Brexit's full 2016 effect on Spanish property

We now finally have the full 2016 property price data, which can allow us to advance another step in understanding the issue from my previous post "Post Brexit - how much exactly is Costa del Sol real estate affected".

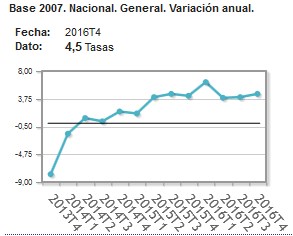

The prices in the 4th trimester of 2016 rose by half a percent compared to the previous quarter, and reached 4.5% for the year for resale properties and 4.3% for new construction. The updated graph is below:

As you can see, 6 months after the Brexit referendum, the effect from the reduced number of British buyers has not been transmitted yet to property prices. In another previous post, I mentioned: "an interesting datapoint is the percentage of foreign buyers: 13.5% of property purchases in 2016 were by foreigners. British buyers were lower compared to 2015, as expected, from 23.9% to 16.4%, however still ahead of German and French buyers at 9% and 8% respectively". As an explanation I would offer that demand from other nationalities has picked up the gap from British buyers. We at HBC have noticed as much, especially Scandinavians and French.

As an alternative explanation for the increase in Spanish property prices, rather than the expected decrease, we could look at the GBP exchange rate. As you can see below, it has dropped like a rock after the Brexit result and has languished near 1.13 for a while now.

(graph from http://www.xe.com/currencycharts/?from=GBP&to=EUR&view=1Y )

However, regardless of what final decision is taken (this poster does not speculate politically!), it seems that there is strong support at the 1.10 point. Currency money managers are usually ahead of the game and I look to hints in their behaviour to try and predict the future. Note how the volume graph shows that there were hardly any trades of currency at the lowest points - noone willing to sell more? Rising volume on the up and declining volume on the down, that in my humble opinion is a sign that the currency managers do not expect further British pound declines. Property buyers want stability so that they can arrange their budgets, and this stability at an albeit lower level is perhaps the reason why British buyers are still interested.

A third reason of course may have nothing to do with Britain and simply be lack of alternatives in a terrified world for retirement/holiday properties.

In any case, it seems that prices are rising despite the "wall of worry" being climbed by the market. This month will be decisive for Brexit and we are eagerly awaiting final decisions so that we can finally get through to the other side!

Thanks for reading.