I hope everyone had a nice summer and are back relaxed and ready for more number crunching and thrilling statistics on Spanish property!

Before you read on, spoiler alert: the prices of Spanish properties are continuing to rise. Not at an overheated pace, but a steady grind upwards.

The data for the 2nd quarter of 2017 have just been published 2 days ago by INE, the Spanish statistics institute. The annual variation of the price index (i.e. compared to the 2nd trimester of 2016) is 5.6%:

Broken down by type, newly constructed properties have risen by 4.4% and resale properties by 5.8% annually.

When compared to the previous quarter, we also see an average upward sloping trend:

This set of data is easy to analyse, since it's in the same trend as before, bringing us to prices around 10% higher than the level of 2015. The table below summarises the data:

| |

|

Quarterly variation |

Annual variation |

| Average index |

|

2,0 |

5,6 |

| New construction |

|

2,6 |

4,4 |

| Resale properties |

|

1,9 |

5,8 |

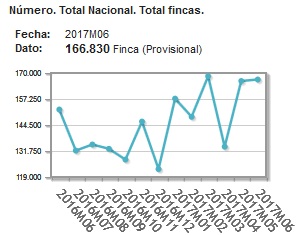

These price increases took place based on an increased number of total sale operations, which is reassuring since it implies a broad market advance. The total purchase operations for June 2017 were 166,830, a 9.7% annual increase:

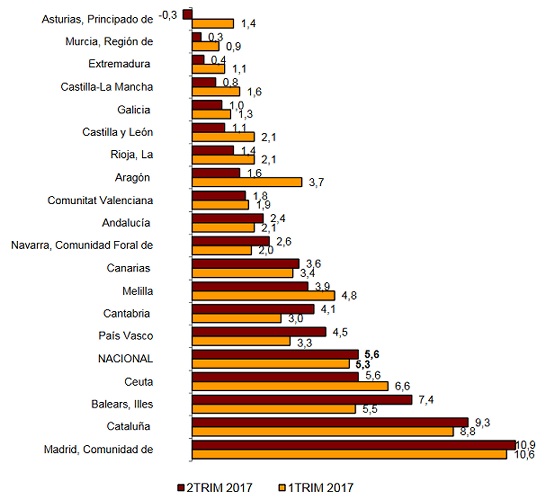

Remember, this is for the whole of Spain. What was more interesting in this data publication was that Andalucia is no longer the leader in percentage price increases. Here is the breakdown by community:

Here comes my personal evaluation of this latest data: I am pleased to see a broad participation in the property market in Spain. The leaders are the capital cities and other northern areas of Spain that have traditionally not been the most popular with foreign buyers. This implies that the local Spanish buyers themselves are fuelling this advance, which to my mind is an indication of a healthy and strengthening economy, where people are feeling more confident.

In coclusion, I would like to see this trend continuing where the Spanish property price index keeps adding on a 2.4% increase in Andalucia and Costa del Sol, rather than a frenetic pace that might lead to imbalances. I will be watching the next set of data after Autumn, which is normally a quiet period for purchases in the south, for more evidence of a broad Spanish market recovery, spread over many areas.

Thanks for reading and, as always, please leave a comment if you have any questions, or visit our Costa del Sol properties website for more statistics: hbcostadelsolproperties.com