It is not widely known that the Supreme Court in December 2015 declared certain mortgage clauses as abusive. Most banks imposed on their clients the payment of all expenses of formalization of mortgages, when it was deemed that banks should assume at least a part, since it is reasonable that also the banking entity is equally interested in registering the mortgage deed. The banks are evidently feeling the pressure, since some of them, such as BBVA, Banco Santander, CaxiaBank, Banco Sabadell, Bankia and Ibercaja have already modified their clauses to assume part of these expenses, although they have not yet officially announced it. Several campaigns are under way to claim these mortgage settlement costs. The first step is to go to the Client Service department of the client of the corresponding bank, which in practice means asking for the "libro de reclamaciones".

The actual text of Decision 705/2015 of December 23 of the Supreme Court is as follows (non-professional translation):

"All taxes, commissions and expenses incurred in preparing, formalizing, correcting, writing, altering, including division, segregation or any change that implies alteration of the guarantee - and execution of this contract, and for the payments and refunds derived therefrom, as well as for the constitution, maintenance and cancellation of its guarantee, as well as the premiums and other expenses corresponding to the insurance of damages, which the borrowing party is obligated (by the bank) to have in force" .

This clause continues, authorizing the borrower to charge the Bank with:

- registration of the mortgage in the Land Registry

- notary expenses

- accountancy (Gestor) expenses

In case of non-payment by the bank, the decision also allows for the judicial or extrajudicial claim of the debt, including attorney and attorney fees.

Similarly, and in some cases identical, this clause is written in almost all mortgage loan agreements.

What is the way of proceeding if you were required to pay all expenses, commissions and taxes of the mortgage loan?

In the first place, a complaint must be made to the Customer Service Department of the Bank or Entity with whom the mortgage loan was contracted, or, if applicable, the new Entity that has merged or absorbed the one to whom it was requested.

After two months from the complaint, whether or not the Customer Service Department has replied, or if the response has been negative, you may proceed to file the corresponding legal action before the judicial party of the domicile of the borrower or of the Bank's registered office.

What must be requested in the lawsuit brought before the Court, will be the "nullity of the abusive clause", and the restitution of expenses paid as a result of that agreement, which must be perfectly documented with their corresponding invoices. For the type of procedure to be filed, it will be necessary to use a lawyer.

What expenses, taxes and commissions can be claimed?

Assuming that only the restitution of the costs corresponding to the formalization of the mortgage, and not of the sale, can be requested, the following will be object of claim:

- Notary's Invoices and Property Registry. The Supreme Court says in its ruling that, "with regard to the formalization of notarial deeds and registration of the same (necessary for the constitution of the security right - that is, the mortgage), both the fee of notaries and the notary of the registrars of the property, attribute the payment obligation to the applicant of the service in question or to whose favour the right is registered. And it is undoubtedly the lender who has the main interest in the documentation and inscription of the deed of mortgage loan, because he thus obtains an executive title, constitutes the real guarantee, and acquires the possibility of special execution". In other words, the Courts are siding with the borrower since it is deemed s/he had the weakest negotiating position, therefore the registration expenses need to be borne by the strongest party.

By not allowing a minimum reciprocity in the distribution of the costs incurred as a result of the notarial and registry intervention, making all the debtor pay, an imbalance is generated to the consumer, reason why the clause is abusive.

- Tax of Documented Legal Acts. According to the Law that regulates the Tax on Patrimonial Transactions and Documented Legal Acts: "the acquirer of the property or right and, failing that, the persons who request or request the notarial documents or those in whose interest they are issued"

The Supreme Court understands that in reference to the Tax on Documented Legal Acts, the payer of the tx is the Bank or lender. So it is advisable to include these in the claim.

What documents do I need to collate for the initial complaint to the Bank?

- The title deeds (look for "Escritura de Compraventa")

- Invoices by the Notary office

- Invoices by the Gestoria, ideally detailing the tax paid and specifically look for the initials "AJD" which stands for "Actos Juridicos Documentados")

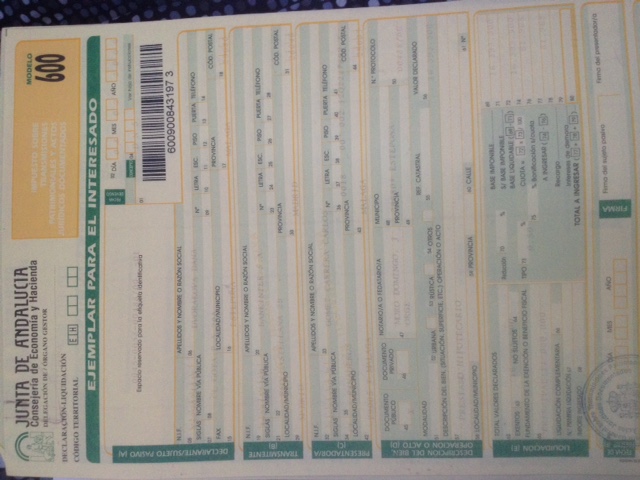

- Model 600 form which shows the actual tax paid. It is a yellow form, an example of which you can see below:

If you want to employ the services of a Gestor to draft your complaint you can search for "gestorias reclamar gastos hipoteca" and you will get a selection, hopefully in your area. In case you want to draft it yourself at this initial stage, here you can download a sample document in Spanish to make your claim.

What is the deadline for requesting the nullity of the clause and claiming the return of the amounts paid?

The term for those mortgages that are still in force, is 4 years to be counted from the day following the date of the Judgment of the Supreme Court, i.e. that term will end on December 24, 2019; And for those mortgages that have been fully paid, the claim can be made if your total payment was made within the 4 year period between December 23, 2011 to 2015.

Hope the above helps as a start. Remember, there have been around 80,000 claimants already according to consumer associations, so there are a lot of claims pending without final decisions. It remains to be seen how this judgement will be applied.

And remember: this is a blog of an interested party - NOT legal advice! :-)