Legal tip 937. UK Government congratulations on Finca Parcs case

Friday, April 26, 2013

Foreign & Commonwealth Office

Overseas Residents Service Unit

Consular Assistance Group

Room WHMZ 4.2

King Charles Street

London

SW1A 2AH

25 April 2013

Our Reference: MIN/*****/2013

Dear Keith,

Thank you for your letter of 04 April to the Prime Minister about his recent visit to Spain. Downing Street have passed the letter to me and asked me to reply.

Firstly, I want to extend my congratulations to you and all those involved over the recent Albacete Appeal Court decision dismissing the Banco CAM appeal and ordering them to pay the costs of the appeal. You must be really pleased with this decision. Myself and colleagues at the British Embassy in Madrid – including the British Ambassador, Giles Paxman - have been monitoring the case and were thrilled to hear of your success. Your success is a valuable case study for us to reference in discussions on property matters with Spanish authorities - particularly when talking about bank guarantees.

In your letter to Prime Minister you ask that he raise bank guarantees with Mariano Rajoy. I can confirm that the Prime Minister discussed a range of issues during his visit, including reform of the EU and prosperity priorities. Unfortunately, property issues were not covered. I can confirm, however, that bank guarantees in Spain remains a subject that UK Ministers are aware of and raise where they have the opportunity. Mr Paxman and officials at the British Embassy do likewise during their meetings with Spanish officials. This is an issue that we know continues to affect British Nationals and we will continue to urge the Spanish authorities to address it appropriately.

Yours sincerely,

Stelios Kyriakides

.jpg)

"Sierra Nevada", Granada, South-east of Spain, by Phranet, at flickr.com

0

Like

Published at 4:27 PM Comments (0)

0

Like

Published at 4:27 PM Comments (0)

Legal tip 936. The Keith Rule Action

Friday, April 26, 2013

Read the article from bottom to top. It pictures how the action against developers of early times, was there converted to an action against Banks ( thanks to Keith Rule´s vision and passion and CostaLuz/De Castro will to assist him and many other ones involved in same fiasco)

The 2013 edition of this post, this of today´s, would be composed by the long list of Courts on all over the spanish territory which are now following the KEITH RULE action, as it is called when the Restore Action was turned against Banks!

Such a great story!

Legal tip 817. The restore action. A revision

23 August 2012 @ 15:04

The restore action post was written in 2009. Some amendments made by September 2010 (italic)

At present many of those claims need to be reconducted against related Banks or Insurance Companies and the deals to be made with them.

It is so good that money was not lost along the way and clients can still give value to their deposits due to the existence of Law 57/68 and developing related Case Law.

There are also cases where developers are offering same properties to same clients even applying a reduction on the outstanding mortgage.

They desperately need buyers. We, as spaniards, need you too. Come!

Legal tip 138. The restore action

11 September 2009 @ 10:24

If you are in the middle of an off-plan contract cancellation action or are thinking of claiming.

There are many things to be done depending on how the finantial/economic situation will develope in the coming months. ( + possibilities of your action against the financial institution you paid your deposit into, for more info on this, please click on here)

First thing to bear in mind is that this is going to be a buyer´s market for many years to come, and with that no-pressure by sellers and buyers running the show....

-You can buy at a good price and better interest rates

-You can rent with an option to purchase, fixing the price in advance.

-If you are pursuing cancellation (action that can also be called: "restore action": it puts balance in the contract after an abusive old agreement ), you have got several finantial assets:

-A potential credit against a developer for the refund of x plus legal interests.

- Buying rights on the property in between (the developer cannot sell to anyone else till the contract is effectively cancelled and your money refunded).

- A better position within the creditor´s meeting (if that ever happened)

So... it is not just a matter of contract cancellation at whatever cost, it is a matter of re-establishment of balance. Many of the clauses of many of the contracts I have seen during the last 4 years and a half, which were drafted during the period 2003-2009 are are corrosively abusive. Repugnant.

They were drafted with no respect at all towards the agreed terms od developers, Ministries, consumers… under the National Institute for Consumers in 2001.

I am enlisting some of the games you can play with the above mentioned assets at hand ( but I am not a finances expert.... so please, make your contributions! ):

- You can negotiate a great price reduction with the developer along the judicial proceeding and complete on the property at a much reduced price and with much reduced interest rates

(some clients of us are using this formula now)

- You can sell your buying rights to someone else and withdraw the claim, negotiate with both developer and new buyer on a reduced price and the payment of the judicial costs ( it seems German and Norwegian have already some money to look for some sun).( Almost all developers are now ready for settlements of this nature)

It is all a matter of some fluctuants, not rigid factors such as:

- Evolution of the market

- Flexibility of developer

This factor seems to be clearly determined by the decisions of the finantial institutions regarding their own property stock.

but the possibilities are there ( together with many other ones, I am sure)

that.... together with the awesome sensation of being back in control of the situation ( a new contract agreement) or at least of a great deal of it.

What do you think?

Could we all together transform the current situation in a win-win scheme? Please send your ideas.

Maria L. Castro

.JPG)

Beach "Fuente del Gallo" (Conil de la Frontera, Cádiz), by Luis López-Cortijo

.jpg)

0

Like

Published at 1:45 PM Comments (2)

0

Like

Published at 1:45 PM Comments (2)

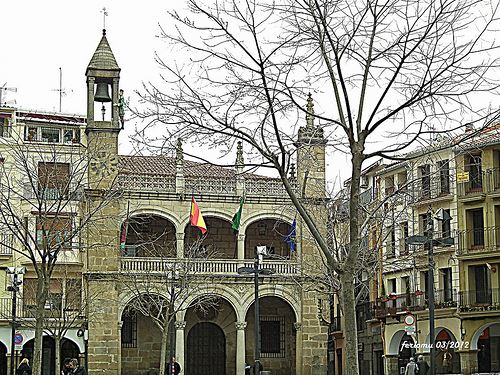

Legal tip 935. NEW! Case won against Bank in Granada

Wednesday, April 24, 2013

A new Court Decission, from a new province: Granada this time. Developer: Leonardo da Vinci- Bank: BBVA

Condemn the Bank to refund buyers due to lack of request by this financial institution of the legally required Guarantees or Insurance Policies according to Law 57/68.

Judges are ruling!

Maria

.jpg)

"Vista Parcial de Granada", South-east of Spain, by Phranet, at flickr.com

0

Like

Published at 4:37 PM Comments (24)

0

Like

Published at 4:37 PM Comments (24)

Legal tip 934. Spanish treasury plans selective fiscal discounts for medium and small businesses

Tuesday, April 23, 2013

Treasury and Public Administrations Ministry is working in order to approve next 26 April selective fiscal discounts to taxes for pymes to promote the economic growth. According to the information given by Treasury, these discounts will be included in the national plan of reforms that the Government wants to send to Brussels just before finishing April together with the program of budgetary stability for the next three years.

In the same way, he advanced a special regime in the VAT for the next fiscal year which will avoid the tax must be deposited when the corresponding invoice hadn´t been paid. That regime, which will entry into force in January 2014, will be applied to autonomous workers and small and medium-sized businesses with a volume of business lower than 2 millions of Euros per year.

.jpg)

"Merida i Extremadura", under the middle and west of Spain, by Spanianytt, at flickr.com

0

Like

Published at 12:28 PM Comments (0)

0

Like

Published at 12:28 PM Comments (0)

Legal tip 933. Gibraltar under siege

Monday, April 22, 2013

Translated by CostaLuz Lawyers from El País, 22-04-2013)

Lisbeth Salander, the iconoclast leading role of the popular saga Millenium written by Stieg Larsson, travels to Gibraltar in the last book from the trilogy in order to open a secret bank account in which to hide 2.400.000.000€ which he had theft from a corrupt organization. Until a short time ago, Gibraltar was considered one of the tax havens for the main international institutions. In the last years the authorities in the Rock have signed agreements to exchange information with almost twenty countries and have introduced changes in its fiscal system in order to go out from this blacklist. But Spain still considers it a tax haven through which every year hundreds of millions of euros escape to the fiscal control and are evaded.

Gibraltar works, in fact, as one of the territories named off-shore (word used in the financial argot for the fiscal limbos) where important businessmen from Costa del Sol send their businesses and part of their patrimony in order to escape from the Treasury. So, Treasury is making narrower the siege to this territory. It has created a working group with the delegations of Andalusia, Ceuta and Melilla in order to analyze the taxation of the transactions done in the Rock, the formation of the legal entities and the financial movement linked to these transactions. The Inland Revenue estimates that hundreds of millions are evaded every year by transactions connected with the Rock. We have no official figures, but in Gibraltar we may find almost as many companies as population.

The working group created by the Treasury tries to clear up the way of creation of the societies established in Gibraltar, the movement of capitals from Spain to the Rock, the participation of offices and entities in both sides of the Fence or the proceeding of the formation of societies in Spain participated by businessmen with fictitious residence in Gibraltar. The Treasury has detected that these entities are created mainly in order to maintain the opacity of the holders of properties and real estates in Spain, and to facilitate their transfer without declaring them to the Inland Revenue.

“Gibraltar was a place that was curiously isolated from the rest of the world, a city composed of a rock, a little more than two squared kilometers of urban area and an airport that began and finished at the sea”. Larsson described the Rock this way. This small territory in which Spain has some aspirations doesn´t go too badly. It has a gross domestic product of 1.050.000.000 pounds (1.230.000.000€) and an annual sustained growth between 5% and 10% of GDP.

Both the gibraltarian taxation system and the facility for opening businesses and escape from the Treasury are uncomfortable for the spanish authorities. Last year they denounced it in the European Comission: they complained because of the fiscal regime because they consider it is incompatible with the European taxation system. This system, named Income Gibraltar Act 2010, reduced the Societies Tax from 22% to 10%. Also, in Gibraltar you only pay for the benefits got in the Rock, those ones got outside are exempt. This fiscal regime converted the Rock in a pole of attraction for the businesses in the area that escape from Spain with a tax rate of 30%. So the number of businesses that carry out their activities in Spain but pay in the colony increases.

In Gibraltar there are almost as many citizens as societies, 30.000. The group created by the Treasury tries to reveal the fiduciary structures which assets are formed by real estates situated in Spain. These frameworks are constituted by “limited” societies addressed in Gibraltar but holders of real estates and patrimony in Spain. There are 1.100 houses in this situation in the Costa del Sol area, according to official data. Another kind of structure is formed by Spanish societies but whose shareholders and administrators are situated in Gibraltar. In this situation there are 370 businesses. In both cases these structures escape from paying the tax transaction owing to the opacity of these frameworks

Fabian Picardo, main minister in the Rock, pointed out to this newspaper some weeks ago: “To be a tax haven has finished. It´s an old pattern which has no place in the modern Europe, even in the modern world. But we have to pay attention to what it is happening in some places which are not tax havens, like societies for nonresidents in the UK or Sicav in Spain”.

Another concern for the Spanish authorities is about the cash movements through the Fence of Gibraltar. There are few declarations about cash flows; however the Treasury knows that there are millionaire transactions. From the 2.788 transactions of traffic of foreign currencies with Gibraltar between 2007 and 2011 only eight are registered in the Rock. In total, transactions of 1.571 millions have been done, and from those ones only 872.000€ are ordered from Gibraltar. This reveals that the flow goes from Spain to Gibraltar but not the other way round.

--

.jpg)

"Gibraltar", by Spanianytt, at flickr.com

0

Like

Published at 4:36 PM Comments (0)

0

Like

Published at 4:36 PM Comments (0)

Legal tip 932. PRESS release Finca Parcs

Wednesday, April 17, 2013

PRESS / MEDIA RELEASE - FOR IMMEDIATE RELEASE – 16 APRIL 2013

FINCA PARCS ACTION GROUP vs CAJA DE AHORROS DEL MEDITERRÁNEO (CAM BANK) & SPANISH PROPERTY DEVELOPER, CLEYTON GES SL

ALBACETE APPEAL COURT DISMISSES CAM BANK APPEAL AND CONFIRMS FIRST INSTANCE SENTENCE

FINCA PARCS ACTION GROUP – TIMELINE OF THE LEGAL ACTION – LAWSUIT 1

● 2006 - No legally required Bank Guarantees for Off-Plan deposits totalling 1.5 million

Euros

● February 2011 – Lawsuit 1 against CAM Bank & developer Cleyton GES SL filed to Court

● 12 January 2012 - First Instance Court Preliminary Hearing

● 21 & 22 May 2012 - Trial held in First Instance Court - Hellín

● 8 June 2012 - Judgment released in favour of Finca Parcs Action Group

● CAM Bank and Cleyton GES SL sentenced to return deposits amounting to almost 1.5

million Euros to the buyers with the addition of legal interest and costs

● July 2012 - CAM Bank appeals the First Instance Court Judgment

● July 2012 - Finca Parcs Action Group submits Opposition to the CAM Appeal

● July 2012 - Finca Parcs Action Group file Provisional Enforcement Order to the Court

● August 2012 – CAM Bank pays full amount of deposits plus legal interest and costs

to the Court

● Appeal to be heard by the Albacete Appeal Court

● 4 March 2013 - Appeal Magistrates to meet for deliberation & voting on the CAM Bank Appeal

● 11 April 2013 – Appeal court dismisses the CAM Bank Appeal and confirms First Instance

Sentence in full and imposes costs of Appeal on CAM Bank

CAM BANK APPEAL DISMISSED

Section 1 of the Albacete Provincial Appeal Court has confirmed the Sentence issued by the First Instance Court No. 2 of Hellín, which sentenced the developer Cleyton GES SL and CAM Bank (now SabadellCAM) to repay almost 1.5 million Euros to 47 buyers at the Las Higuericas Finca Parcs development near Murcia, Spain.

Following the Trial in May 2012, Spanish property developer Cleyton GES SL and financing bank BANCO CAM SLU were sentenced to repay in full the off-plan deposits paid by members of the Finca Parcs Action Group plus interest and costs. Cleyton GES SL did not appeal the First Instance Court Sentence which as a consequence is now ‘firm’ against them; however CAM Bank did Appeal.

The Albacete Appeal Court Magistrates met for deliberation and voting on 4 March 2013 and they have just announced their decision.

The CAM Bank appeal has been dismissed and the First Instance Sentence issued by the First Instance Court in Hellín on 8 June 2012 has been confirmed in full with all costs of the Appeal imposed on CAM Bank.

FIRST INSTANCE SENTENCE CONFIRMED

The First Instance Sentence that has now been ratified concluded that both the developer and Bank failed to fulfil their legal obligations.

The court convicted jointly and severally both defendants, the developer Cleyton GES SL and the sole financial entity of the project, Caja de Ahorros del Mediterráneo (CAM), to return the off-plan deposits paid by group members totalling almost 1.5 million Euros for houses that were never built at the abandoned Las Higuericas, Finca Parcs development close to Agramón, Albacete.

The First Instance Judge declared the 55 sales contracts terminated due to “serious breaches” by the developer and stated that CAM Bank “failed in its legal obligations to control the use of off-plan deposits paid in advance for this development”.

Regarding the involvement of CAM Bank, which claimed it has no relationship with the buyers and that it was ‘oblivious’ to the off-plan deposits paid to accounts at its branches, the First Instance Sentence stated that, “The fact is that CAM knew that the payments into Cleyton GES accounts opened at its branches were payments by buyers on account of off-plan real estate purchases and CAM showed an absolute disregard to the obligations imposed on financial institutions by LEY 57/1968 and this behaviour can only be described as malpractice”. The Judge noted that “it is clear the off-plan deposits were used in a manner contrary to the requirements of Spanish Law, LEY 57/1968”.

The First Instance Sentence concluded:

We must not forget that the obligation to deposit the amounts advanced to an account opened specifically for that purpose is that of the financial institution as not only does it receive the premium of the guarantees but also benefits by way of profit from the project. In fact, CAM was the only financial entity involved in the project as it demanded exclusivity.

Keith Rule, the claimant questioned at the trial, clearly demonstrated that the buyers contacted both the developer and Bank through multiple means urging them to grant the Bank Guarantees for the deposits paid”.

CAM BANK APPEAL & OPPOSITION TO THE APPEAL

In its appeal CAM Bank again argued that it was oblivious to the payments made by the claimants and that clauses in the ‘Contract of Guarantee Operations’ signed between itself and Cleyton GES SL protected it from having to automatically issue the individual Bank Guarantees to buyers.

In its opposition to the Appeal, Finca Parcs Action Group Lawyer, Jaime de Castro argued that the reliance by CAM of the need for the buyers to pay their deposits to the ‘one’ Special Account was baseless. This argument was supported by evidence to show that over a 19 month period prior to June 2007 CAM had already issued well in excess of 100 Bank Guarantees with a value of 4.1 million Euros to other Finca Parcs buyers, not subject to this action, before a single entry was made in the Special Account that was opened in November 2005.

Finca Parcs Action Group Co-ordinator, Keith Rule says:

“As a result of opening the Special Account CAM must remain vigilant and ensure that all funds paid by buyers is entered into that account without deviation. CAM also has an obligation according to Spanish Law LEY 57/1968 to ensure that those funds are only used for the construction of the housing.

Furthermore CAM included clauses in its own ‘Contract of Guarantee Operations’ that are in direct contravention to the obligations imposed on financial institutions by LEY 57/1968. With regards to the operating of the ‘Special Account’ it is clear that there was absolutely no reliance by CAM on this account and that it performed a flagrant breach of its own contract. To compound its negligence CAM attempted to shift all responsibility exclusively onto the developer”.

APPEAL COURT SENTENCE

The Sentence issued on 11 April 2013 by the Albacete Appeal Court completely ratifies the First Instance Sentence and states:

“One need not look at the description of the fundamentals of the First Instance Sentence against the developer, Cleyton GES SL, since it has not been appealed by them”

The Appeal Sentence transcribes very broadly the following points from the First Instance Sentence:

“CAM argued that it was not bound by any legal relationship with the plaintiffs and that it did not provide Guarantees for the payments made by the plaintiffs in this action because the payments were made to ordinary current accounts. However the relationship here was not regulated only by Article 1822 of the Civil Code but a guarantee of special nature governed by LEY 57/1968 aimed especially to ensure the inalienable rights of buyers of off-plan properties”

“Although it was agreed between CAM & Cleyton GES that the buyers payments should be entered in the special account and that the payments by the plaintiffs were not deposited mainly in that account, but in two ordinary accounts, the truth is that CAM issued guarantees to other buyers for funds paid to and held in the same ordinary accounts and described those accounts as ‘special’ on those corresponding guarantees”

“CAM knew perfectly well that the payments by the plaintiffs into the ordinary current accounts were payments by buyers in an off-plan property development in which it had assumed the role of guarantor under the law, LEY 57/1968”

The Appeal Court Sentence continues:

“The appellant, Banco CAM, was not happy with the reasoning of the First Instance Sentence.

All of the appellants argument revolves around the clauses contained in the ‘Contract of Guarantee Operations’ concluded between Itself and Cleyton GES SL whereby its obligation to guarantee the repayment of the amounts paid on account by the buyers of homes promoted by the co-defendant was not ‘automatic’, but that it depended on the timely request from Cleyton GES to formulate each of the individual guarantees together with a copy of each purchase contract and ensuring the funds were paid to the Special Account.

The appellants ‘Contract of Guarantee Operations’ does not comply with the provisions of LEY 57/1968 and introduces a number of conditions that could result in the amounts paid by buyers not being guaranteed. These conditions included the notification of the Purchase Contract by Cleyton GES, the entry to the Special Account of the buyers deposit payments and also most importantly the ‘the positive rating’ by the Bank.

Put another way, the appellant Bank provided a way for Cleyton GES SL to give the appearance of fulfilling the Law, and thus buyers generated the belief that by making payments to the account, the eventual return of those funds was supported automatically when in fact the existence of the guarantee was subject to various conditions, among which was one that depended on the will of the Bank. Such clauses, which contravene the provisions of the Law, must not be used against the plaintiffs, for indeed they pose a loss of rights that Article 7 of LEY 57/1968 deems as ‘indispensible’.

In a similar sense various rulings of the Supreme Court state that buyers cannot be harmed by clauses that contradict LEY 57/1968 or the lack of harmony or proper relations between the bank and developer, since the buyers who merely fulfilled their contractual obligations are not involved in the formulating or signing of the aforementioned warranty contract.

The existence of the guarantee referred to in Article 1 of LEY 57/1968 is not dependent on the amounts being deposited in a Special Account or communication to the bank of the realization of the sale, much less for the approval or positive rating of the Bank. The law refers to the amounts being paid to a bank or savings bank and adds that the amounts must be deposited in a Special Account, but that does not mean that the buyer is obliged to admit the funds to the special account.

The appellant was the guarantor bank of the promotion and the bank to which all buyers off-plan deposits were paid. Not only did CAM issue guarantees to other buyers, not subject to this action, for amounts paid to accounts other than the ‘Special Account’ but the bank also described those other accounts as ‘Special Accounts’ on the guarantee documents issued to those other buyers.

It follows therefore, that the refusal by the defendant Bank to endorse the payments of the plaintiffs is arbitrary and not in accordance with the Law as it has not always considered it essential that the payment was made to the Special Account.

And the defendant Bank inferred that it was a seemingly inexplicable practice of Cleyton GES SL to provide its clients with a non-special account number in which to make its payments, however the Bank did not give importance to the account into which the payments were made as it issued many guarantees to other buyers where the payments were made to the same ordinary accounts to which the plaintiffs paid.

With regards to the need for Cleyton GES to seek each individual guarantee, although we have already stated that this contravenes the Law, we must add that in practice it was purely formal. We can see from evidence provided that the dates of the guarantees issued to other buyers and the dates of those applications coincide, which means that the process was not firstly a request, then studied by the relevant departments of the Bank, then to be approved and then to issue the guarantees. In fact the issuing of the guarantee and the request for guarantee were simultaneous”.

The Appeal Court Sentence concludes:

“For all these reasons, and for the reasons stated in the decision appealed against, the appeal should be dismissed and the costs against the appellant”.

“We dismiss the appeal filed by the representation of BANCO CAM S.L.U. against the sentence of 8 June 2012 in Ordinary Procedure 182/11 issued by the Judge of the First Instance Court No.2 of Hellín. We CONFIRM that decision and order the appellant (BANCO CAM S.L.U.) to pay the costs of this appeal”.

CONFIDENCE

Keith Rule, Co-ordinator of the Finca Parcs Action Group says;

“We always believed that we had a very strong first Instance Sentence and that our opposition to CAM’s Appeal included a significant amount of Case Law on the issue of banks liabilities according to Spanish Law, LEY 57/1968.

This appeal court decision could not be any better. It totally dismisses the CAM Bank appeal, upholds the First Instance Sentence in full and imposes all costs of the Appeal on the Bank.

Our group members are elated at the significance of this Appeal Court decision. Justice has prevailed”

María de Castro, Director of Costa Luz Lawyers comments:

“The Appeal Court Sentence is an excellent example of how Judges in Spain are teaching Banks to treat people.

It follows the Supreme Court Interpretation of the inalienable rights of buyers according to LEY 57/1968.

It is a positive sign of the good health of Spanish Law and the judicial system, which puts balance on the wild behaviour of financial entities. A pro-consumer Court Decision”

BEHAVIOUR OF THE BANKS

With regards to the behaviour of the Banks in cases such as this, Keith says:

“It has now been established by two Courts that CAM Bank attempted to harm the buyers by the use of a ‘Contract of Guarantee Operations’ between itself and the developer that contained several abusive clauses that contradict the requirements of LEY 57/1968. CAM exhibited a total lack of professional due diligence, flagrantly violated its own Contract with the developer and systematically and repeatedly violated the obligations imposed on financial entities by LEY 57/1968.

We complied with each and every one of our contractual obligations and we as buyers have no control over the relationship between the Bank and Developer; therefore we cannot be prejudiced or harmed by deficiencies in the contract or in the relationship between bank and developer.

As a financial institution CAM Bank is fully aware of the obligations imposed on financial entities by LEY 57/1968, however it was instrumental in creating and endorsing the violations against that Law during the period 2004 to 2010 in collaboration with the co-defendant.

After initially chasing the developer for our Bank Guarantees we first contacted CAM Bank in July 2008 and on a number of occasions after that by multiple means including the submission of a 100 page dossier of evidence. Yet throughout the legal process CAM continued its attempt to avoid complying with its legal obligations by maintaining that is was oblivious to the payments we made to the developers accounts at its branches.

Our long term beliefs regarding the liability of banks have now been substantiated and this Appeal Court decision is now evidence that there has always been substance to our views and opinions in cases such as this”

LANDMARK APPEAL DECISION CAN NOW BE USED AS CASE LAW BY OTHER OFF-PLAN VICTIMS

Lawyers representing other buyers of off-plan property in Spain who were not issued with the legally required Bank Guarantees to protect their deposits can now use this Appeal Court Decision as Case Law to strengthen legal arguments in their own cases.

Keith says;

“There has always been great interest in our Finca Parcs case from other buyers of off-plan property in Spain who did not receive the legally required Bank Guarantees many of whom have their life savings at risk. We have always believed that according to LEY 57/1968 banks have a liability in these types of cases. Together with our legal team we have worked tirelessly since 2008 to highlight this issue in the media and to the Spanish & British Governments. That belief and hard work is now backed up by two very strong sentences from the Hellín First Instance Court and the Albacete Appeal Court which is now Case Law”

RETURN OF THE MONEY

In July 2012 the group’s legal team provisionally enforced the First Instance Sentence against both defendants and this resulted in CAM Bank paying the funds to the Court Bank Account. As a result the enforcement process should now be concluded in a timely manner by the Court and the funds will be released to the group via the legal team. Initially this will be the principal amount of each group members deposit and interest and costs will follow when the case is ‘firm’.

SUPREME COURT

CAM Bank has the right under Spanish Law to file a cassation appeal with the Supreme Court and this must be done within 20 working days from the date of notification of the Appeal Court Sentence. If after 20 working days no Supreme Court appeal has been filed by the Bank then the case is ‘firm’ against both defendants.

Group Lawyer, Jaime de Castro comments:

“I would say that although a cassation appeal is possible the Banks chances of success are now reduced to less than 5% according to the statistics. The decision is technically sound and the given facts cannot be challenged in a cassation appeal, only the legal grounds of the decision”

CAM BANK FAIL TO DEFEND SECOND GROUP LAWSUIT

In December 2012 Finca Parcs Action Group filed a second Lawsuit against the developer Cleyton GES SL and CAM Bank for another 13 group members who were not members of the group at the time Lawsuit 1 was filed in February 2011. This second Lawsuit was admitted into procedure at the First Instance Court in Hellín on 2 January 2013.

The value of deposits claimed by the 13 buyers in the second Lawsuit is just under 500,000 Euros.

CAM Bank had a deadline of 13 March to submit a defence to this Lawsuit.

We can now confirm that no defence was filed by CAM Bank to this second group Lawsuit.

Therefore, in the absence of any defence from the Bank the First Instance Court in Hellín will set a date for the Preliminary Hearing with a full trial to follow thereafter should a settlement not be reached in the meantime.

.jpg)

"gontar 4", Albacete, East of Spain, by alamez, at flickr.com

0

Like

Published at 3:46 PM Comments (2)

0

Like

Published at 3:46 PM Comments (2)

Legal tip 931. NEW! Finca Parcs Victory at the Appeal Court

Tuesday, April 16, 2013

Just in case you still do not know about Keith Rule´s victory in Albacete!

FINCA PARCS ACTION GROUP - LAWSUIT 1 – UPDATE – 11 APRIL 2013

Justice has prevailed. We have won in the Albacete Appeal Court with a sentence totally dismissing the Banco CAM Appeal.

Here is a translation of the final paragraph of the Appeal CourtSentence:

AUDIENCIA PROVINCIAL DE ALBACETE SECCIÓN PRIMERA

Apelación Civil 272/12

SENTENCIA NUM. 76

IN THE NAME OF THE KING

In Albacete 11 April 2013

DECISION

We dismiss the appeal filed by the representation of BANCO CAM S.LU. against the judgment of 8 June 2012 in ordinary procedure 182/11 issued by the Lady Judge of the First Instance Court No. 2 of Hellin. We CONFIRM that decision andorder the appellant (BANCO CAM S.L.U.) to pay the costs of this appeal.

Congratulations to all!!!!

Kind regards

Keith

Finca Parcs Action Group (FPAG)

.jpg)

"Feria de Albacete _ 01", Albacete, East of Spain, by Gabriel Villena, at flickr.com

0

Like

Published at 12:32 PM Comments (3)

0

Like

Published at 12:32 PM Comments (3)

Legal tip 930. Swiss group Genint to build a university in Marbella

Monday, April 15, 2013

Source:http://www.investinspain.org/icex/cda/controller/interes/0,5464,5322992_6261977_6279071_4665735_0,00.html

The Swiss investment group Genint is to build a private university in Marbella with an investment of €7.4 million. It will be the second private university in Andalusia after the Loyola Centre in Seville, which was opened by Abengoa.

The first phase of the project will consist in the refurbishment of the building in which the new centre is to be set up, and the opening is scheduled for next autumn.

According to the project managers, the University will have an initial offer of four degrees:

International Communication and Multimedia;

International Relations;

International Businesses; and

Advertising and Public Relations.

However, the aim is to offer up to 15 degrees by the 2014-2015 academic year.

The city of Marbella currently has more than 3000 university students and more than 1800 baccalaureate students.

.jpg)

"IMG_0217", Marbella, Málaga, South-east of Spain, by _DODO, at flickr.com

0

Like

Published at 7:50 PM Comments (0)

0

Like

Published at 7:50 PM Comments (0)

Legal tip 929. Investors come to Cadiz!. A land of life and... opportunities

Monday, April 15, 2013

Investors come to Cadiz! A land of life and oportunities!

Spain: your partner in Europe. Business opportunities

| Título |

Spain: your partner in Europe. Business opportunities |

| Autor |

Strategy and Information Division. INVEST IN SPAIN |

| Editor |

INVEST IN SPAIN |

| Fecha publicación |

19|03|2013 |

| Páginas |

98 |

| Resumen |

Spain holds the 9th largest accumulated inward FDI stock and the 11th largest investor in the world. It offers many business opportunities and investment in many sectors as: Information and Communication Technologies (ICT), Environmental, Biotechnology, Aerospace, Automotive, Logistics & Transport and Renewable Energies. |

| Descargar |

Descargar documento (4929 Kb.) Descargar documento (4929 Kb.) |

Source:

http://www.investinspain.org/icex/cda/controller/interes/0,5464,5296169_6274032_6295206_4615779,00.html

.jpg)

"Cadiz 11", Cadiz, South-west of Spain, by ferlomu, at flickr.com

0

Like

Published at 2:10 PM Comments (0)

0

Like

Published at 2:10 PM Comments (0)

Legal tip 928. Congratulations Keith!

Thursday, April 11, 2013

Congratulations Keith and the rest of the group!. Congratulations to CostaLuz and De Castro. Congratulations to everyone fighting for balance and justice within the financial system.

We sincerely hope this will help a bit to bring back confidence in our judicial system and our economy!

We love the way Judges are telling Banks how to treat people. It is so edifying!

Celebrate!

Maria

.jpg)

"Fuegos Benidorm 06", Benidorm, Alicante, East of Spain, by edomingo, at flickr.com

0

Like

Published at 4:10 PM Comments (2)

0

Like

Published at 4:10 PM Comments (2)

Legal tip 927. Blogging in English

Wednesday, April 10, 2013

I saw myself in a mirror when I read this post today on Expatica. Thanks for suffering my English all these years!

By the way... what is your opinion?

Cheers,

María

The European Mama: Blogging in English when you’re not a native speaker

Polish blogger Olga Mecking encourages the unique styles that come from blogging in a language other than your native one. Polish blogger Olga Mecking encourages the unique styles that come from blogging in a language other than your native one.

Maybe you remember that when this blog first started, it was trilingual. I saw it as an exercise for my mind, a way to present the different sides of me, and write about different topics for different audiences.

Then I decided I wanted to reach a bigger audience. I found I was writing more and more about multilingualism and being an expat – things I could perfectly write about in English. So I started looking for some advice on how to write better in English. Among others, I found this article. While it seems helpful, I found a lot about it unfair. First, the writer assumes that mannerisms and "accents" in writing are a bad thing. Why? Speaking or writing with an accent isn't necessarily bad, because it shows that we're making an effort to speak the language.

Another thing that was a warning: "Perfection may forever elude you". What does it mean? That native speakers write in "perfect" English while we do not and never will? I often find that non-native speakers think about language in a very creative way, and often ask questions that natives can't answer. And it shows in their writing. Joseph Conrad is one of the most acclaimed writers of the English language, and yet he had a strong Polish accent when he spoke it. Salman Rushdie's command of English is awe-inspiring. It's not always the English speakers who speak perfect English.

But it can be done. The fact that we have an "accent" in the way we write is not so bad. Blogging is about personal expression. It is as much about the bloggers as it is about their audience. We all have our personal styles, our way of writing. Some of these characteristics come from being a native speaker of a language that is not English.

This is who we are, and why should we be ashamed of it? After all, it is possible to write in English as a non-native speaker and still be read. I found that in most cases, people are more interested in what you have to say than how you're saying it, at least in writing – unless you make very obvious mistakes. I very honestly say in the header of my blog that I am Polish, and my readers don't expect perfect English from me. On the contrary, they want to read about my experiences as a Polish woman living in the Netherlands – and all that comes with it: accent, mannerisms, and my linguistic inventions – "techerous" anyone?

For all that would like to blog in English but are too afraid to try, I'd like for them to try to write at least one post. You can write about any topic, and it's a great mental exercise! For those of you who write in English and it's not your mother tongue – don't worry! I think the important thing in blogging is being yourself, mistakes and all.

Reprinted with permission from The European Mama.

Photo credit: erink_photography.

Olga moved to the Netherlands in 2009 with a 6-week-old baby to be with her German husband. She is now mum to two trilingual daughters and expecting her third child. She is a translator, and trainer in intercultural communication. She blogs about her experiences on The European Mama, which focuses on expat life and raising trilingual children. It won the Expat Blog Award in 2012 and continues to gain readership from all over the world. You can find her on Facebook and Twitter. Olga moved to the Netherlands in 2009 with a 6-week-old baby to be with her German husband. She is now mum to two trilingual daughters and expecting her third child. She is a translator, and trainer in intercultural communication. She blogs about her experiences on The European Mama, which focuses on expat life and raising trilingual children. It won the Expat Blog Award in 2012 and continues to gain readership from all over the world. You can find her on Facebook and Twitter.

.jpg)

"Municipio del Puerto de Tornavacas", Extremadura, almost south-west of Spain, by ferlomu, at flickr.com

0

Like

Published at 3:28 PM Comments (2)

0

Like

Published at 3:28 PM Comments (2)

Legal tip 926. Spanish judges stopping repossessions

Monday, April 8, 2013

The way financial beast will be tamed is very much in hands of independent and wise judges. Another sign of the prevalence of people and people´s dignity over unfocused or over-dimensioned financial power.

Three recent Court decissions in Spain have recently stopped repossesssions basing on the European Court Decission on Civil Repossession procedures and Consumers Law.

First Instance Court Number 13 in Madrid

First Instance Court Number 3 in Arrecife, Lanzarote, Las Palmas, Canary Islands

and another one in Mallorca

So good for stopping overpower of financial institutions: step by step, little by little.

With lots of joy and fun!

.jpg)

"Requijada (Segovia)", Segovia, North of Madrid, Spain, by ferlomu, at flickr.com

0

Like

Published at 12:28 PM Comments (0)

0

Like

Published at 12:28 PM Comments (0)

Legal tip 925. NIE explained

Friday, April 5, 2013

Foreigners who want to stay on Spanish territory must obtain a personal number, which is unique and exclusive: the Foreign Citizens Identification Number (NIE).

The NIE is granted by the General Directorate of the Police at the request of the interested party. This number must feature on all documents issued as well as the stamps in his passport or analogous document.

For the NIE, to be assigned, the interested party must present the documents described below at the Foreigners Office or at the General Office for Foreign Nationals and Documentation of the Police in the place where he is resident, as well as having to prove that he is not in Spain in an illegal manner:

● Application for the NIE: The form can be downloaded from the page of the Ministry of the Interior: http://www.mir.es/SGACAVT/modelos/extranjeria/modelos_extranje/ex_14.pdf

● Original passport and a photo of the passport, duly legalised and, if applicable, apostilled and with a sworn translation if the language of the document is not Spanish.

For the case of those interested in obtaining the NIE who cannot come personally to the competent authorities in Spain as they are in their country of origin, there is also the possibility of obtaining it at the Spanish diplomatic mission or the consular section located in the country of residence abroad, where the documents in proof of the reason of the examination have to be produced. It can also be obtained through Power of Attorney.

The period for obtaining the NIE is between 30 and 60 days as a maximum.

If you need our asistance on the obtaining of this document, you can contact us at web@costaluzlawyers.es

.jpg)

"Plasencia - Caceres - Ayuntamiento ", Plasencia, Caceres, Extremadura, South-west of Spain, by ferlomu, at flickr.com

0

Like

Published at 3:37 PM Comments (0)

0

Like

Published at 3:37 PM Comments (0)

Legal tip 924. Aifos showing Bank accounts to our clients

Friday, April 5, 2013

Great decission by Malaga Court.

On our aim to produce an action against a Bank receiving off plan deposits, we requested a Malaga Court to ask Aifos´ Judicial Administrators to show accounts. This has been accepted by the Judge considering we have a legitimate reason for that information.

Another sign of how the judiciary is understanding and punishing irregularities of operating Banks during the off plan boom.

Another reason for celebration.

Cheers,

Maria

.jpg)

"Plasencia (Caceres) calle", Plasencia, Cáceres, Extremadura,South-west of Spain, by ferlomu, at flickr.com

0

Like

Published at 3:11 PM Comments (2)

0

Like

Published at 3:11 PM Comments (2)

Legal tip 923. CAM paying Eurohouse clients without Bank Guarantee

Friday, April 5, 2013

Sabadell is doing an excellent job on transforming the reputation CAM created for itself along the years of the financial and construction boom.

We have received today the new of voluntary payment to our Eurohouse clients which paid amounts to Cam´s accounts.

Good for Sabadell!

María

.jpg)

"Skate Surf rn Trafalgar, Los Caños de Meca", Barbate, South of Spain, by Manuel Acebedo, El Viajero de la Janda Litoral, at flickr.com

0

Like

Published at 3:06 PM Comments (0)

0

Like

Published at 3:06 PM Comments (0)

Legal tip 922. Energy performance certificate

Wednesday, April 3, 2013

At the present moment, in Spain, a similar certificate is required only for new buildings and housings or big renovations but Europe will require it for every building and housing and not only from property developers but from any owner.

WHAT IS IT?

A certificate recognised by the State or a legal person designated

by it, which includes the energy performance of a building.

Every building will have a label (similar to those already used for electrical appliances) and it will receive some advice in order to get a better energy performance.

HOW MUCH WILL IT COST?

In Italy ( where this certifícate is already required), it´s about 250 euros

( for a building of 100 m2)

WHO WILL HAVE TO GET AND PAY IT?

The owner of the building

HOW LONG WILL IT BE VALID?

Ten years

WHEN WILL IT BE COMPULSORY?

Possibly from June 2013

Excluded buildings

Buildings and monuments officially protected as part of a

designated environment or because of their special architectural

or historic merit, where compliance with the requirements

would unacceptably alter their character or appearance; buildings used as places of worship and for religious activities; temporary buildings with a planned time of use of two years or less, industrial sites, workshops and non-residential agricultural buildings with low energy demand and nonresidential agricultural buildings which are in use by a sector covered by a national sectoral agreement on energy performance; residential buildings which are intended to be used less than four months of the year and stand-alone buildings with a total useful floor area of less than 50 m2.

If you need more information on this, we have an authorised engineer among the members of our team who can assist you with questions, please email us web@costaluzlawyers.es

.jpg)

"Sacristia", Tarifa, Cadiz, South of Spain, by Chodaboy, at flickr.com

0

Like

Published at 3:29 PM Comments (0)

0

Like

Published at 3:29 PM Comments (0)

Legal tip 921. NEW! Enhanced Defense to clients in repossessions

Wednesday, April 3, 2013

New regulations on repossession procedures and abusive clauses in Spain is about to be passed after the Sentence of the European Court.

From day these regulations will come into force, you, having an ongoing respossession procedure by a Spanish Bank has new defence tools to be brought to Courts within 10 or 15 days , depending on if debt has been fixed by Courts or not.

You will be able to allegate on any abusive clause which has been used to start the repossession.

If you stopped making your payments, did not bring any defence before the Bank, and the process is still not finished, this is your turn to try to stop the procedure and be benefited by this new regulation.

As this law will be passed within the next two months, it is now the right time to ask your lawyer to review this and bring a defence for you.

.jpg)

"Playa de Los Lances, Tarifa, Cadiz", Tarifa, Cadiz, South-west of Spain, by Chodaboy, at flickr.com

0

Like

Published at 1:36 PM Comments (0)

0

Like

Published at 1:36 PM Comments (0)

Legal tip 919. Easier relations between Spain and the UK

Tuesday, April 2, 2013

It is excellent our government sees the importance of treating UK people nicely. Number of UK people in Spain is so important as to consider all possible legal facilities!

Spain and the United Kingdom have signed an agreement to prevent the double imposition and to avoid the tax evasion as regards assets and income taxes. The agreement has been signed by Federico Trillo, Spanish Ambassador in the United Kingdom and the British Treasury Minister, David Gauke. This agreement will be valid in three months´ time and it will substitute the one signed in London on 21 March 1975.

The purpose of this agreement is to update the articles, which according to the information of the Spanish Treasury have become antiquated. Cristobal Montoro, Spanish Treasury Minister, says that this updating “will allow responding to the economic needs that the commercial relations between both nations have at present time”.

The new articles will make possible to solve conflicts like the one arisen because of the treatment to the residents with no house in the UK. Among the clauses it appears the arbitration as a mean to solve the conflicts that may come up after the implementation of this agreement.

Both countries have agreed to reduce the taxation in origin, establishing the exclusive taxation in residence for those dividends got from majority shares, rents and interests.

From Cinco Dias.

.jpg)

"Estampas Albayzineras", El Albayzin, Granada, South-east of Spain, by Landahlauts, at flickr.com

0

Like

Published at 1:38 PM Comments (0)

0

Like

Published at 1:38 PM Comments (0)

Legal tip 918. Life is beautiful

Monday, April 1, 2013

Smile, without a reason why

Love, as if you were a child,

Smile, no matter what they tell you

Don't listen to a word they say

Cause life is beautiful that way.

Tears, a tidal wave of tears

Light, that slowly disappears

Wait, before you close the curtain

There is still another game to play

And life is beautiful that way

Here with his eyes forevermore

I will always be as close as you

remember from before

Now that you're out there on your own

Remember what is real and

what we dream is love alone

Keep the laughter in you eyes

Soon your long awaited prize

We'll forget about our sorrows

And think about a brighter day

Cause life is beautiful that way.

We'll forget about our sorrows

And think about a brighter day,

Cause life is beautiful that way

There's still another game to play

And life is beautiful that way.

.jpg)

"En esta orilla jugando en la Playa", Tarifa, Cadiz, South of Spain, by Chodaboy, at flickr.com

0

Like

Published at 4:46 PM Comments (0)

0

Like

Published at 4:46 PM Comments (0)

Spam post or Abuse? Please let us know

|

|