Legal tip 542. Law on Holiday rentals in Andalucia

Tuesday, May 31, 2011

In Andalucía, there has not been further development of this type of touristic resources since 1999. Touristic apartments (which are block of units under a same/only management company) were under precise regulation in 2010.

The only rules for Holiday houses or touristic rental houses in Andalucía are those few articles of a Tourism Regional Law dated 1999

According to the 1999Law, holiday rental houses are those which offer a lodging service and are offered to the public for a seasonal use or are occupied for touristic reasons once or more times a year. The rentals are for the whole house and not for rooms.

Rural touristic houses are, by definition of this Law, these same units in the rural area. Just lodging service is provided.

These touristic houses need to have enough furniture and house ware for immediate use. A decree (still not existing) will regulate minimum requirements.

.jpg)

Chipiona Beach, Costa de la Luz, Cádiz by Werkmens at Flickr.com

0

Like

Published at 10:11 AM Comments (0)

0

Like

Published at 10:11 AM Comments (0)

Legal tip 541. Force for Consumers

Friday, May 27, 2011

Last 3rd of May, the European Economic and Social Committee published a report on “Consumers and Cross-Border possibilities in the Internal Market”

Article 4 of said report advises on the need of a Directive on Consumers Rights with important emphasis on information rights.

The Committee endorses a position in favor of an European judicial instrument which will allow consumers who are victims of collective damages to start a collective judicial action for the redress of those damages and to make possible an effective compensation of collective moral or material damages suffered by Consumers of any member Estate and applying identical conditions.

In relation to Internal Market of Retail Finantial services, the report proposes:

- Creation of a universal Bank account

- Minimum Bank services for all the European citizens

- Reliable and same system of electronic transfers for all the Member Estates

- Strict definition of Banks liabilities when granting credits

- Uniform system for Insurances for all the European territory

- List of abusive clauses and unfair commercial practices for financial products.

- Possibilities for comparison of Bank commissions

- Reinforced obligation for advice about complex financial products and effective mechanisms for the solution of conflicts and compensation related to wrong running of financial systems ( Bank and Insurances)

The Commission also considers as necessary to promote neutrality of Internet and inclusion of HighSpeed services for all.

The report also does some recommendations for protection of consumers in local businesses.

.jpg)

Sancti Petri ( Chiclana, Costa de la Luz) beach by La Convento at Flickr.com

0

Like

Published at 4:47 PM Comments (0)

0

Like

Published at 4:47 PM Comments (0)

Legal tip 540. Euro-fallacy and Spain´s current situation

Thursday, May 26, 2011

I think of Paul de Grauwe´s statements made in 1998 and wonder what he thinks of current situation of Spain. I guess he thinks that Europeans need to complete the Spanish dream, as it is not a dream we spaniards had alone.

We dreamt together, let´s work together for it to be completed:

This is a very telling paragraph of De Grauwe´s thinking, written, as you know, back in 1998, before everything started:

Suppose a country, which we arbitrarily call Spain, experiences a boom which is stronger than in the rest of the euro-area. As a result of the boom, output and prices grow faster in Spain than in the other euro-countries. This also leads to a real estate boom and a general asset inflation in Spain. Since the ECB looks at euro-wide data, it cannot do anything to restrain the booming conditions in Spain. In fact the existence of a monetary union is likely to intensify the asset inflation in Spain. Unhindered by exchange risk vast amounts of capital are attracted from the rest of the euro-area. Spanish banks that still dominate the Spanish markets, are pulled into the game and increase their lending. They are driven by the high rates of return produced by ever increasing Spanish asset prices, and by the fact that in a monetary union, they can borrow funds at the same interest rate as banks in Germany, France etc. After the boom comes the bust. Asset prices collapse, creating a crisis in the Spanish banking system.

http://www.eyeonspain.com/blogs/costaluz/5546/legal-tip-527-on-europe-banks-and-spain.aspx

What do you think?

Cheers,

Maria

.jpg)

Cádiz, Costa de la Luz beach by José Picardo at Flickr.com

0

Like

Published at 12:35 PM Comments (1)

0

Like

Published at 12:35 PM Comments (1)

Legal tip 539. Bargains by Banks: 60.000 units

Thursday, May 26, 2011

Published today by Expansion

Prices by areas

Location: Orihuela (Alicante).

Characteristics : 2 bed, 500 m from the seaVivienda de dos habitaciones a 500 metros del mar.

Price: 96.000 to 145.000 euros (40% discount during the show) By Marsol Internacional.

Location: Mijas (Málaga).

Characteristic: 1 to 3 bed.

Price: 141.800 euros (6.000 discount during the show) By Iberdrola Inmobiliaria.

Location: Mar Menor (Murcia).

Características: 2 and 3 bed.

Precio: 95.000 euros (35% dicount in Sima).Marsol Internacional.

Location: Roquetas de Mar (Almería).

Characteristcs: 1 and 2 bed.

Price: 126.252 euros (40% discount in show). By Realia.

Location: Estepona (Málaga).

Characteristc: 2 to 3 bed.

Price: 139.000 euros. By Ahorro Corporación Soluciones Inmobiliarias.

Location: Benidorm (Alicante).

Characteristcs: 1 to 2 bed.

Price: 109.000 euros. By Catalunya Caixa.

.jpg)

Chiclana´s shell by Quinocho at Flickr.com

0

Like

Published at 10:41 AM Comments (5)

0

Like

Published at 10:41 AM Comments (5)

Legal tip 538. I am doing something crazy this summer

Wednesday, May 25, 2011

Summer is arriving. Judicial activity fall and I need to do something really crazy for my clients.

Please understand what I mean when I say crazy.

I did a survery recently and most of my clients are willing to buy in Spain again as soon as they receive their refunds. These clients, many of them, do not have a Bank Guarantee and we are therefore directing claims against Banks which received the deposits ( provision 1.2 of Law 57/68)

I am approaching Banks with good properties in their stock and am offering them to settle with the claim our clients are bringing against them in exchange of one of those properties, with the correspondent price reduction ( equivalent to amount of claim).

I will be asking them to pay all expenses and legal fees.

Would you be interested? Please email me

Would Banks be interested? Please email me too :)

Love,

Maria

.jpg)

Zahara, Costa de la Luz, Cádiz, Spain by Tixikita69 at Flickr.com

0

Like

Published at 9:49 PM Comments (3)

0

Like

Published at 9:49 PM Comments (3)

Legal tip 537. Law on Holiday rentals in Valencia area

Wednesday, May 25, 2011

Regulated by Decree 92/2009 de 3 julio 2009

Rentals of houses, apartments, villas... are regulated by this decree when:

a) They are marketed by companies

b) They are marketed by their owners for touristic services

c) They are marketed through tourism market channels including Internet and other IT ways.

A company for the management of holiday rentals needs to have at least 5 properties in its portfolio. They need to be registered in the Touristic Registry of the region and the province where most of the houses are located.

Owners or companies dealing with these rentals will be responsible of the habitability of these, according to its category and description registered. They will always be made available to users in perfect estate of conservation and cleanness and with all the necessary services for its use.

Owners will be obliged to do a perfect use of the house and its common facilities in the development.

Publicity, offer and management of these rentals will be according to requirements of truthfulness, objectivity and good faith in full respect to Consumer Law.

There is a classification of these units according to quality characteristics.

Prices will always include taxes and any reparations necessary for the use of the house.

There is specific regulation for blocks of holiday houses, which are also classified according to categories

Prohibitions to users are, according to this Decree:

To bring furniture to the house or do repararations without express consent of the owner.

2. To lodge more people than authorized

3. To use the house for different uses than those contracted

4. To bring dangerous materials to the house

5. To bring animals against prohibitions of the company unless they are helper-gods for handicapped people.

The infringement of these rules can be used as a cancellation cause

The Decree also offers regulations for rural rentals

.jpg)

Caños de Meca, Costa de la Luz, Spain by Vongolazzi at Flickr.com

0

Like

Published at 3:10 PM Comments (0)

0

Like

Published at 3:10 PM Comments (0)

Legal tip 536. Law on Holiday rentals in Cataluña

Tuesday, May 24, 2011

Regulated by Decree 164/2010.

Definition: Those rented by owners to tenants for uses different to home (first or second). They need the authorization of Touristic authorities. To the effects of this Decree, rentals of three or less months are considered seasonal rentals.

Requirements:

- Habitability license and technical/quality conditions applicable to dwellings.

- They cannot be used by more people than those allowed by license.

- They need to have enough furniture and house ware.

- Owners also need to be authorized by the Local Council.

- Owner need to provide a contact phone to users, neighbors and authorities.

- Owners need to provide a service for help and house maintenance.

.jpg)

Chiclana, Costa de la Luz, Spain by Basilievich at Flickr.com

0

Like

Published at 10:21 AM Comments (0)

0

Like

Published at 10:21 AM Comments (0)

Legal tip 535. Non declared touristic rentals under tougher controls

Monday, May 23, 2011

Non declared touristic rentals under tightest controls now.

The last big fraud-bag of the real estate field, according to technicians of the Treasure, is reaching its end. Crossing of catastral data and electricity bills are discovering these undeclared benefits.

Home or more permanent rentals are being declared since some years ago as the tenant was obliged to declare catastral references and this declaration was attached to taxes benefit. It is not the same with touristic rentals, where taxes declarations are much more infrequent.

Advantages linked to declaring the rentals are as follows:

- -Tax return equivalent to: interests of the mortgage, conservation expenses, insurance, IBI payment, Community of owners, 10% of improvement expenses, 2% of value of the house as damges costs.

- - Even 100% reductions depending on circumstances of the tenant

-50% of net income if it is a home rental

.jpg)

Sanlúcar horse races, Costa de la Luz, Spain by Laura Suarez at Flickr.com

0

Like

Published at 12:30 PM Comments (0)

0

Like

Published at 12:30 PM Comments (0)

Legal tip 534. Spanish Revolution

Friday, May 20, 2011

Just came back from one democraciareal, spanishrevolution event here in Algeciras: gorgeous!

Civilized, pacific, respectful, throughtful, critical, risponsable, creative, hopeful, energizing, human, person-oriented...... EXCELLENT! a great example of democracy in direct, democracy alive, uncut....

Something is emerging....

So excited and encouraged: just what we all are needing: go, join, partake, contribute

Cheers,

Maria

.jpg)

Spanish Revolution May 2011. By Pepe Pont at Flickr.com

0

Like

Published at 11:52 PM Comments (0)

0

Like

Published at 11:52 PM Comments (0)

Legal tip 533. Commun vacations and retirement for europeans

Thursday, May 19, 2011

Merkel is suggesting common vacations and retirement for all Europe. A good measure in my opinion. It connects to her point about linking salary to productivity and not to inflation.

Let´s be encouraged and put it in the positive way of Europe harmonization. Work is a good. We will then be able to ask for same salaries as in Germany, to keep having good social protection and to be able to retire at a younger age: t is very telling the fact that at the end of the day, anticipated retirement is more common in Germany than in Spain.

It is always better to assume liabilities and be responsible than to blame. It makes us happier people.

.jpg)

Barrosa beach, Chiclana, Costa de la Luz, Spain by quinocho at Flickr.com

0

Like

Published at 12:23 PM Comments (0)

0

Like

Published at 12:23 PM Comments (0)

Legal tip 532. They will buy again in Spain if....

Wednesday, May 18, 2011

....they are refunded of their disasterous off-plan purchases of the Crazy Boom Years..

We recently sent an email to all our clients, announcing to them we are firmly endeavoring to conveyancing and asking if they bought in Spain again. And that is what the majority said: yes, we will once we receive our failed deposits back.

And I can understand.

They need to feel they have been compensated. Therefore even when prices now would allow them to think that they have lost nothing ( as the market itself has gone down and prices are half of what they were), they want to see their rights being respected.

I wonder why Banks do not realise this and offer their properties to them..... Those same banks which did not protect their deposits and have thousands and thousands of properties on stock.

It is so simple.

.jpg)

.JPG)

"Golf Club La Alcaidesa", by Luis López-Cortijo

0

Like

Published at 10:30 PM Comments (3)

0

Like

Published at 10:30 PM Comments (3)

Legal tip 531. Law is above any testament

Wednesday, May 18, 2011

An explanation, which I think will clarify:

UK will´s disposition apply MAINLY becuase Law applicable to his inheritance allow this. UK Law applies due to having both UK nationality and assets, and UK Law allows this will to display its effects.

If his last will was the UK one and this intended to deal with assets worldwide, but Inheritance applicable Law did not allow the dispositions of the will, this would not be applicable.

For instance: the deceased leaves a will naming an NGO as his heirs. The deceased just have real estate assets in Spain and spanish residency. He has UK nationality and will. This will does not apply.

Why? Becuase this is not respecting his legal heirs according to Spanish Law, the UK will does not apply.

Why? Becuase Law of his nationality ( UK Law) forward the inheritance to Spanish Law ( due to residency and estate assets) and Spanish Law has the restrictions of legal heirs.

In short and clear terms.:a will is a document which at the end will be always checked to be respectful with applicable Inhieritance Law.

In even shorter and simpler terms: Law is above testament.

.jpg)

Chiclana beach, Costa de la Luz by Zisk0 at Flickr.com

0

Like

Published at 1:52 PM Comments (1)

0

Like

Published at 1:52 PM Comments (1)

Legal tip 530. Pro-rentals in Spain and the Norway Funds Plan

Tuesday, May 17, 2011

No, they are not connected, or at least that I know of....

They are simply two news that caught my attention this morning when reading the papers:

Proposals for Spanish rentals, made by representatives of several political parties in Madrid, Barcelona and Seville:

1. - Easy rentals for emerging families (young people, divorced, single families…): temporary aids of up to five years, no more.

2. Promotion of rentals instead of building and other models which bet for employment and not for land speculation.

3. Alignment to Europe. Germany has more that 57% on rented properties.

4. Tax Aids for tenants on their Annual Income return. This will eliminate some informal economy and would turn rentals on a good chapter for estate tax collection.

5. Courts for rentals. Más medios para la justicia: creación de juzgados dedicados al alquiler

6. Just one administration for dealing with rentals. Efficiency and savings involved.

Norway Funds Plan for Spain

Norges Investment Bank, manager of the Norwegian Funds plan has extended its investment in Spanish debt. Current amount being is 3347 millions of Euros approximately. A 3% higher than in 2010.

Spanish debt has the eighth position in this Fund after the EEUU, UK and Italy among other ones.

.jpg)

Barrosa Beach, Chiclana, Costa de la Luz by Juan Jaén at Flickr.com

0

Like

Published at 9:41 AM Comments (0)

0

Like

Published at 9:41 AM Comments (0)

Legal tip 529. Murcia Courts: Change of house facing: breach and cancellation

Monday, May 16, 2011

If you bought off plan a house facing the pool and the golf course and finally , after a 180º turn of the building you are receiving a house facing the road and a lemon trees plantation you are receiving a different object ( aliud pro alio) and therefore have rights to cancel the contract and receive all amounts plus legal interests, plus legal fees back from developer.

Great again for San Javier/ Murcia judges on Consumers protection!

Please keep going ahead through this line! It is, at the end, for the benefit of all. Consumers protected: economy running.

Cheers,

Maria

.jpg)

Chiclana beach, Costa de la Luz, by Vibragiel at Flickr.com

0

Like

Published at 1:43 PM Comments (0)

0

Like

Published at 1:43 PM Comments (0)

Legal tip 528. Prosecutors pro Consumers in Spain

Monday, May 16, 2011

Madrid Public Prosecutor, José Ignacio Esquívias Jaramillo, who has been recently

appointed as Prosecutor pro Consumers by the General Public , has taken part in

an ongoing judicial procedure against abusive clauses of Bank contracts.

This means that the results of this Case will be applied to all the finantial

institutions in Spain and not just to those who are part in the trial: BBVA and

Banco Popular

Clauses under discussion in this case are:

- Floor clauses: Which limits reductions on mortgage interests.

- Clauses which require consumer´s request within ten days previous to revision if an interest rate change is applicable.

- Clauses which allow Entities to sell their own products without the previous consent of clients.

Good that Judges and Prosecutors are putting Consumers first. This drives to better balance.

.jpg)

Sancti Petri Beach, Chiclana, Costa de la Luz by La Convento at Flickr.com

0

Like

Published at 10:28 AM Comments (2)

0

Like

Published at 10:28 AM Comments (2)

Legal tip 527. On Europe, Banks and Spain

Sunday, May 15, 2011

All is about Euro-balance. We all, Europeans countries and EU´s financial authorities have our part.

The article below was written by Paul de Grauwe in 1998!

Pay special attention to the paragraph in bolds.

http://www.econ.kuleuven.be/ew/academic/intecon/Degrauwe/PDG-papers/FT_articles/FT%201998%2002.htm

THE EURO AND FINANCIAL CRISES

Published in the Financial Times, 1998.02.20

Can a financial crisis similar to the Asian one erupt in Europe? Our immediate answer is negative. These disturbing financial upheavals occur in “emerging” markets not in the bastions of stability that are found in Europe. The conditions that led to the financial crises in Asia are just not present in Europe.

The question of whether financial crises of the Asian kind can happen in Europe should not be brushed aside too lightly, however. From the Asian financial debacle we have learned the following about the conditions that can lead to financial instability. First, capital markets are liberalised creating the potential for vast international movements of financial assets. Second, countries keep their exchange rates pegged creating the perception that there is little risk involved moving funds from one market to the other. Third, the monetary regime (including the system of regulatory control) is not adapted to the new regime of liberal capital markets. These three factors have been present in one way or the other in the financial crises in Asia, but also in Latin America during the 1970s and 1980s. Of course, they do not always lead to disaster. There are also examples of countries that have avoided financial disturbances despite the fact that they went through the same process of liberalisation. Nevertheless it is fair to conclude that these three factors substantially increase the probability of major crises.

So, are these factors to be found in today’s Europe? Obviously not. But Europe is soon going to move into EMU creating a totally different financial environment. It can be argued that the factors that create the conditions for financial disturbances may very well emerge in the future EMU.

EMU is certainly going to dramatically increase the degree of capital mobility within the euro area. Today, it is still the case that European capital markets are relatively closed. Financial institutions and insurance companies in Germany, France, Italy, etc. hold an overwhelming share of their total portfolio (often more than 90%) in domestic assets. The complete elimination of foreign exchange risk following the introduction of the euro and the disappearance of regulatory constraints on the holdings of “foreign” euro assets will change all that, leading financial institutions to dramatically increase their holdings of “foreign” euro-assets. The result will be to open up financial markets in Europe in a more profound way than in the 1980s when most European countries eliminated their systems of capital controls. The size of the funds that will be freely moving within the euro area will make a quantum jump.

Against the background of this dramatic liberalisation of Europe’s financial markets there is the fact that the regulatory and institutional environment will not be adapted. Prudential control will still be done at the national level. This will handicap the regulators in assessing the risk of the institutions under their jurisdiction. In addition, financial institutions in each country of the euro area will, at least initially, overwhelmingly be national. The German financial markets will be dominated by German financial institutions, the French markets by French institutions, etc. Thus, institutionally the financial markets will still have a substantial domestic segmentation. This will make it difficult to efficiently spread the risk of asymmetric economic shocks, i.e. economic shocks occurring in one country and not in others.

The conditions that could lead to financial disturbances will, therefore, be present in the future euro area, at least during its initial phase when institutions have not yet adapted to the new environment. This, of course, does not mean that crises must inevitably occur. In order to gauge the risk of such occurrence let us analyse a particular scenario.

Suppose a country, which we arbitrarily call Spain, experiences a boom which is stronger than in the rest of the euro-area. As a result of the boom, output and prices grow faster in Spain than in the other euro-countries. This also leads to a real estate boom and a general asset inflation in Spain. Since the ECB looks at euro-wide data, it cannot do anything to restrain the booming conditions in Spain. In fact the existence of a monetary union is likely to intensify the asset inflation in Spain. Unhindered by exchange risk vast amounts of capital are attracted from the rest of the euro-area. Spanish banks that still dominate the Spanish markets, are pulled into the game and increase their lending. They are driven by the high rates of return produced by ever increasing Spanish asset prices, and by the fact that in a monetary union, they can borrow funds at the same interest rate as banks in Germany, France etc. After the boom comes the bust. Asset prices collapse, creating a crisis in the Spanish banking system.

Too far fetched to be realistic? The US monetary union provides many examples of such local booms and busts followed by financial crises that lead to large scale bail-out operations. Scenarios of local booms and bust, as the one just described, will almost certainly happen in the future euro-area. The essential ingredient triggering such crises is the existence of regional differences in rates of return on assets coupled with the fact that in a monetary union banks can borrow at the same interest rates.

These future euro financial crises, however, will in one crucial aspect be different from the financial crises recently experienced in Asia. They will not lead to speculative crises in the foreign exchange markets. Thus, if Spain is confronted by a banking crises this will not spill over into the Spanish foreign exchange market because there will be no such market. One source of further destabilisation of the markets will, therefore, be absent.

The founders of EMU have taken extraordinary measures to reduce the risk of debt default by governments. Maastricht convergence criteria and a stability pact have been introduced to guard EMU from the risk of excessive government debt accumulation. The Asian financial debacle teaches us that excessive debt accumulation by the private sector can be equally, of not more, risky. This has escaped the attention of the founders of EMU, concerned as they were by the dangers of too much government debt. In the meantime the EMU-clock is ticking, while he institutions that should guard EMU from financial and banking crises have still to be put into place.

.jpg)

0

Like

Published at 7:11 PM Comments (0)

0

Like

Published at 7:11 PM Comments (0)

Legal tip 526. Yes, Spanish property is safe to buy now...III

Friday, May 13, 2011

The First Occupation License is a license which states that what it has been built is adjusted to the work Project who obtained the work License by the Local Planning Authorities.

The FOL verifies if the building can be assigned to its legal use, because it is located in a proper planning zone and if it meets the basic safety and health conditions. It also confirms that the builder has fulfilled his commitments on urbanisation of the surrounding land.

The Ground Act dated the 28th of May 2007 establishes in its provision 19 that the Notary deeds of " Under construction New Work " which are granted at request of developers when starting the building of a work require the existence of Work License. No Notary can sign a New Work deed without such license.

Provision 19 of same Act also establihses that the deed for the end of work will need the verification by the Notary on the existence of the First Occupation License and therefore deeds for the completion of the purchase business and transmission of ownership rights to Consumers cannot be granted without First Occupation License. In short words: no house can be acquired without that license now in Spain. Notaries cannot athorise these transmissions

If you are buying a house who was finished before May 2007, and there is no mention of First Occupation License in the Notary deed it is important that your lawyer verifies that the said License exists before even allowing you to sign the initial deposit.

Part II of this serie here

Part I of this serie here

.jpg)

0

Like

Published at 12:17 PM Comments (2)

0

Like

Published at 12:17 PM Comments (2)

Legal tip 525. Yes, Spanish property is safe to buy now...II

Thursday, May 12, 2011

And has always been.

Some articles on Land Registry we wrote a while ago:

Legal tip 61. What the hell is the Land Registry in Spain?

31 March 2009 @ 09:31

It is not the Town Hall property registry, it is not a census, it is not a cadastre, it is not a list... is the ultimate authority on ownership and real estate rights in Spain.

....a public office for the record of ownership and real estate rights to the general knowledge of people.

The main function of a property registry is to provide reliable information and legal safety to citizens; they can rely on what is recorded there at the time of contracting on ownership or any other real estate rights: full and legal ownership, encumbrances, loans, charges, easements, habitation rights, ownership limitations, prohibitions for transference, judicial actions on the property, embargos...

Land Registry was created in Spain in 1861 to cover three goals:

1. - To provide solid foundations to the mortgage loan system.

2. - To provide protection to the holders of registered rights

3. - To provide speed to real estate legal traffic.

In some jurisdictions, such as German, registration is mandatory in order to convey the property. In other countries such as Spain, registration is voluntary, but it has huge and inmensely relevant advantages that make it highly advisable!

Some registration principles in Spain:

1. - Principle of request: Any registration in the Land Registry must derive from the request of interested party; the Registrar can not record rights ex officio.

2. - Principle of priority: "First in the registry, better in Law". Once a right is registered, any other non- compatible right cannot win over it. For instance: in the case of double sale of a estate (a person sells a property twice, taking advantage that the first purchaser has not registered the property) the ownership will belong to that one good faith buyer who has duly recorded the right in the Land Registry, leaving the other only entitled to claim a compensation.

3. - Principle of Register Public Faith: This principle has the aim to provide legal safety to the market: "that which is not in the Register,is not in the reality". It is important to remark that the principle of Public Good Faith covers just purchasers for good and valuable consideration acting in Good faith. Good faith is supposed and who denies it need to prove it.

4. - Principle of legality: Just valid and perfect right titles are registered. The legal judgement on validity and fullness is the mission of the Land Registrar.

5. - Principle of publicity: Nobody can allegate ignorance of what is recorded in the Land Registry

6. - Principle of legitimacy: All the Land registry records make every necessary legal effect and are fully valid unless they are expressly declared inexact or invalid.

(more principles in tomorrow’s article… hopefully written from London!)

Maria

Fountain and orange trees by Kenneth Iriarte at Flickr.com

01 April 2009

Legal tip 62. More protection by the Land Registry

Principle of sucessive tract:

"No entry except the first, will not be registered, or recorded without the right form where it emanates has been recorded previously" In simple words: Land Registry in Spain works as a chain, so no link can be engaged without the previous one. Sometimes, in order to register a right which has no inmediate right recorded, you will have to do through th registry procedure for resumption of the sucessive tract.

For instance: we are working for a client who wants to register a house he has inherited, the deceased person did not have the house reistered under his name in the Land Registry, we need to prove ownership through public and private means and aply for the registration of ownerhip by the deceased person BEFORE instating our client's ( the heir) record.

Principle of specialty:

Tells about the system of the Land Registry, whose unit is the PLOT, which has anumber and on which all related rights are recorded. So if you own a house in Spain, you need to know its registry number. Your property must be registered in the Registry according to location, no every town has one, so if your house is in a little town , it is very possible the Registry will be in the nearest big one. Anyway, your lawyer will be able to check on your registered ownerhip status online.

Principle of impenetrability:

Once the procedure for registration of a right has started, there is no gate for any incompatible rights to try to enter the Registry.

As you know Land Registry procedures in Spain are very controlled and strict in order to provid safety and consitency to the mortgage market and the real estate traffic.

The role of Notary and Registrars is generally unlaw by commun law citizens as it is completely different from the role of them in your legal system. That is also why conveyancing lawyers play a very different part in Spain and in the UK when working for you at the buy or sale of your house in Spain.

Your conveyancing lawyer in Spain is a guide who will make your company while you are inmersed in a system, country and language that you do not know . The spanish convenyancer will procure that deposit and purchase contracts are fully respectful to your Consumers rights, and will defend your position before the other contract party in every sense, but it is essential that you end the process by signing a Notary deed and registering the property in the Land Registry.

The sale is completed with the private contract but you will not be able to oppose it to good faith buyers if it is not registered and of course, no bank will lend you money if the property is not also properly recorded.

Part I of this serie here

0

Like

Published at 10:43 PM Comments (1)

0

Like

Published at 10:43 PM Comments (1)

Legal tip 524. Legal rights of the widow in Spain

Monday, May 9, 2011

By Law, the widow in Spain has these rights in respect to his spouse´s inheritance:

1) If together with the widow there are children or descendants alive: usufruct of 1/3 of the inheritance

2) If together with the widow there are just ascendants alive ( no descendants): usufruct of 1/2 of the inheritance

3) If there is no ascendants/ no descendants: usufruct of 2/3 of the inheritance

.jpg)

Chiclana beach by zisk0 at Flickr.com

0

Like

Published at 6:59 PM Comments (0)

0

Like

Published at 6:59 PM Comments (0)

Legal tip 523. Welcome to Spain Mr. Smith, help us to get this back to its feet

Saturday, May 7, 2011

This is the publicity of a very charasteristic movie about those spaniards who in the 60´s and 70´s emigrated to Germany to have a living.

Now the case needs to be the opposite, we should be inviting those German to establish their businesses here in Spain to help us pick our economy up.

Who says Germany, says UK or any other european country with the passion of doing businesses under the sun.

Who is coming? This is an urgent call.

We can provide some finances to start up, the legals, and a good set of consulting.

.jpg)

0

Like

Published at 10:41 PM Comments (2)

0

Like

Published at 10:41 PM Comments (2)

Legal tip 522. One Law for European marriages

Friday, May 6, 2011

In Europe, there are around 16 millions of international couples, the 13% of the total of married couples of Europe. These usually have assets located in different countries of the Union.

This is the reason the European Union have proposed two regulations for legal clarity for property rights of the international marriages and international registered unions.

This will enable these marriages to choose the applicable law- either habitual residency or nationality of one of the spouses- for the regulation of common goods in case of divorce, separation or death of one of the spouses

The Decree establishes an unitarian regime for Law applicable to patrimony of the marriage, with the exception of real estate’s for which there is the possibility of submitting them to the Law of place of location.

According to the European Commission this can imply a saving of nearly 400 million yearly.

International, registered couples can be under the country where registered. In terms of protection of the family home, the country of living can establish its own protection rules and measures.

Judicial competence

Unification on jurisdictional criteria too: nullity/divorce and separation and their attached procedures for division of the marriage estate will be all heard by the same Court.

In case of death same Court that decides on wills enforcements and European inheritance certificate will decide on distribution of marriage assets.

The European regulation also establishes rules for jurisdiction on commun residency or late common residency.

All the above will make a saving of 2000/3000 € per case as procedures are heard together by the same Court.

Validity and enforcement of Court Decisions are proposed to be processed through a sole procedure too.

.jpg)

Jerez de la Forntera house, Costa de la Luz by jose_gonzalvo at Flickr.com

0

Like

Published at 10:23 AM Comments (0)

0

Like

Published at 10:23 AM Comments (0)

Legal tip 521. We need many Keith Rules in Spain

Friday, May 6, 2011

I fully agree with all your concerns about buying property in Spain after all your problems ( I am quite aware of some of them), this claims of you and the fact that you chose Spain once makes me clear that you have a passion for our country. And we need people in love, passsionated about our country.

Please do not give the fight up: follow Keith Rule´s example: your determination and desire to change things will be contagious to nationals who will join your camapigns for a better future. We all are Europe

I was once influenced by Keith too and decided to make his company on discerning the extent of Bank´s liabilities when off plan advanced amounts were not protected. And I find myself now inmerse in a constant renovation of my proffession as a lawyer due to the challanges this is bringing along. Thanks Keith!

May the fights and disgust of you all be welcome for the benefit of many! We need a better country!

Maria L. de Castro

.jpg)

Sanlucar de Barrameda, Horse races by wwwmanuelgarcia at flickr.com

0

Like

Published at 1:28 AM Comments (12)

0

Like

Published at 1:28 AM Comments (12)

Legal tip 520. Yes, Spanish property is safe to buy now...

Thursday, May 5, 2011

Yes, do not get misled by the discourse.

Already built Spanish property is very safe to buy. It always has been. It is true that our system of Property Registration makes the third party good faith buyer have all safety when buying built ,registered property in Spain. I am not commenting on planning issued and Coastal Law here... which is a different matter as it involves Public Law.

Things are different in terms of guarantees when buying off plan properties.

There:

1) The funding Bank has the guarantees

2) The developer has the risk he has freely chosen by setting the business and

3) The poor buyer has all the risks the two above have unlawfully left him with. He, who is putting his personal money on it.

Very unfair. Specially when Banks who should have verified that the Guarantees existed, left people´s deposit unbcontrolled and without the necessary Guarantees. These same banks are now becoming the owners of the whole cake through the enforcement of their Mortgage-to-developers.

The old trick: do not open the "special account "and we will be free ( say the Bank Manager to his cousin, the property developer or viceversa). But tricks are tricks at the end and if well explained, taken into pieces to a judge, will certainly make him see plainly clear: Provision 1.segundo or Law 57/68 is undoubtedly simple: Banks have the role on ensuring the existence of the guarantees for the protection of buyers... under their risponsability.

At the end, Banks are the clear symbol of what society has been during the last decades: benefit above all, just rights no risponsabilities, but.... they need to pay.

.jpg)

Zahara de los Atunes, Costa de la Luz, by Asier Llaguno at Flickr.com

0

Like

Published at 12:04 AM Comments (5)

0

Like

Published at 12:04 AM Comments (5)

Legal tip 518. Stuck and no property

Wednesday, May 4, 2011

A post cowritten with Louise Reynolds of Property Venture in the UK: thanks Louise!

Original link here

Property buyers in Spain-are you stuck with a deposit paid, but no property to show for it?

Thought you were covered by a bank guarantee, but are being told this isn’t the case?

Want to know what to do about it?

Some buyers of property in Spain find themselves in a tricky position. They may have paid a deposit for a property, but the developer went bust and the development never got built, or only partially built.

Well, this is the position:

It is a legal requirement, as part of the buying process in Spain, to have an insurance policy or a bank guarantee, for a deposit on an off-plan property. This is designed to protect the off-plan buyer.

For resale properties there is no legal requirement for this type of Guarantee.

Property Developers, which receive money from buyers before they start, or during the construction, must have an Insurance policy or a Bank Guarantee, provided by an entity listed in the Register of Insurers, Banks, or Saving Banks, to protect against the situation where construction is not commenced, or not finished, for any reason by the agreed deadline. This has been enshrined in Law since 1968

It is the responsability of Banks that advanced amounts are deposited in special accounts, separate from any other kind of funds belonging to the developer or promoter. It is in effect a developer´s Escrow account, controlled by the Bank.

o Money is held in escrow by a third party until the purpose of the underlying agreement is accomplished, in this instance a finished building. When the condition specified in the escrow agreement is performed, the entity or individual holding the deposit funds (bank) gives it over to the party entitled to receive it (developer). This is known as the second delivery. The escrow agreement is a contract. The parties to such an agreement determine when the agreement should be released prior to making the deposit. After the escrow agreement has been entered, the terms for holding and releasing the document or money cannot be altered in the absence of an agreement by all the parties

So if Banks or Savings Banks have been accepting sums advanced by purchasers, highlighted as deposits for off-plan purchases into accounts, even if not classed as 'Special Accounts' (Cuenta Especial ) and no Bank Guarantees/Insurance Policies were handed to the buyer, the financial institution is, liable to refund those amounts to the buyers if, with a minimum level of due dilligence they would have realised that the said funds were deposits for off-plan purchases.

Banks in Spain are regulated by the Banco de Espana or Bank of Spain and must incorporate strict financial controls to prevent money laundering and fraud. These controls together with their own due diligence must result in the Bank or Savings Bank having a clear understanding that the funds were for off plan purchases and therefore subject to the legal requirements.

If this has not happened in your situation, what can you do about it?

Take individual legal action against the developer and the Bank where your money was placed.

Take group or individual actions against the banks – which might be more cost-effective-and an established group, which is bringing pressure to bear on Banks, may be noticed more

If you used a solicitor during the purchase, and no Bank Guarantee was given to you, you can also claim against him/her (who should have professional liability Insurance).

If you do not know where your money was paid to, you can start by asking the solicitor to verify the account where money was deposited, so you can build an action against the Bank too. The Judge can also help you, through the practicing of “ preliminary diligences” at your request, to know who is the liable party.

Please call if you want to discuss your situation: 01932 849536

Co-written by Louise Reynolds of Property Venture and Maria de Castro of Costa Luz Lawyers

.gif)

0

Like

Published at 7:02 PM Comments (13)

0

Like

Published at 7:02 PM Comments (13)

Legal tip 517. José Blanco: you can do it!

Tuesday, May 3, 2011

According to RightMove, "British interest in buying property overseas is

booming. Enquiries soared by 53 per cent last month, according to figures from

Rightmove Overseas and Moneycorp, with Spain continuing to top the league,

followed by France, the US and Australia"

Just ask Banks to acknowledge their liabilities under 1. segundo of Law 57/68 and you may find a good list of claimers wanting to turn into buyers of these bank´s real estate stocks:

Once the credit is recognised and Banks are open to sell at reasonable prices. It is still time. Just a bit of courage and the decency of calling things by their name is neeed.

Do not start by the end.....first things first.

These acknowledgments will turn frustration into new hopes about Spain.

Talk to Mr. Rule! You will be very happy after this.

Cheers,

Maria

.jpg)

Conil, Cádiz, Costa de la Luz beach by Abby Mishra at Flickr.com

0

Like

Published at 3:55 PM Comments (3)

0

Like

Published at 3:55 PM Comments (3)

Legal tip 516. A commun mistake on rental legalilities

Tuesday, May 3, 2011

I am transcribing here part of an email conversation with a member of EOS today. Her words in black, our answers in green.

Hello,

My partner and I recently retired. We do not have enough cash to buy a home in Spain, and a mortgage at the age of 66 is a little daunting. We shall be staying in ******* for several months in the next couple of months or so, and whilst there, will be looking for a long-term rental property.

I am told that under Spanish law, we can only stay in a rental property for 11 months, and then it is reviewed. That is not correct.

1). Does this mean that we can, on the review, stay there another 11 months, and so on, for the rest of our lives? (as long as the owner agrees)

Of course not. That is not the case.

Spanish Rental Laws give special protection to rented houses used as homes with legal extensions of up to 5 and 3 subsequent years.

Owners use the 11 months deadline on a wrong understanding that this will avoid the contract to be unbder forced extension rules of the Urban Rental Act and will allow them to evict the tenants once this period has ellapsed. This is not the case.

If you have rented a house as a home, whatever the period is, you are entitled to the extensions of the Urban Rental Act.

2) Do we need to notify anyone in the local Town Hall of our intention to stay, and is there any legal paperwork we need to complete? It is advisable that you are registered in Padron at the Local Council.

.jpg)

Tarifa, Costa de la Luz, Spain by elarequi61 at Flickr.com

0

Like

Published at 3:06 PM Comments (2)

0

Like

Published at 3:06 PM Comments (2)

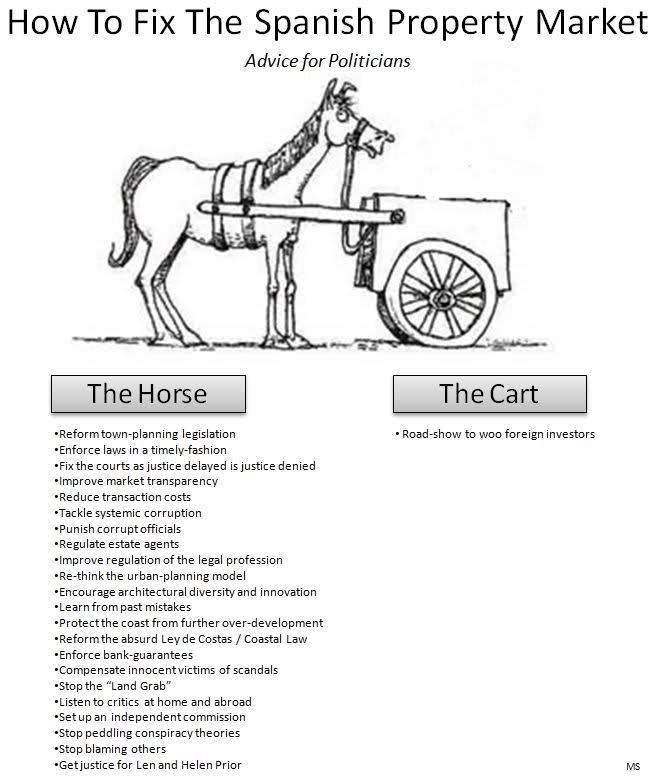

Legal tip 515. THE CARTOON :)

Tuesday, May 3, 2011

The Cartoon that our Justin found and post, whose author we are all looking for :)

Please the author, say Hello!

María

.jpg)

0

Like

Published at 2:17 PM Comments (1)

0

Like

Published at 2:17 PM Comments (1)

Spam post or Abuse? Please let us know

|

|