Post Brexit - how much exactly is Costa del Sol real estate affected

For the most part of 2016 Brexit has been the subject of conversation when it came to property. This is also evident on this very forum where the "Brexit" thread is been commented on daily. As realtors we are always looking for data to help us identify market trends and predict changes in them. So the obvious candidate here is how much has Brexit really affected purchasing decisions of Costa del Sol property buyers?

I like to defer proclamations until I see facts and figures, so I went to the National Institute of Statistics of Spain (INE) and to the Registrars institute (Registradores) to examine for myself. I looked at the latest month of property data available, November 2016. This was quite some time after the Brexit shock so data should be quite representative of decisions that have taken well into account the effects of Britain's departure.

Consider the next table. My analysis follows below:

| November 2016 |

Number |

% change m/m |

% change year to date |

| Habitable dwellings transacted |

33,806 |

15.1 |

17.3 |

| All real estate transactions |

143,470 |

13.8 |

6.8 |

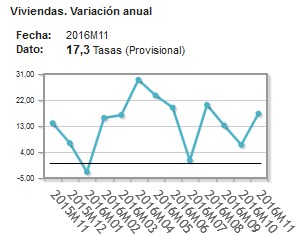

These are national statistics that show purchasers were increasingly buying properties in Spain compared to October. But what was the trend upto then, in other words was October so low that this 17.3% increase is meaningless? The chart below shows the trend of the above data upto November 2016:

It looks like the period from May to October was certainly a dip, perhaps when buyers were already worried about Brexit effects, however it seems that it was not a significant one and may even indicate that November's breakout was the result of clarity and difusion of uncertainty that followed the Brexit result. Of course this is speculation - we are looking forward to the 4th trimester data coming up in a few days to shed some more light. But it is interesting to anticipate!

Ok, the above data is at the national level. What about Costa del Sol? Is it following the same pattern?

In the 3rd trimester of 2016 (upto Sep 2016) the total transactions for Andalucia were 20,167, well ahead of the next 3 areas: Catalunya (17,850), Valencia (15,908), Madrid (12,727). This ranking has been consistent for the last 2 decades. Of this, during the same 2 decades, Malaga province has had almost 50% of the sales of the whole Andalucia, therefore it is safe to assume that the post-Brexit trent seen nationally above is actually well observed in the Costa del Sol. Compared to 2014 the number of transactions in Malaga has risen 22.8% overall.

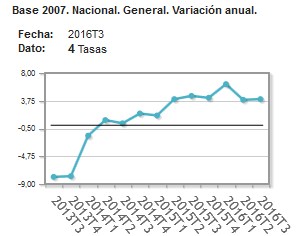

So the number of sales/purchases has been rising nationally and quite healthily in our area of interest, the Costa del Sol. But how about price? For this we only have trimester data so we will need to extrapolate a bit. Here is what the index of %age change looks upto the 3rd trimester 2016:

As you can see, prices have been ticking up steadily. We need to be aware that the end of September 2016 did not necessarily fully include the effects of Brexit, but there is no reason to assume that during the same period of increasing real estate transactions the direction of price would have changed. If anything, I would put my head out and state that when the next set of data comes out it will show a proportional price increase too. And again, the data over the last decades have the UK as the leading purchaser of properties on the Costa del Sol, followed after a large margin by French and German, so it would be logical to assume that most of that uptick can be attributed to British buyers still shopping.

In conclusion, I would say that it seems that the real measurable effect of Brexit is at worst neutral to the Costa del Sol property market, and in fact may be positive, subject to confirmation.

Hope you have found this post interesting. I will be trying to write as regularly as possible, so visit back often! Any questions or discussion below I will try to answer.

Thanks,

HBC