchaser, they are not unconnected to its content or the performance of obligations arising thereof and they must ensure that these are met with the guarantees established by Law 57/1968.

Precisely because of this, the Ministerial Order of 29 November 1968 was established to implement the Law 57/1968. The controllability of Contracts of Sale of the Promotion by the guarantor reveals its obligation to monitor compliance with the obligations of LEY 57/1968.

The bank should not allow the opening of Special Accounts or accepting the deposits without first ensuring that the developer has assumed a legal obligation to ensure repayment of the amounts paid in advance by buyers. It the Bank fails in its legal duty then it is liable for the damages that failure causes to the buyers who may otherwise not be able to obtain repayment of the amounts advanced.

The agreement by the buyer to any repayment proposals offered by a bankrupt developer does not extinguish the Guarantee and the obligations therein.

In response to the arguments put forward we fully estimate this Lawsuit, ordering the defendants to refund the amount delivered to the account for the purchase of housing amounting to xx,xxx Euro. The conviction of the two entities is joint and several.

In this case, the construction of the housing has not been completed or even started, so the frustration of the purpose of the Purchase Contract is clear”

Elche, province of Alicante, Valencia, East of Spain

1

Like

Published at 3:21 PM Comments (0)

1

Like

Published at 3:21 PM Comments (0)

Legal tip 1330. NEW! LEY 57/1968 WON CASE in FIRST INSTANCE COURT AGAINST SGR & BBVA FOR HERRADA DEL TOLLO S.L. BUYER AT ‘RESIDENCIAL SANTA ANA DEL MONTE’

Thursday, October 8, 2015

LEY 57/1968 WON CASE in FIRST INSTANCE COURT AGAINST SGR & BBVA FOR HERRADA DEL TOLLO S.L. BUYER AT ‘RESIDENCIAL SANTA ANA DEL MONTE’

We were pleased to our client today that we had won their case against SGR & BBVA in the First Instance Court. The client did not receive an individual Guarantee from the developer, Herrada del Tollo S.L. or from the Bank, BBVA or from the General Guarantor of the development, SGR.

Re: YOUR CASE AGAINST SOCIEDAD DE GARANTÍA RECÍPROCA DE LA COMUNIDAD VALENCIANA (SGR) & BANCO BILBAO VIZCAYA ARGENTARIA S.A. (BBVA)

Please find attached Sentence number xxx/2015 from the First Instance Court No.6 in Orihuela.

Your case against SOCIEDAD DE GARANTÍA RECÍPROCA DE LA COMUNIDAD VALENCIANA & BANCO BILBAO VIZCAYA ARGENTARIA S.A. has been won.

The final paragraph of the First Instance Sentence delivered on 23 September 2015 and notified on 2 October 2015 states:

“Estimating the Lawsuit filed on behalf of XXXXXXX against SOCIEDAD DE GARANTÍA RECÍPROCA DE LA COMUNIDAD VALENCIANA & BANCO BILBAO VIZCAYA ARGENTARIA S.A. I condemn the defendants jointly & severally to pay to XXXXXXX the amount of XX,XXX Euro plus legal interest on X,XXX€ from 28 April 2006 & on XX,XXX€ from 16 August 2006 until the full repayment and impose the costs on the defendant”

So SOCIEDAD DE GARANTÍA RECÍPROCA DE LA COMUNIDAD VALENCIANA & BANCO BILBAO VIZCAYA ARGENTARIA S.A. are jointly & severally liable to refund the total amount of XX,XXX€ plus legal interest from the date each amount was paid to the developer’s bank account.

Particular points of interest stated by the Judge in the Sentence are:

“In the present case, although the plaintiffs do not have an individual guarantee for the amounts paid on account for the purchase of off-plan housing, this fact does not preclude them from being under the protection of the General Guarantee.

Regarding the exhaustion of the maximum risk amount of the General Guarantee, the Supreme Court Sentence of 19 July 2004 said that if the aim of the guarantor (if it was an insurer) was to impose on the buyers the consequences of disharmony or imbalance with LEY 57/1968 then this was inadmissible.

Applying the doctrine set forth above, the alleged exhaustion of the guarantee line cannot affect the consumer”

Valencia, East of Spain

1

Like

Published at 3:14 PM Comments (0)

1

Like

Published at 3:14 PM Comments (0)

Legal tip 1329. FINAL DEADLINE FOR IHT CLAIMS: 10th November.

Tuesday, October 6, 2015

The judgment of the European Court of Justice (ECJ) on September 3, 2014, determined the breach by the Kingdom of Spain of European Union law, because the state regulations governing the inheritance and gift tax, provided a clear discrimination against non-residents. Such discrimination entailed a restriction on the free movement of capital, prohibited by Articles 63 TFEU and 40 EEA (EU countries and Norway, Iceland and Liechtenstein).

There are two ways to request to claim a refund of IHT paid in excess according to the EU Court Decission:

1) Request the return of sums paid, provided that the period of limitation, that is, four years has not elapsed since your payment.

2) State liability claim for excessive demand of taxes according to rules of of the EU. In the event that four years has elapsed.

This last action has an expiry date on 10Th November 2015 ( one year after puiblication of the Judgment in the Official Journal of the European Union (OJEU)

NO MUCH TIME LEFT FOR THIS!

As an EOS member, we can help you with this: contact us for a FREE initial appraisal

Reservoir of the Count of Guadalhorce, Ardales, Málaga, South eastern Spain, at facebook.com

0

Like

Published at 12:45 PM Comments (0)

0

Like

Published at 12:45 PM Comments (0)

Legal tip 1327. NEW! Supreme Court further protection of off plan buyers with no Bank guarantees

Thursday, October 1, 2015

Translation into English of main parts of recent, most relevant Supreme Court decision on Law 57/68 and lack of individual guarantee

Law 57/1968 General Guarantee to ensure the repayment of amounts paid on account. Failure to issue individual certificates.

According to (1) the protective spirit of the Law, recently highlighted by the Chamber, which requires assurance or guarantee of the amounts paid in advance, and

(2) the fact that a collective guarantee has been agreed to cover any repayment obligations of the developer in regards to the advanced amounts perceived from buyers, a copy of which has been delivered along with contracts of sale,

it is clear that the risk is directly covered, without the need of issuance of an individual guarantee in respect of which the buyer has no responsibility. -

Cassation Appeal BBVA and SGRCV

8. Paragraph Five: It is jurisprudence of this Court that article. 1 of Law 57/1968 allows the buyer to act jointly and severally against the developer and its insurer or guarantor to demand repayment of the advanced, when "construction does not timely start or does not reach good end" . [Judgments 476/2013, of July 3; 218/2014 of 7 May and 218/2015, of April 22]. This same law also allows the buyer to claim just against the guarantor or insurer without having to sue the developer for breach of contract.

This Court has also stated that the guarantee covers all amounts paid on account of the price, even if the insurance policy sets a lower maximum amount because otherwise art. 2 of Law 57/1968 and Art. 68 of the Insurance Act would be violated [Sentences 476/2013 of 3 July and 779/2014 of 13 January 2015].

11. Paragraphs Third, Fourth and Fifth: Provisions 1, 2 and 3 of Law 57/6 can be violated under the guise of the existence of a general guarantee as the buyer does not have to know that he should still receive an individualized endorsement. In that scenario, the buyer is at the mercy of the degree of diligence of the developer, depending on if he requests the certificate of guarantee or not.

According to (1) the protective spirit of the Law, recently highlighted by the Chamber, which requires assurance or guarantee of the amounts paid in advance, and

(2) the fact that a collective guarantee has been agreed to cover any repayment obligations of the developer in regards to the advanced amounts perceived from buyers, a copy of which has been delivered along with contracts of sale,

it is clear that the risk is directly covered, without the need of issuance of an individual guarantee in respect of which the buyer has no responsibility. -

The buyer who has paid advanced amounts should not weigh on the gross negligence or willful misconduct of the developer who fails to require certificates or individual guarantees.

In conclusion:

i) Guarantor, once General Guarantee is signed and premiums are perceived, needs to cover the guaranteed event, which is to refund the amounts received, together with interest as provided in the legal standard, in regards to the development the guarantee is linked to.

ii) the issuance of the certificates or individual guarantees, by the insurer or guarantor, for each of the buyers, legitimizes these to enforce them, according to art. 3 Law 57/1968; AND

iii) the absence of the corresponding individual guarantees does not preclude the obligation to repay the advanced amounts, with interest, is covered for buyers who have entered into a purchase agreement and delivered these advance payments, under the existence of the General Guarantee.

2

Like

Published at 1:12 PM Comments (7)

2

Like

Published at 1:12 PM Comments (7)

Spam post or Abuse? Please let us know

|

|